Trade setup for 14 February: BANK NIFTY 200 DMA in focus as US inflation and dollar heat up

Upstox

4 min read • Updated: February 14, 2024, 8:11 AM

Summary

The Indian markets will be reacting to the US inflation data today. The U.S. Consumer Price Index (CPI) rose 0.3% in January, exceeding expectations of a 0.2% increase. On an annual basis, inflation rose 3.1%, slightly higher than the anticipated 2.9%. In response, the 10-year bond yield jumped over 3% and the Dollar index advanced 0.7%, which is seen as negative for emerging markets including India.

Asian markets update 7 am

Indian equities are poised for a gap down start as the GIFTY NIFTY plunges 1%, mirroring losses on Wall Street. Other Asian markets are also trading in red. Japan's Nikkei 225 is down 0.7% and Hong Kong's Hang Seng Index fell 1.6%.

U.S. market update

U.S. stocks closed lower on Tuesday as investors digested hotter than expected inflation data for the month of January. The Consumer Price Index (CPI) rose 0.3% month-over-month and 3.1% on annual basis, exceeding forecasts of 0.2% and 2.9% respectively. However, it is important to note that the inflation rose 3.1% in January and has slowed from December’s 3.4% annual gain.

All the three major indices slipped over 1%. The Dow Jones Industrial Average fell 1.3% to 38,272, while the S&P 500 lost 1.3% and closed at 4,953. The tech-heavy Nasdaq Composite declined 1.8% to 15,655.

NIFTY50

February Futures: 21,823 (▲0.5%) Open Interest: 2,39,912 (▲1.2%)

The NIFTY50 bounced off its intraday low on Tuesday and regained its 20-day moving average. Despite sharp bouts of volatility, the index defended the 21,600 mark, aided by a rebound in private sector banks.

The ongoing consolidation that began on January 17 in NIFTY50 still continues. The NIFTY50 is trading in a range between 22,126 (all-time high) and 21,100. Within this range, traders are witnessing sharp price swings without any sustained follow-through. Experts believe that this sideways consolidation with increased volatility could continue until the index breaks out of this range. Meanwhile, the immediate support for the index now stands at the 50 DMA (21,500).

