Budget & Fed in focus: NIFTY50 faces crucial test at 21,850 - Key levels to watch ahead of expiry

Upstox

4 min read • Updated: February 1, 2024, 7:59 AM

Summary

The charts paint a mixed picture for the NIFTY50. The monthly doji indicates traders' indecision, but the daily bullish piercing candle inspires optimism. The index faces a stiff test at 21,850, with the unfilled gap above acting as a psychological barrier. Renewed buying interest around 21,450-21,500 offers support, but a decisive break above/below either level on a closing basis will provide definitive directional clues.

Asian markets update 7 am

Indian equities might experience a flat start on Thursday, with the GIFTY NIFTY future currently trading 12 points higher than yesterday's close. Other Asian markets are presenting a mixed picture. Japan's Nikkei 225 fell 0.6%, while Hong Kong's Hang Seng Index saw a slight gain of 0.1%.

U.S. market update

U.S. stocks tumbled on Wednesday following the Federal Reserve's decision to keep interest rates steady. Chairman Jerome Powell's statement that the central bank would not start cutting interest rates at its March meeting dampened investor sentiment. The tech-heavy Nasdaq Composite fell 2.2% to 15,164. The Dow Jones slumped 0.8% to 38,150 and the S&P 500 dropped 1.6% to 4,845.

NIFTY50 February Futures: 21,808 (▲0.7%) Open Interest: 2,24,930 (▼0.07%)

The NIFTY50 shrugged off yesterday's dip to rise 1% in a volatile session, forming a bullish piercing candle on the daily chart. This rally comes ahead of the all-important interim Union Budget, indicating optimism among the market participants.

However, a doji candle on the monthly chart suggests that traders remain undecided. As highlighted in our previous blogs, the index still faces a hurdle at 21,850, with the unfilled gap above acting as a potential barrier. However, according to the experts, there does seem to be some renewed buying interest around the 21,450-21,500 levels. Traders will want to keep a close eye on both the 21,850 and 21,450 levels on the daily chart. A decisive break above or below either level on a daily closing basis will provide valuable directional clues.

