BANK NIFTY expiry: Key levels and trading range for today’s session

Upstox

4 min read • Updated: March 13, 2024, 8:26 AM

Summary

The BANK NIFTY mirrored the volatility in the NIFTY50 yesterday and ended flat after early volatility. While most of the banking stocks declined, HDFC Bank bucked the trend with a gain of over 2%. As a result, the BANK NIFTY found support at its 20-day moving average (46,900) and closed above the key level of 47,000. For today's expiry, options data points to a trading range of 46,500-48,200 with key support at 47,000-46,900.

Asian markets update

Indian equities may start Wednesday's session flat to positive, as indicated by the GIFT NIFTY (+0.1%). Asian markets are trading lower. Japan's Nikkei 225 is down 0.4% and Hong Kong's Hang Seng Index slipped 0.1%.

U.S. market update

U.S. stocks snapped a two-day losing streak and closed higher on Tuesday despite a slightly hotter-than-expected inflation print. The Consumer Price Index rose 3.2% year-on-year in February, up from 3.1% in January.

The Dow Jones Industrial average jumped 0.6% to 39,005, while the S&P 500 advanced 1.1% to 5,175. The tech-heavy Nasdaq Composite gained 1.5% to 16,265.

NIFTY50

- March Futures: 22,447 (▲0.07%)

- Open Interest: 2,50,052 (▲3.71%)

The NIFTY50 closed flat on Tuesday after a choppy trading session. Index heavyweights like TCS, HDFC Bank and Reliance Industries provided some support but the index swung over 150 points in two hours in the morning session and traded sideways for the rest of the day. This indecisiveness is reflected in a doji candle formation on the daily chart.

Experts note that the NIFTY50 has been trading in a range between 22,000 and 22,600 for the past week. The index has immediate support in the 22,200-22,250 area, which also coincides with the 20-day moving average (DMA).

Following the release of slightly higher than expected US inflation data for February, traders will be watching the price action near the doji candle closely. A close above or below the previous day's closing price will provide further directional clues.

The 14 March open interest of NIFTY50 shows a significant concentration of calls on the 22,500 and 22,600 strikes. Conversely, the put base is concentrated at the 22,000 and 22,300 strikes. Based on the positioning of the OI, traders are expecting NIFTY50 to trade between 21,900 and 22,700 this week.

BANK NIFTY

- March Futures: 47,527 (▲0.07%)

- Open Interest: 1,30,278 (▲0.99%)

The BANK NIFTY mirrored the indecisiveness of the NIFTY50 on Tuesday, closing flat with a doji candlestick on the daily chart. Similar to the NIFTY50, the banking index witnessed sharp swings of nearly 1,000 points in the first half of the day before settling into a narrow range.

Bucking the trend: HDFC Bank was the only gainer on Tuesday, rising 2.2%. Conversely, Federal Bank (-2.3%) and Punjab National Bank (-2.2%) led the decline among the other eleven banking stocks.

Support and resistance levels: The BANK NIFTY found support at its 20 DMA (46,900) and managed to close above the key psychological level of 47,000. Experts see immediate support for the index between 47,000 and 46,900, with resistance at 48,200 ahead of today's expiry.

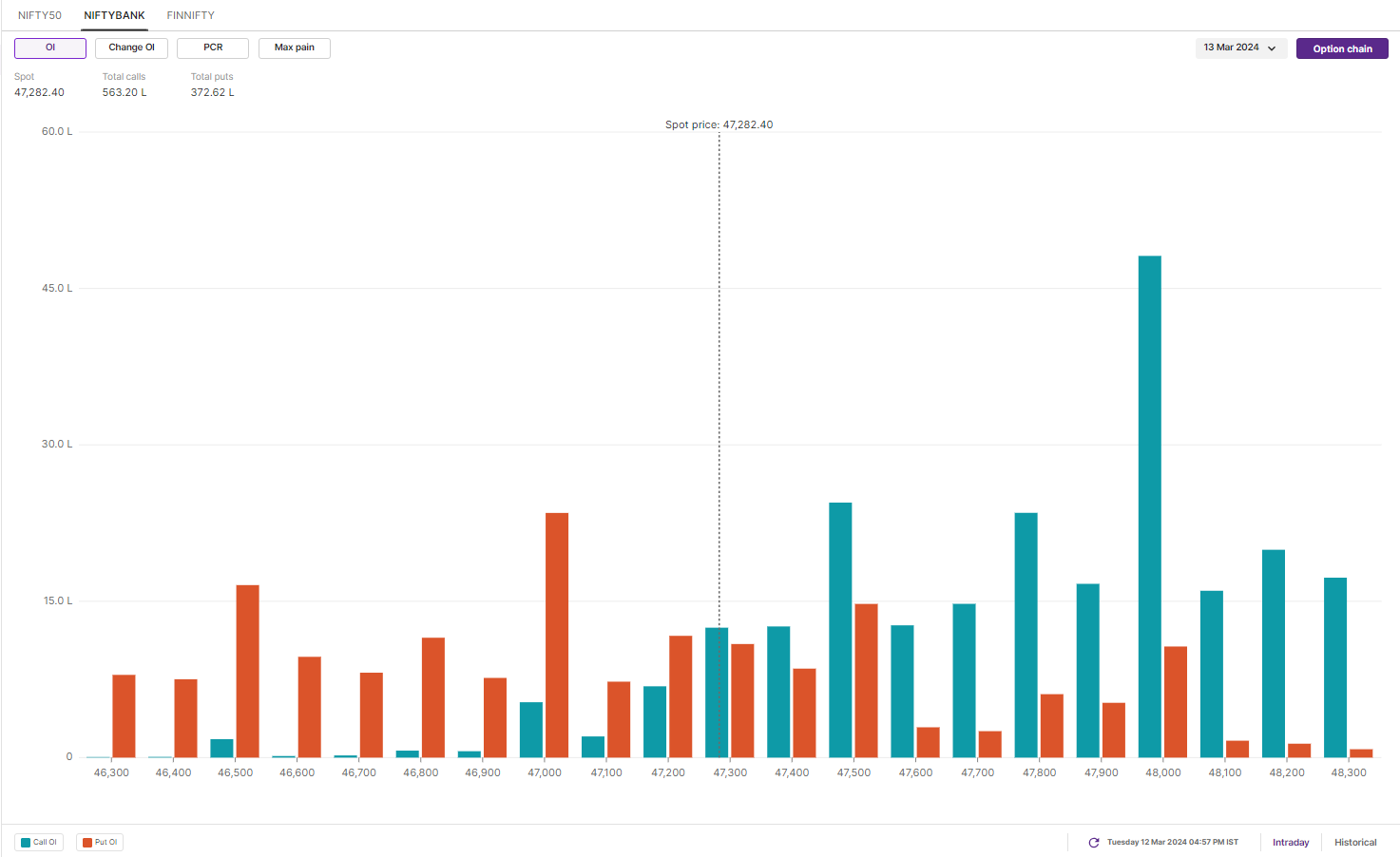

Options data points to trading range: Open interest data suggests significant activity at the 48,000 & 48,500 call option strikes and the 46,000 & 47,000 put option strikes. This suggests that traders expect the BANK NIFTY to trade in a range of 46,500 & 48,200 for today's expiry.

FII-DII activity

Continuing their recent trend, Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) remained net buyers for the 5th consecutive day on Tuesday. FIIs bought shares worth ₹73 crore, while DIIs purchased shares worth ₹2,358 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/

Stock scanner

- Long build-up: Oracle Financial Services ,TCS and IndiaMART InterMESH

- Short build-up: DLF, National Aluminium, Bharat Electronics and BHEL

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.