Market News

NIFTY50 outlook (Jan 29-Feb 2): Union Budget, Q3 earnings, US Fed rates and US Tech stocks key drivers

.png)

6 min read | Updated on January 28, 2024, 19:54 IST

SUMMARY

Next week promises to be an eventful one. with the interim Union Budget, domestic Q3 earnings and US tech giants' results all coming together. In addition, the US Federal Reserve's decision on interest rates could add further trigger to volatility in the Indian markets. Traders can buckle up for the potential volatile week.

NIFTY50 outlook (Jan 29-Feb 2)

Indian equities fell for the second week in a row, with the NIFTY50 losing 1.4% and the SENSEX losing 1.2%. This two-week correction of nearly 4.5% has investors nervously eyeing the upcoming interim budget on 1st February.

In contrast, the broader markets NIFTY Midcap 100 and NIFTY Smallcap 100 were relatively stable and ended the week flat. Sector-wise, Pharma (+2.2%) and PSU Banks (+1.7%) outperformed, while Media (-11.1%) and Realty (-3.8%) were the worst performers.

Next week promises to be an eventful one. with the interim Union Budget, domestic Q3 earnings and US tech giants' results all coming together. In addition, the US Federal Reserve's decision on interest rates could add further trigger to volatility in the Indian markets. Traders can buckle up for the potential volatile week.

