Banking giants lead charge, BANK NIFTY surges past 50-DMA

Upstox

5 min read • Updated: March 2, 2024, 8:24 AM

Summary

The BANK NIFTY surged on Friday, breaching key resistance levels and reclaiming the 47,000-mark. The strong performance was driven by buying in major private sector banks like ICICI and HDFC.

Indian markets will hold a special trading session today, March 2nd, 2024, to test the disaster recovery system of the National Stock Exchange and Bombay Stock Exchange. The session will be divided into two phases:

- The first phase will run from 9:00-10:00 am

- The second phase will be held from 11:15 am to 12:30 pm

Buoyed by gains on Wall Street, the GIFT NIFTY is currently trading higher (+0.2%), suggesting a positive start for the Indian equities today.

U.S. market update

U.S. stocks closed higher in the green, led by a strong performance from technology stocks. The Nasdaq Composite rose to an all-time high, surpassing the November 2021 high. The tech-heavy index gained 1.1% to close at 16,274, while the S&P 500 rose 0.8% to 5,137. The Dow Jones Industrial Average added 0.2% to close at 39,087.

NIFTY50

- March Futures: 22,443 (▲1.3%)

- Open Interest: 2,58,270 (▼1.2%)

The NIFTY50 started the March F&O series on a strong note and scaled to a new-all time high. After a strong start, the index extended its opening gains and fomed a bullish marubozu candle on the daily chart. Better than expected third-quarter GDP data and upbeat auto sales numbers boosted the positive sentiment.

Among the NIFTY50 pack, Tata Steel (+6.8%) and Larsen & Toubro (+4.3%) advanced the most, while Dr. Reddy’s (-3.6%) and Infosys (-1.2%) were the top losers.

As highlighted in our yesterday’s blog, the NIFTY50 extended its upmove on Friday after protecting the 20-DMA and the crucial swing low of 21,875. The index broke its immediate resistance of 22,297 (recent all-time high) and traded above it for the entire second half of the day. Moreover, it formed a bullish marubozu candle on the daily chart and closed near the day’s high.

Experts suggest that with the formation of bullish candle and a close above immediate resistance, the broader uptrend of the NIFTY50 remains intact. A bullish marubozu indicates strong buying pressure. It's characterised by a long, filled body with minimal or no upper and lower wicks.

