NIFTY50 suffers biggest fall since Jan, Mid and Smallcaps bleed further

Upstox

2 min read • Updated: March 13, 2024, 5:12 PM

Summary

In a dramatic reversal, the NIFTY50 plunged over 500 points from its intraday high and closed below the psychologically important 22,000 level. Going forward, the index faces immediate resistance around the 22,200-22,300 area.

Despite opening higher, Indian markets reversed course and closed sharply lower today, shrugging off positive global cues. The NIFTY50 fell over 1.5% to close at 21,997, its biggest daily fall since 23 January. The SENSEX mirrored the decline, losing over 900 points or 1.2% to close at 72,761.

Broader markets plunged for the third consecutive day, extending their losses. The NIFTY Midcap 100 and Smallcap 100 indices fell sharply by over 4% and 5% respectively. From their recent all-time high, both the indices are now down over 7% and 14% respectively.

Sector-wise, the FMCG was the only gainer, eking out a small gain of 0.05%. All the other major sectoral indices ended in red with Metals (-5.6%), Realty (-5.3%), Oil & Gas (-4.8%) and PSU Banks (-4.2%) posting significant losses.

On the daily chart, the NIFTY50 has formed a bearish engulfing candle, breached a key support level (22,200) and closed below its 20-day moving average. In today's session, the index fell over 500 points from the day's high and closed below the psychologically important 22,000 level. Going forward, the 22,200 and 22,300 zones will act as immediate resistance.

Key highlights of the day:

🚀ITC surged over 4% after the British American Tobacco (BAT) sold a 3.5% of stake at an average price of ₹400 per share.

🔥Vedanta slipped over 7% after SEBI ordered the company to pay ₹78 crore to Cairn UK Holding for delayed dividend payments.

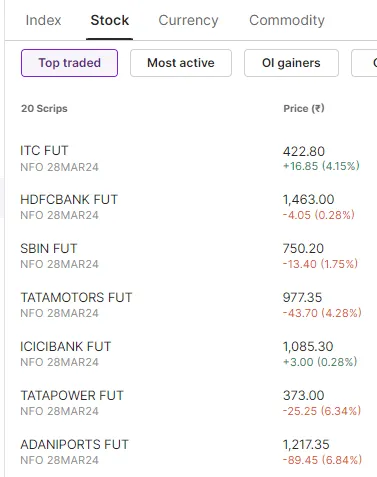

Top traded Futures contracts

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Bharat Petroleum, Bharti Airtel, Hindustan Unilever, AB Capital and Gujarat Gas

📈Open = Low (Bull power): N/A

🏗️Top five fresh 52 week-high: TCS and Colgate-Palmolive

⚠️Fresh 52 week-low: Zee Entertainment, Hindustan Unilever, Bandhan Bank, UPL and Navin Fluorine

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!