Trade setup for 22 April: NIFTY50 rebounds with bullish piercing pattern, all eyes on 50-DMA

Upstox

4 min read • Updated: April 22, 2024, 8:19 AM

Summary

The NIFTY50 rose over 1.6% from day’s low and formed a bullish piercing candle on 19 April. To validate this pattern as a reversal signal, traders will monitor today's close; a close higher than the close of the bullish piercing candle serves as confirmation of the trend reversal.

Asian markets update 7 am

Indian equities are set for a positive start as the GIFT NIFTY climbs 0.6%, surpassing the 22,200 mark. Other Asian markets are also trading higher. Japan's Nikkei 225 is up 0.3% and Hong Kong's Hang Seng Index is up 1.7%.

U.S. market update

U.S. equities ended the Friday’s session lower after a sell-off in technology stocks, particularly Nvidia slipped 10%. The S&P 500 slipped 0.8% to 4,967, while the Nasdaq Composite dropped 2% and closed at 15,282. However, the Dow Jones Industrial Average bucked the trend and advanced 0.5% and ended the day at 37,986—aided by earnings of American Express.

NIFTY50

April Futures: 22,128 (▲0.3%)

Open Interest: 2,06,802 (▼10.01%)

After a gap-down start, the NIFTY50 index rebounded from the day’s low and recaptured the 22,000 mark, led by gains in banking and metal stocks. The index rose over 1.6% from day’s low and formed a bullish piercing candle on the daily chart.

A bullish piercing is a two candlestick pattern which typically occurs after a down trend and is seen as a possible reversal, subject to confirmation. This pattern begins with the market opening at a lower level on the second day, followed by a significant rebound that results in a closing price above the midpoint of the previous day's trading range. To validate this pattern as a reversal signal, traders monitor the following day's close; a close higher than the close of the bullish piercing candle serves as confirmation of the trend reversal.