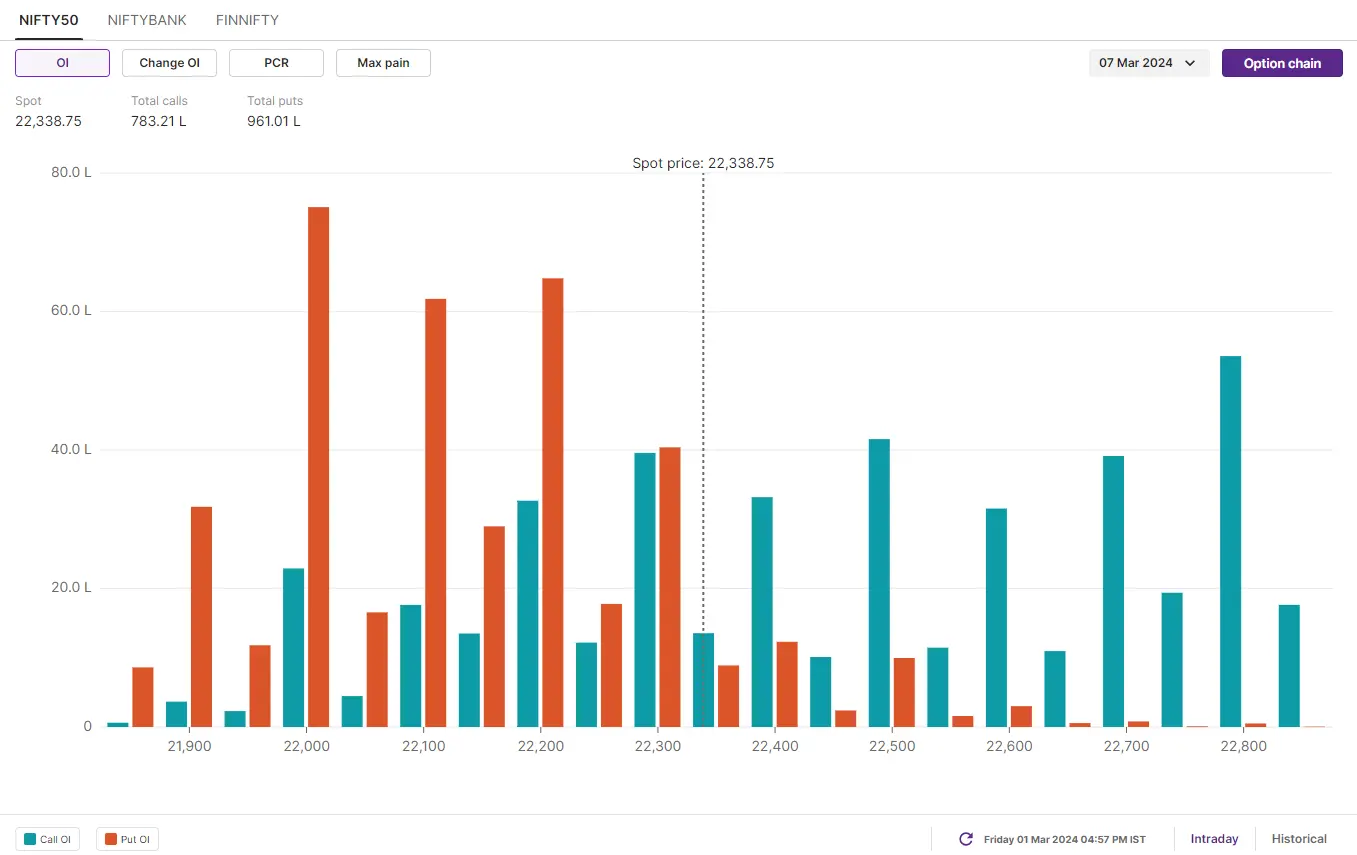

The March 7 open interest of NIFTY50 shows a significant concentration of calls on the 23,000 and 22,800 strikes. Conversely, the put base is concentrated at the 22,000 and 22,200 strikes. Based on the positioning of the OI, traders are expecting NIFTY50 to trade between the 21,800 and 22,800 in the upcoming week.

BANK NIFTY

- March Futures: 47,578 (▲2.2%)

- Open Interest: 1,55,701 (▼4.3%)

The BANK NIFTY started the Friday’s session above 46,300 mark, which had acted as a strong resistance on expiry just a day earlier. With strong buying in private banking heavyweights, particularly ICICI Bank (+3.3%) and HDFC Bank (+1.4%), the index broke through all barriers and reclaimed the key 47,000 level on closing basis.

On the daily chart, the BANK NIFTY has also formed a strong bullish marubozu candle, indicating the dominance of buyers on Friday. As we pointed out in yesterday's blog, the banking index closed at a very important point, just below its 20-DMA. We advised our readers to keep an eye on the 50 DMA, which was just above 46,500. Today, the BANK NIFTY closed decisively above its 50-DMA, turning former resistance at 46,300 into support.