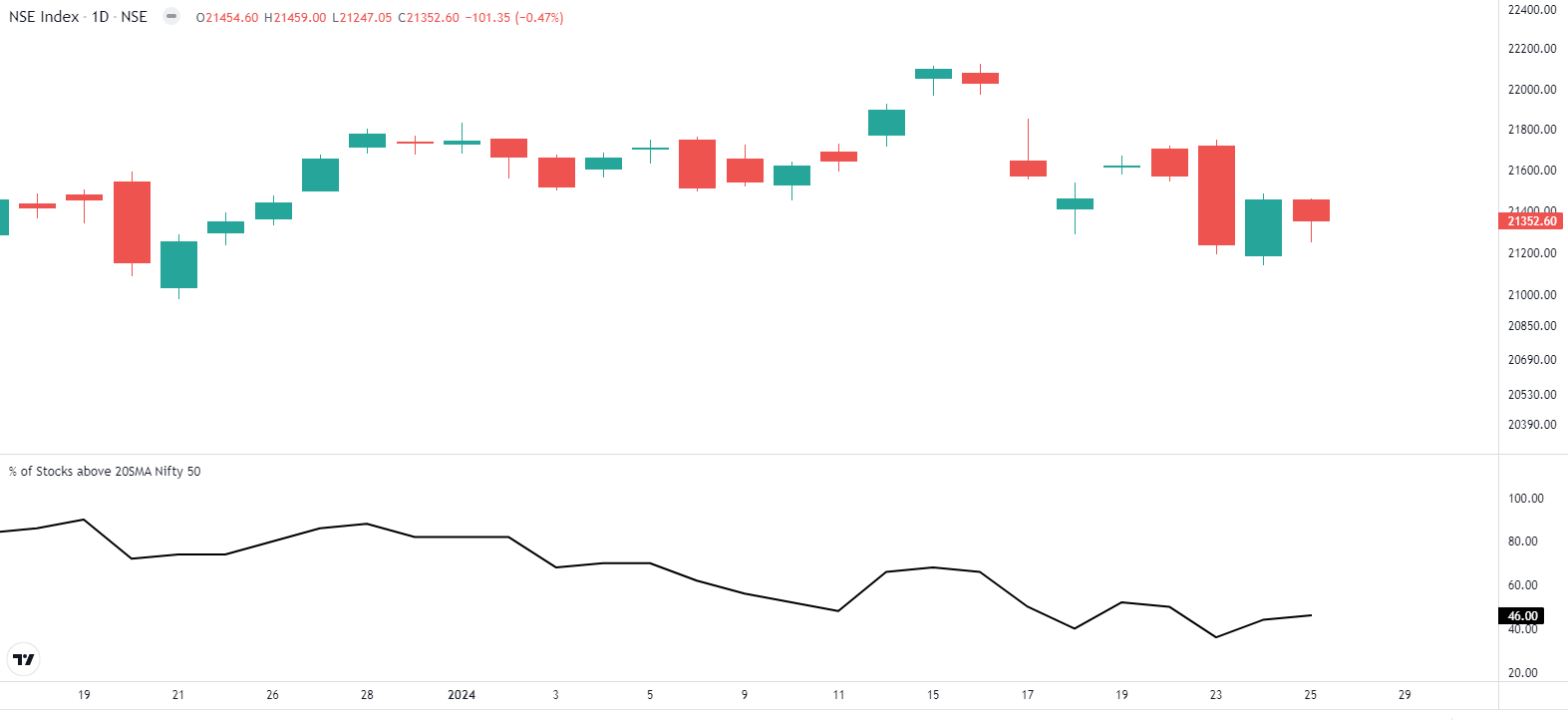

As highlighted in last week's outlook, the NIFTY50 continued its bearish trend, which was confirmed after closing below its 20-day moving average (DMA). This move is in line with the bearish engulfing pattern and its confirmation seen on the weekly chart. Currently, the index is trading between its 20 and 50 DMAs, suggesting a period of range bound activity.

Adding to the bearish sentiment, there was a notable shift in the NIFTY50 stocks. The percentage of stocks trading below their 20-DMAs increased by 4% compared to the previous week. This indicates a decline in short-term momentum, as only 46% of stocks are now trading above their respective 20-DMAs, compared to 50% last week.

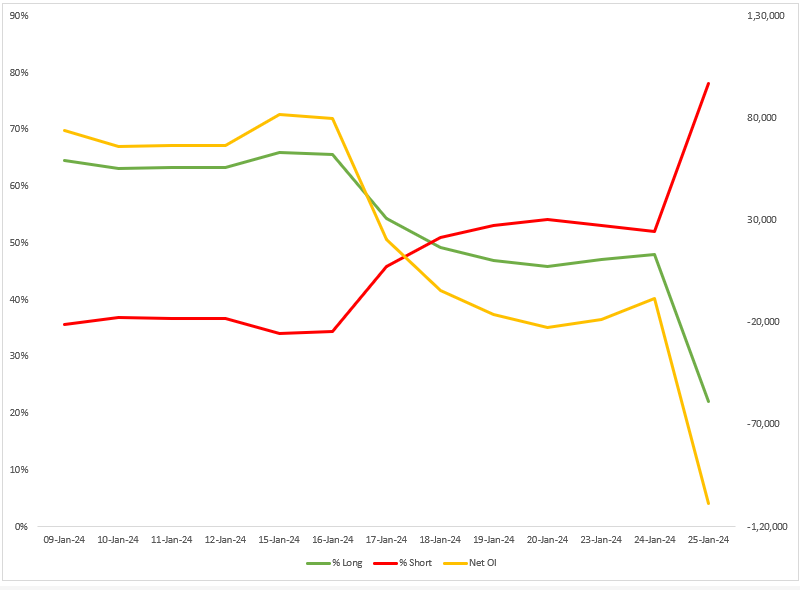

Foreign Institutional Investors (FIIs) continued their bearish stance in index futures after the monthly expiry. In particular, their long positions, reflecting a bet on rising prices, fell sharply from 48% to 28%. At the same time, their short positions, reflecting a bet on falling prices, have risen sharply from 52% to 78%.

This increase in bearish bets, now over 70%, is particularly notable as we approach the Union Budget. If the budget generates positive sentiment, it could lead to a short-covering rally. Traders who wish to understand and anticipate these movements should monitor the daily changes in Open Interest (OI). This will help track the fluctuation in the ratio of long to short positions and provide insights into market trends and FII behaviour.