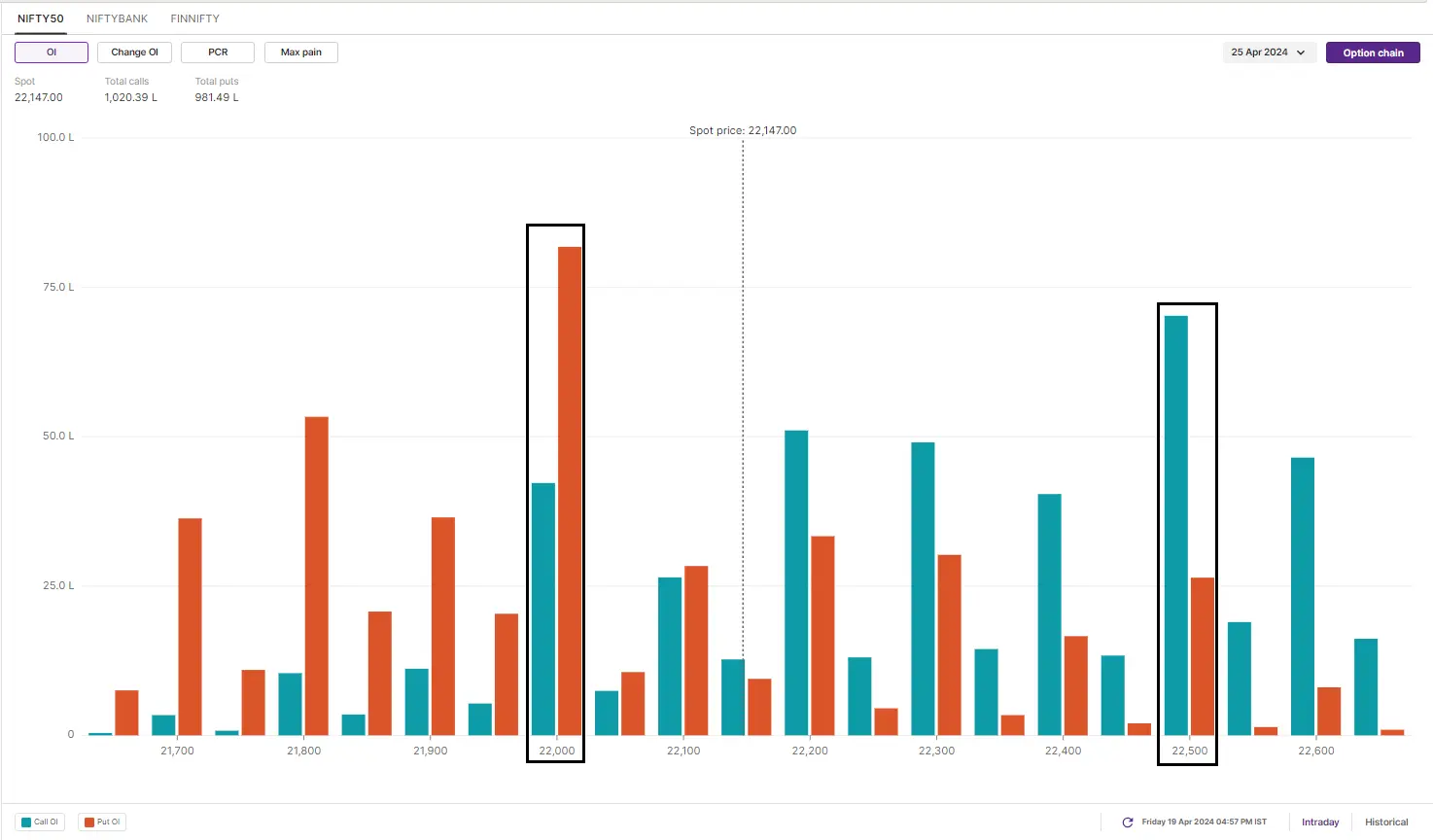

Open interest (OI) for the 25 April expiry has significant call OI at 22,500 strike, which may act as a resistance. On the other hand, the 22,000 strike has the highest put options base which will act as a support.

BANK NIFTY

April Futures: 47,575 (▲0.9%)

Open Interest: 1,09,963 (▼12.3%)

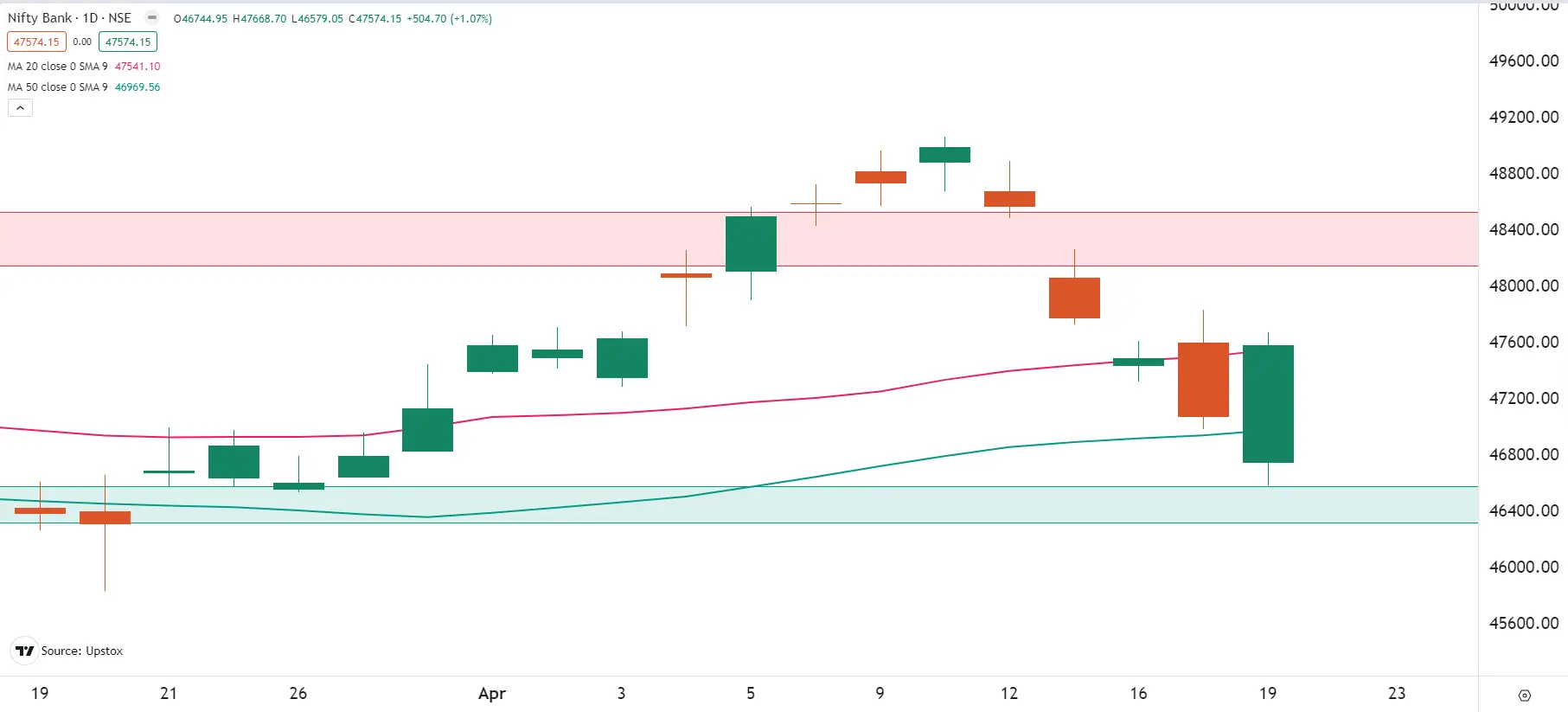

The BANK NIFTY also started the Friday’s session on a negative note but made a sharp recovery of over 2% from the day’s low and reclaimed the crucial 47,500 mark on closing basis.

Similar to NIFTY50, the BANK NIFTY also formed a bullish piercing pattern on the daily chart. Moreover, the index also recaptured both 20 and 50 day moving averages and closed above it. It is important to note that the BANK NIFTY will also react to the results of HDFC BANK which were in line with the street expectation.