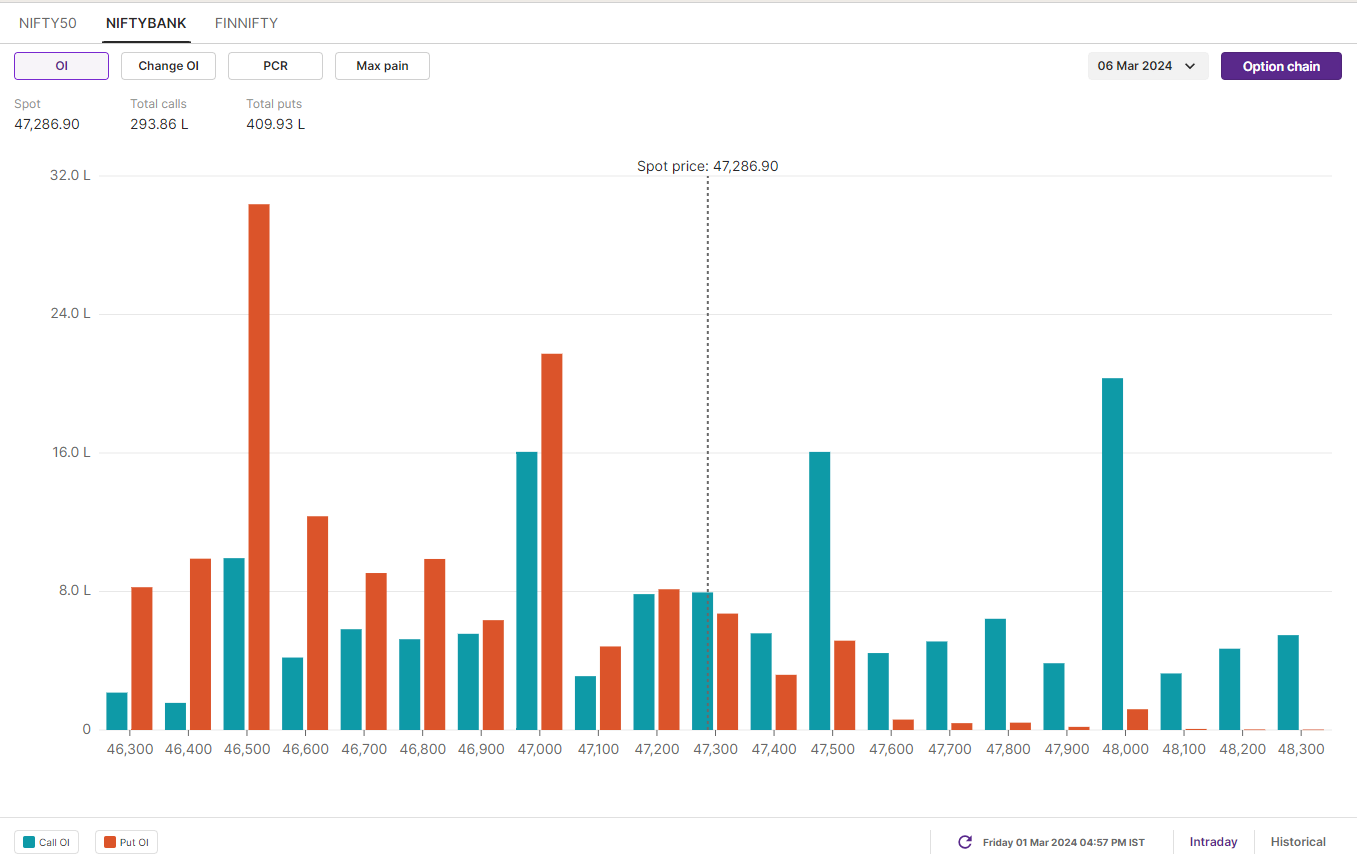

For BANKNIFTY's March 6 expiry, options data shows significant open interest at the 48,000 & 49,000 call strikes and the 46,500 & 47,000 put strikes. Based on the open interest, traders are eyeing BANKNIFTY's trading range between 45,800 and 48,500 for next week.

FII-DII activity

In the cash market, the Foreign Institutional Investors (FIIs) bought shares worth ₹128 crore, while Domestic Institutional Investors (DIIs) sold shares worth ₹3,814 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/

Stock scanner

Long build-up: Steel Authority of India, Jindal Steel, Indus Towers, Vodafone-Idea and Dixon

Short build-up: Zee Entertainment

Catch up on yesterday’s trading insights from NIFTY 200! Don't miss our market recap blog, offering valuable insights in a concise format. Click here to read and stay informed

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.