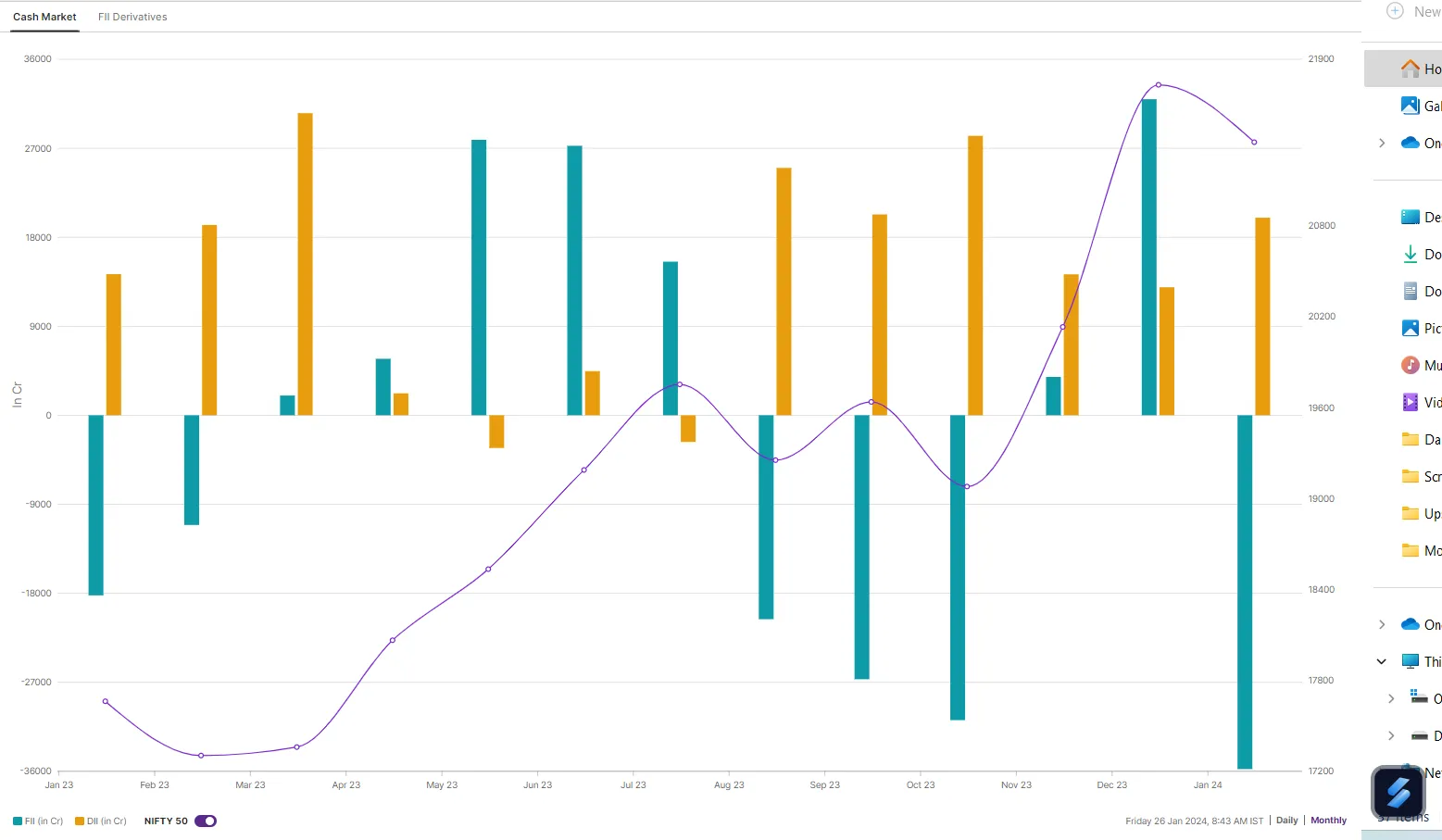

Meanwhile, in line with the bearish bets, FIIs have been dumping shares in the cash market. Till 25th January, the FIIs have sold shares worth ₹35,778 crore. This figure is 12% higher than what they bought in the previous month.