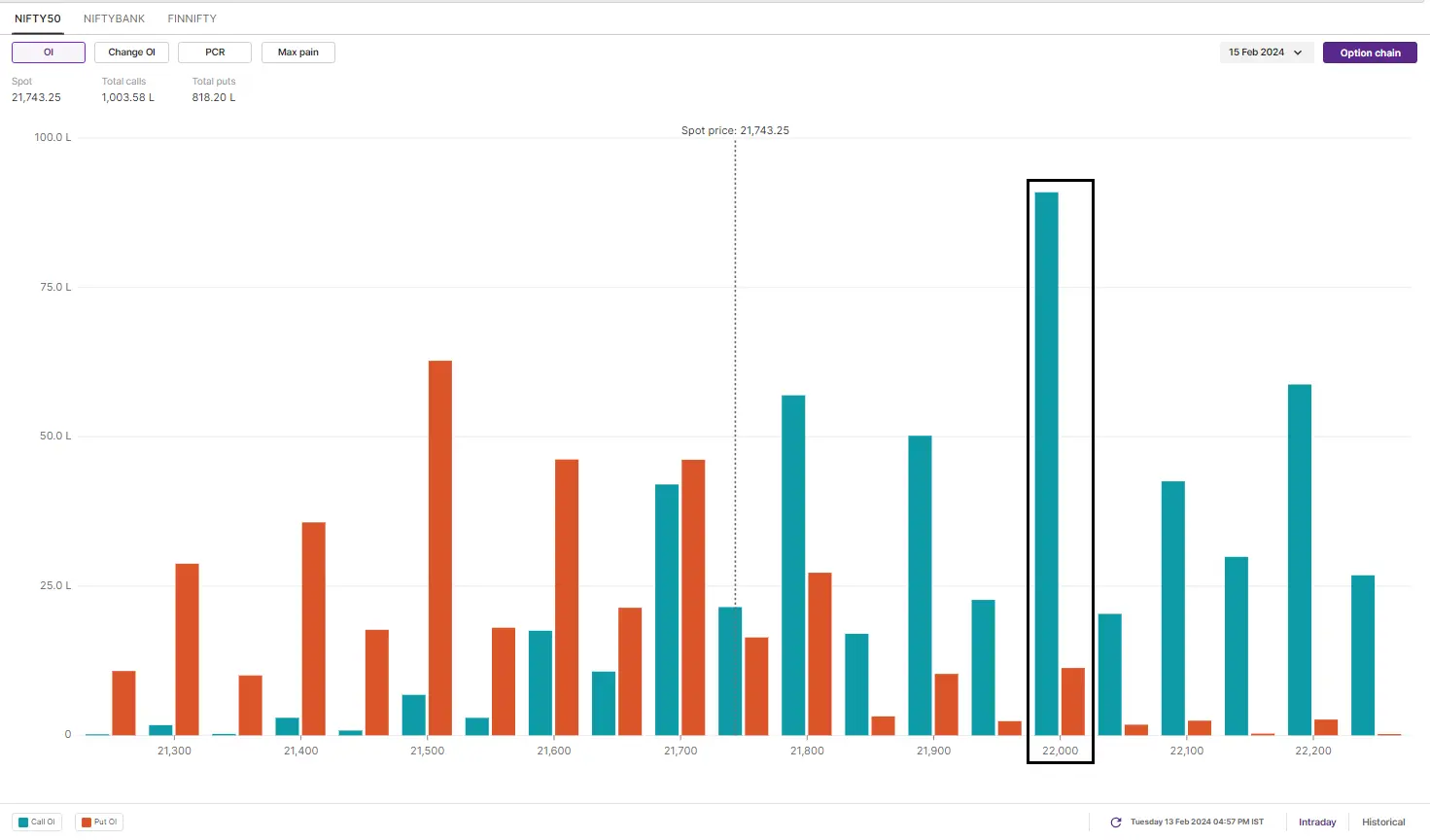

Open interest data for the NIFTY50's 15th February expiry has significant call base at the 22,000 and 21,800 strikes. Conversely, the 21,000 and 21,500 strikes hold the maximum put base. This suggests that market participants expect the NIFTY50 to trade in a range of 21,100-22,100 for 15 February expiry.

You can track open interest of the NIFTY50 here: https://pro.upstox.com/

BANK NIFTY

February Futures: 45,732 (▲1.2%) Open Interest: 2,20,857 (▲2.7%)

The BANK NIFTY once again witnessed a pull back from its 200-DMA and formed a bullish harami candlestick pattern on the daily chart. Barring Bandhan Bank (-0.8%) and AU Small Finance Bank (-0.1%), all the other ten banking stocks closed in the green. Punjab National Bank (+3.2%) and ICICI Bank (+2.3%) were the top gainers.

As highlighted in our yesterday’s blog, BANK NIFTY continues to consolidate between its 50 and 200-DMA with sharp intraday swings. Experts believe, the banking index needs to close above the immediate resistance of 46,000 mark for any meaningful recovery. The immediate support for the index is at 44,300 mark.