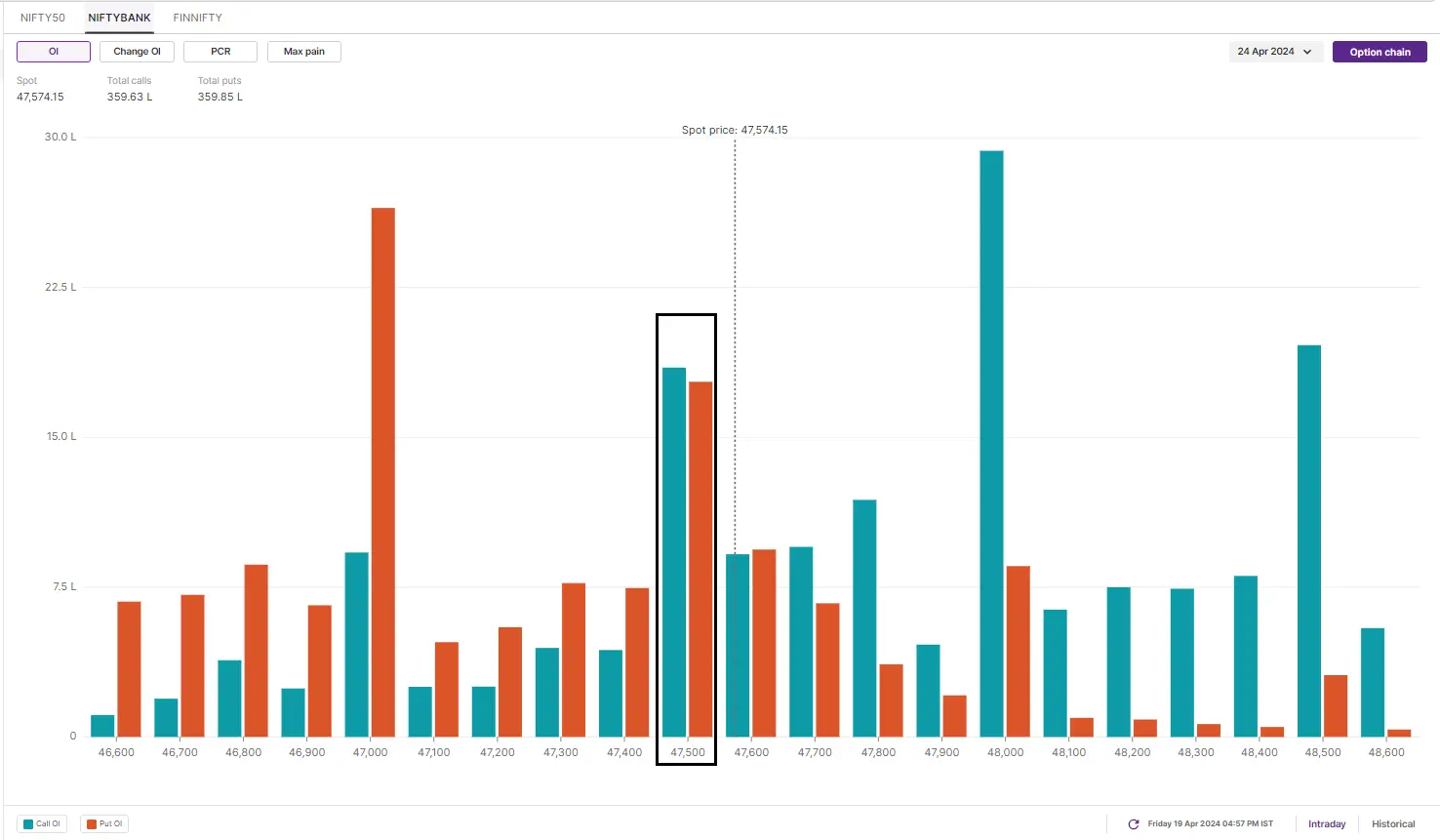

Open interest (OI) build-up for the 24 April expiry has significant call option base at 48,000 and 48,500 strike. These levels may act as the resistance for the index. On the flip side, the put option base is at 47,000 and 47,500. These levels may act as immediate support.

FII-DII activity

The institutional activity remained muted on 19 April. The Foreign Institutional Investors (FIIs) turned net buyers for the small quantity and purchased shares worth ₹129 crore. Conversely, the Domestic Institutional Investors (DIIs) sold shares worth ₹52 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: Jindal Steel and Max Financial Services

Short build-up: Tata Communications, Bajaj-Auto, Lupin, M&M Financial, TVS Motor and Biocon

Under F&O ban: Balrampur Chini, Bandhan Bank, Biocon, Exide Industries, Vodafone Idea, Metropolis, Piramal Enterprises, Steel Authority of India and Zee Entertainment

Out of F&O ban: Gujarat Narmada Valley Fertilizers (GNFC), National Aluminium and Hindustan Copper.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.