NIFTY50 slips below 20-DMA, volatility index rises above 16

Upstox

2 min read • Updated: May 6, 2024, 6:06 PM

Summary

The NIFTY50 index fell below its 20-day moving average and confirmed the bearish engulfing candlestick pattern formed on 3 May. Accompanied by a 13% spike in the Volatility Index, traders are advised to stay cautious for potentially sharp swings in the market.

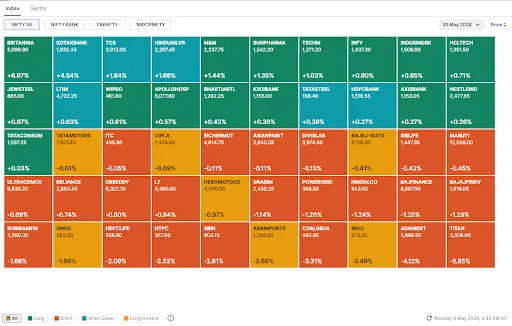

Markets traded in a narrow range with a negative bias, led by profit booking in PSU banks and Reliance Industries. The NIFTY50 failed to hold its morning gains and closed below the crucial 22,500 mark. The index slipped 0.1% to 22,442, while SENSEX closed flat at 73,895.

-

Top gainer and loser in NIFTY50: Britannia (+6.6%) and Titan (-7.0%)

-

The broader markets also witnessed profit booking with NIFTY Midcap 100 index falling 0.5% and the Smallcap 100 index declining 1.5%.

-

Top gainer and loser in NIFTY Midcap 100: Godrej Properties (+10.4%) and Biocon (-1.6%)

-

Top gainer and loser in NIFTY Smallcap 100: Piramal Pharma (+3.4%) and Cochin Shipyard (-2.2%)

The NIFTY50 index fell below its 20-day moving average and confirmed the bearish engulfing candlestick pattern formed on 3 May. Accompanied by a 13% spike in the Volatility Index, traders are advised to stay cautious for potentially sharp swings in the market. Looking ahead, NIFTY50 has immediate support at 22,300 and resistance at 22,800.

Key highlights of the day:

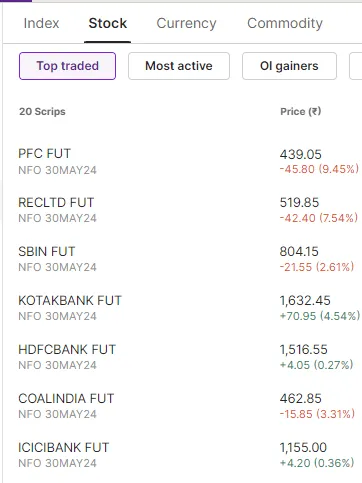

💰REC and PFC both fell over 7% as the RBI proposed an additional 5% provisioning for infrastructure finance companies, applicable to both existing and new loans. This measure affects both banks and NBFCs.

🪙Titan slumped over 7% after the company's Q4 FY24 net profit rose 7% YoY to ₹786 crore. However, the company's profit margin declined and was below street estimates.

🥐Britannia gained 6% despite the company's Q4 FY24 net profit falling 3.6% YoY to ₹538 crore. The company's results were in line with street estimates and improving market share boosted investor sentiment.

Top traded futures contracts

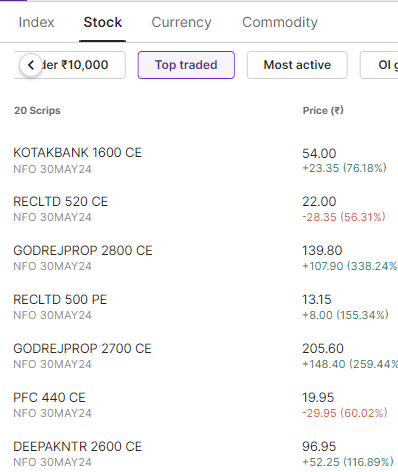

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Punjab National Bank, Nestle India, Hindustan Petroleum, Bank of Baroda and LIC Housing Finance.

📈Open = Low (Bull power): ABB, Tata Consultancy Services, Aurobindo Pharma and Persistent Systems.

🏗️Fresh 52 week-high: Godrej Properties, Prestige, Supreme Industries, Deepak Nitrite, ABB, Siemens and Mahindra & Mahindra.

⚠️Fresh 52 week-low: Zee Entertainment

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!