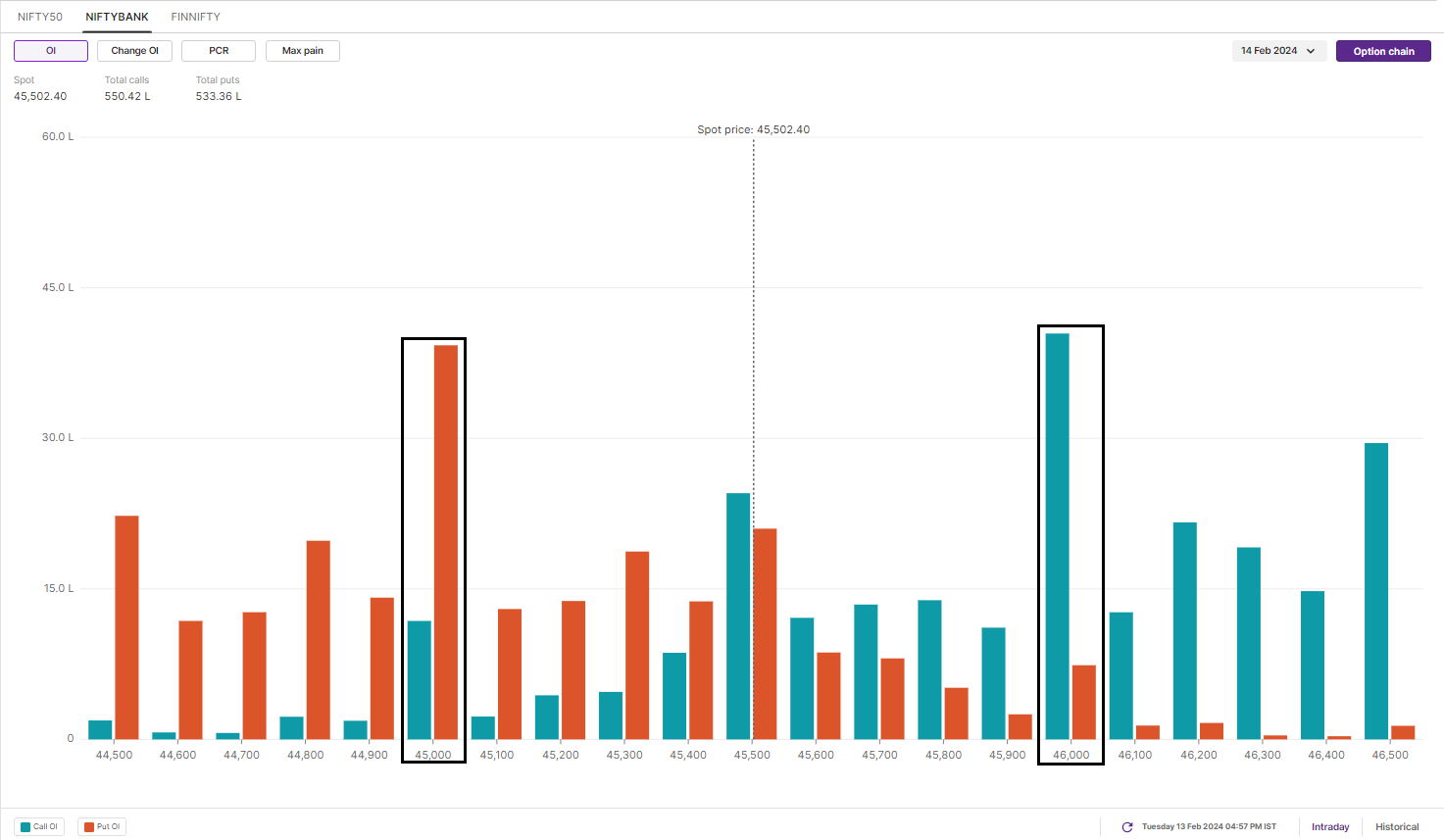

For BANK NIFTY's today’s expiry, the options data shows significant open interest at the 46,000 & 46,500 call option strikes and 45,000 & 44,000 put option strikes. As per the open interest, traders eye BANK NIFTY’s trading range between 44,000 and 46,500.

FII-DII activity

In the cash market, both the Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) remained net buyers for second day in a row. The FIIs bought shares worth ₹376 crore, while the DIIs purchased shares worth ₹273 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: Bosch, Voltas, Birlasoft and Siemens.

Short build-up: Hindalco and Bharat Heavy Electricals.

Catch up on yesterday's NIFTY 200 insights! Don't miss our market recap blog, offering valuable insights in a concise format. Click here to read and stay informed.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.