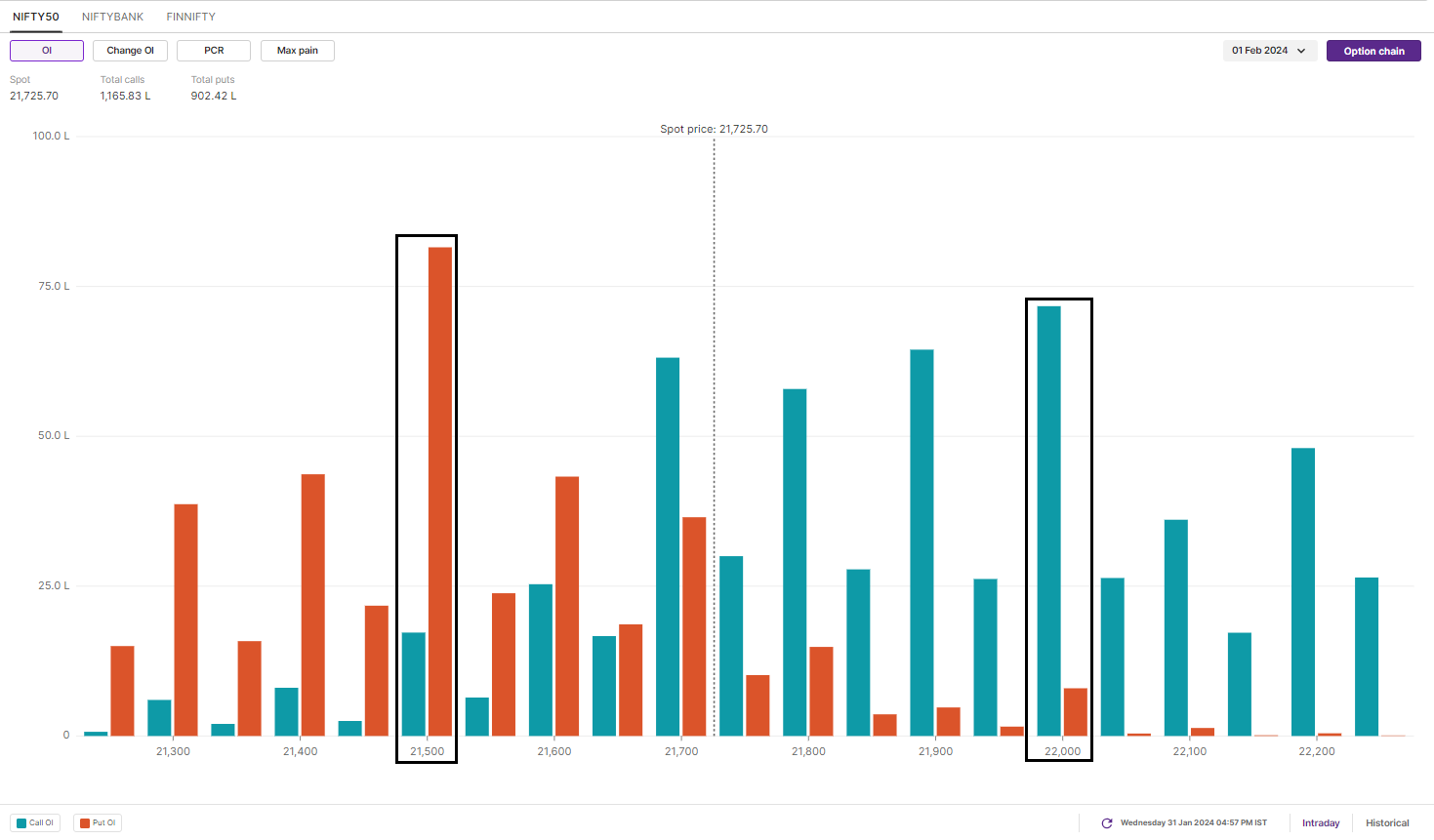

As per the open interest, the maximum call base for today’s expiry is present at 22,500 and 22,000 strikes. On the other hand, the put options have formidable base at 21,500 and 21,000 strikes. As per option premiums and open interest, traders are expecting the NIFTY50 to trade between 21,200 and 22,200 levels.

You can track open interest of the NIFTY50 here: https://pro.upstox.com/

BANK NIFTY

- February Futures: 46,324 (▲1.3%)

- Open Interest: 2,06,742 (▼5.8%)

Despite starting lower, the BANK NIFTY (+1.3%) showed resilience and formed a bullish engulfing candle on the daily chart. This surge has engulfed the previous doji candle on the daily chart.

However, the index is not out of the woods yet, as a formidable hurdle awaits at the 46,500 level. This level coincides with the crucial 50-day moving average, which acts as a psychological and technical barrier. Experts warn that unless the BANK NIFTY decisively breaks above this resistance on a daily closing basis, further upside momentum could be in doubt. A break above would pave the way for potential gains, while a failure could lead to consolidation or even a pullback.