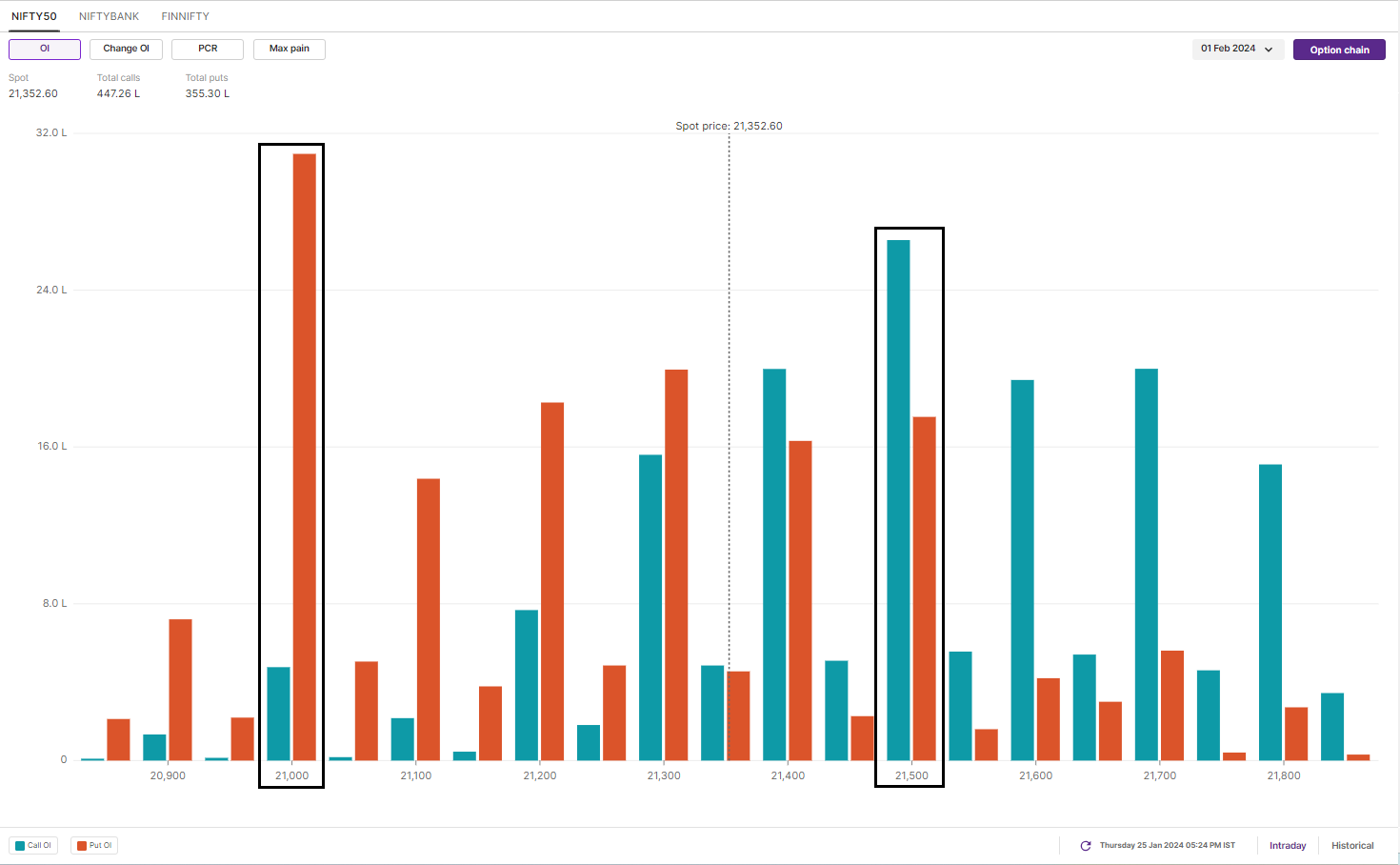

For the 1 february expiry, the maximum call writing was seen at the 21,500 and 22,000 strikes. On the other hand, the bulls have established a base with maximum put writing at the 21,000 and 21,300 strikes. As per the options data, the trading range for the NIFTY50 in the current week is between 22,800 and 20,100.

