NIFTY50 surge to new all-time high, metals and banks shine

Upstox

2 min read • Updated: April 1, 2024, 7:14 PM

Summary

The NIFTY50 faces resistance at the 22,500 level, where call options expiring this week have the highest open interest. Experts believe that the 22,500-22,550 zone will act as immediate resistance, while support remains at 22,200.

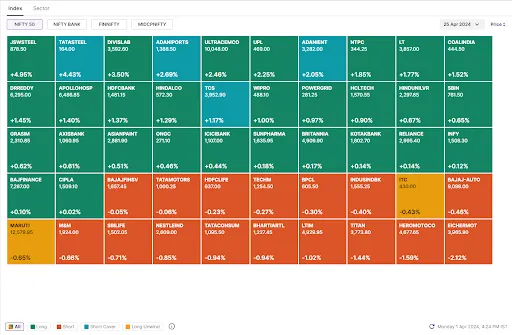

Markets extended the winning momentum for the third day in a row and hit a fresh all-time high, led by metals and banking stocks. The NIFTY50 rose 0.6% and closed Monday's session at 22,462, while the SENSEX advanced 0.4% and closed the day at 74,014.

- Top gainer and loser in NIFTY50: JSW Steel (+4.8%) and Eicher Motors (+1.6%)

- The broader markets outperformed their benchmark peers. The NIFTY Midcap 100 index jumped 1.7% and the Smallcap 100 index rose 3.2%.

- Top gainer in NIFTY Midcap 100: Indus Towers (+8.2%) and BSE (+7.6%)

- Top gainer and loser in NIFTY Smallcap 100: PNB Housing Finance (+20.0%) and Welspun Living (+12.6%)

Except for Auto (-0.1%) and FMCG (-0.1%), all the major sectoral indices ended in the green. Media (+4.6%) and Realty (+4.3%) advanced the most.

The NIFTY50 remains buoyant on the daily chart, holding above its key daily moving averages (20 and 50). However, the index still faces resistance at the 22,500 level, where the call options for this week's expiry have the highest open interest. Experts believe that the 22,500-22,550 area will act as immediate resistance, while support remains at 22,200.

Key highlights of the day:

🚀Metal stocks were in focus after China's manufacturing PMI index rose to 50.8 in March from 49.1 the previous month. Shares of Hindustan Copper, National Aluminium, Vedanta and SAIL jumped between 4% and 11%.

🛬Hindustan Aeronautics (+2.1%) hit a new 52-week high after the company announced that it had posted its highest ever revenue of more than ₹29,810 crore in FY24.

🚢Adani Ports (+2.6%) was in focus after the company recorded its highest ever monthly cargo volume of 38 million tonnes in March. On a year-on-year basis, the company's total FY24 cargo volume grew by 24%.

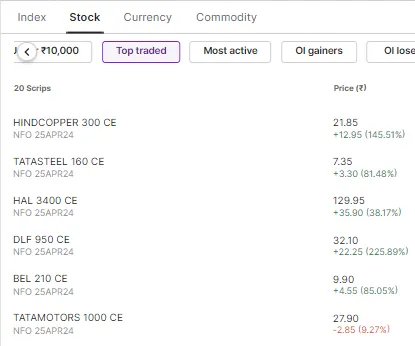

Top traded futures contracts

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Cipla, HDFC Life, Max Healthcare and Crompton Greaves

📈Open = Low (Bull power): JSW Steel, Divi's Laboratories, Ultratech Cement, Steel Authority of India (SAIL) and AB Capital.

🏗️Fresh 52 week-high: Tata Steel, Indus Towers, DLF, Indian Hotels, Ambuja Cements, Adani Ports and HAL

⚠️Fresh 52 week-low: N/A

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!