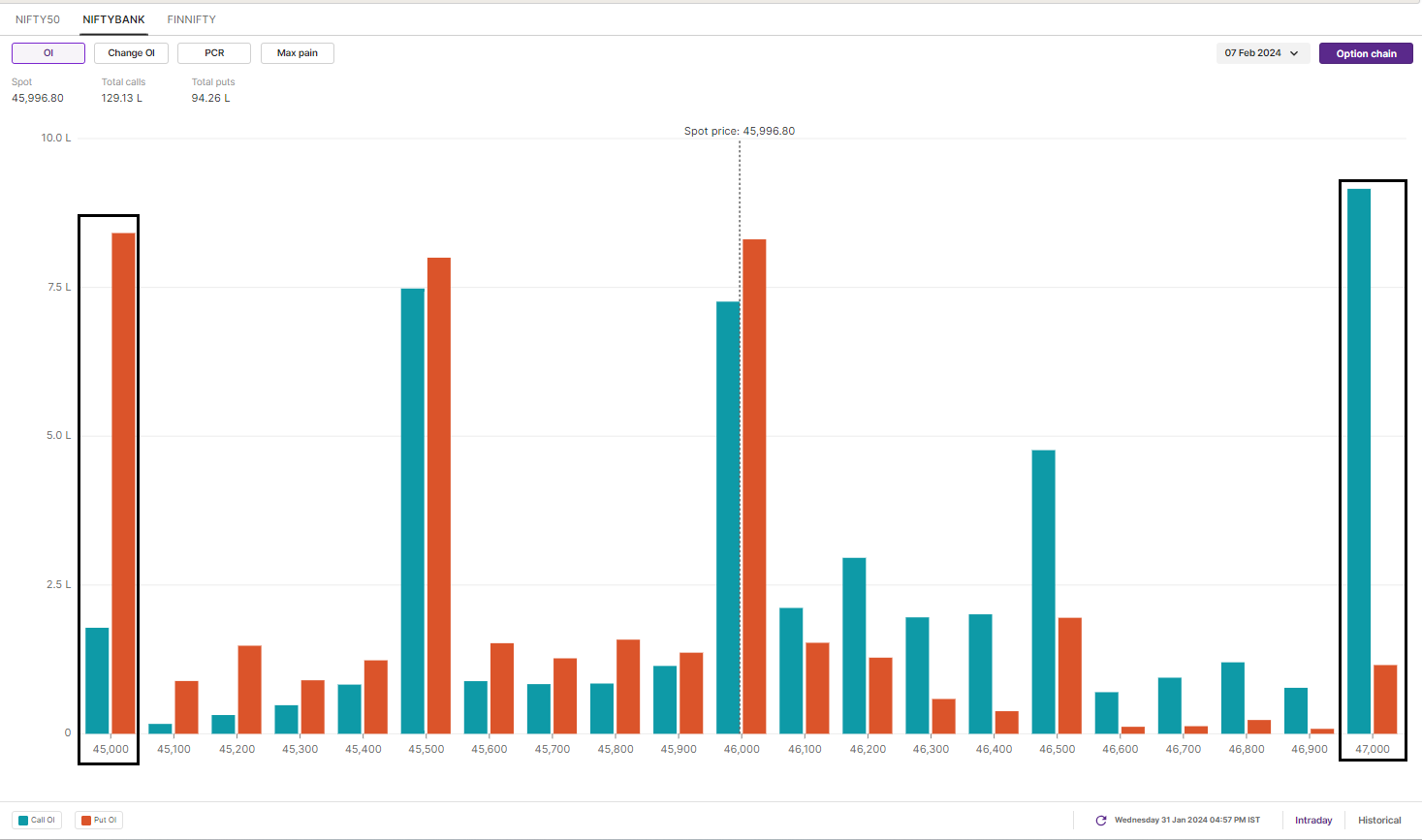

On the options front, the BANK NIFTY call options have significant open interest at the 48,000 and 47,000 strikes for the February 7 expiry. Conversely, the put options have the highest open interest at the 45,000 and 46,000 strikes. Based on the options data, the BANK NIFTY's trading range for the February 7 expiry could be between 47,800 and 44,000.

You can track open interest of the BANK NIFTY here: https://pro.upstox.com/

FII-DII activity

In the cash market, the Foreign Institutional Investors (FDIIs) bought shares worth ₹1,660 crore, while the Domestic Institutional Investors (DIIs) purchased shares worth ₹2,542 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives.

Stock scanner

Long build-up: Dr. Reddy's Laboratories, Gujarat Gas, Sun Pharmaceutical, HDFC Asset Management Company and Cummins India.

Short build-up: Larsen & Toubro, Cholamandalam Investment and Finance, Pidilite Industries and Ambuja Cements.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.