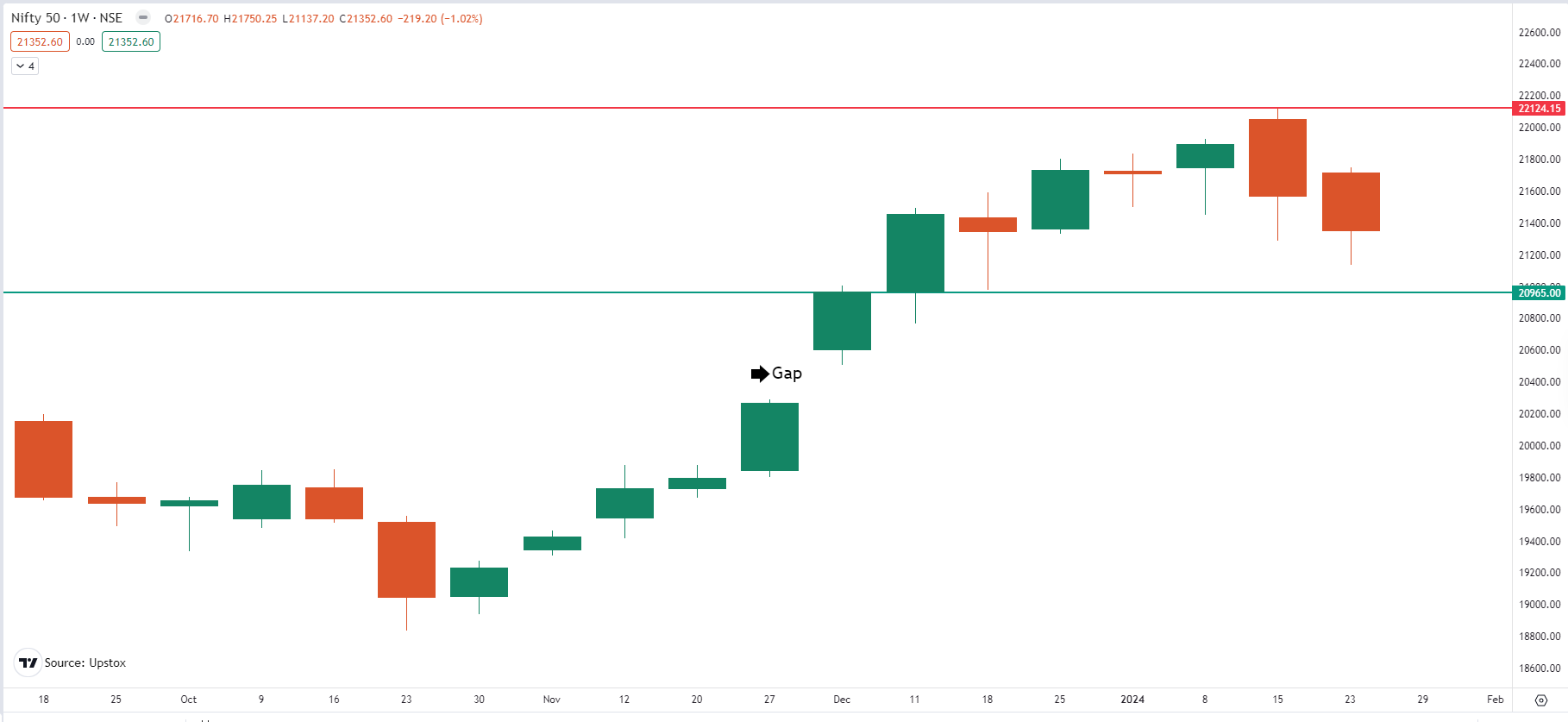

Market experts believe that intraday volatility may increase ahead of the interim Union Budget. On the weekly chart, the NIFTY50 closed below the previous week's close, confirming the bearish engulfing pattern that formed last week. In addition, the index has yet to close the gap (marked on the chart below) that formed between the 20,500 and 20,300. This unfilled gap remains a key area to watch.

Notably, the Fed's preferred measure of inflation, the core personal consumption expenditures (PCE) index, slowed from 3.2% to 2.9% in December, the lowest level in almost three years. This easing of inflationary pressures may influence upcoming rate decisions.

With a slew of global events and the upcoming interim Union Budget, we expect volatility to remain elevated in the near term. Traders are advised to monitor the 20 and 50 day moving averages on the daily chart. A decisive break above or below these averages could provide further clues to the market's direction.

About The Author

Next Story