NIFTY50 holds fort at 22,000, stages weekly recovery

Upstox

3 min read • Updated: March 22, 2024, 6:06 PM

Summary

Despite a bearish signal last week, the NIFTY50 defied expectations and recovered from an initial dip to rally from 21,700, erasing most of its weekly losses. However, experts caution that the bulls need to break above 22,200 for a sustained uptrend.

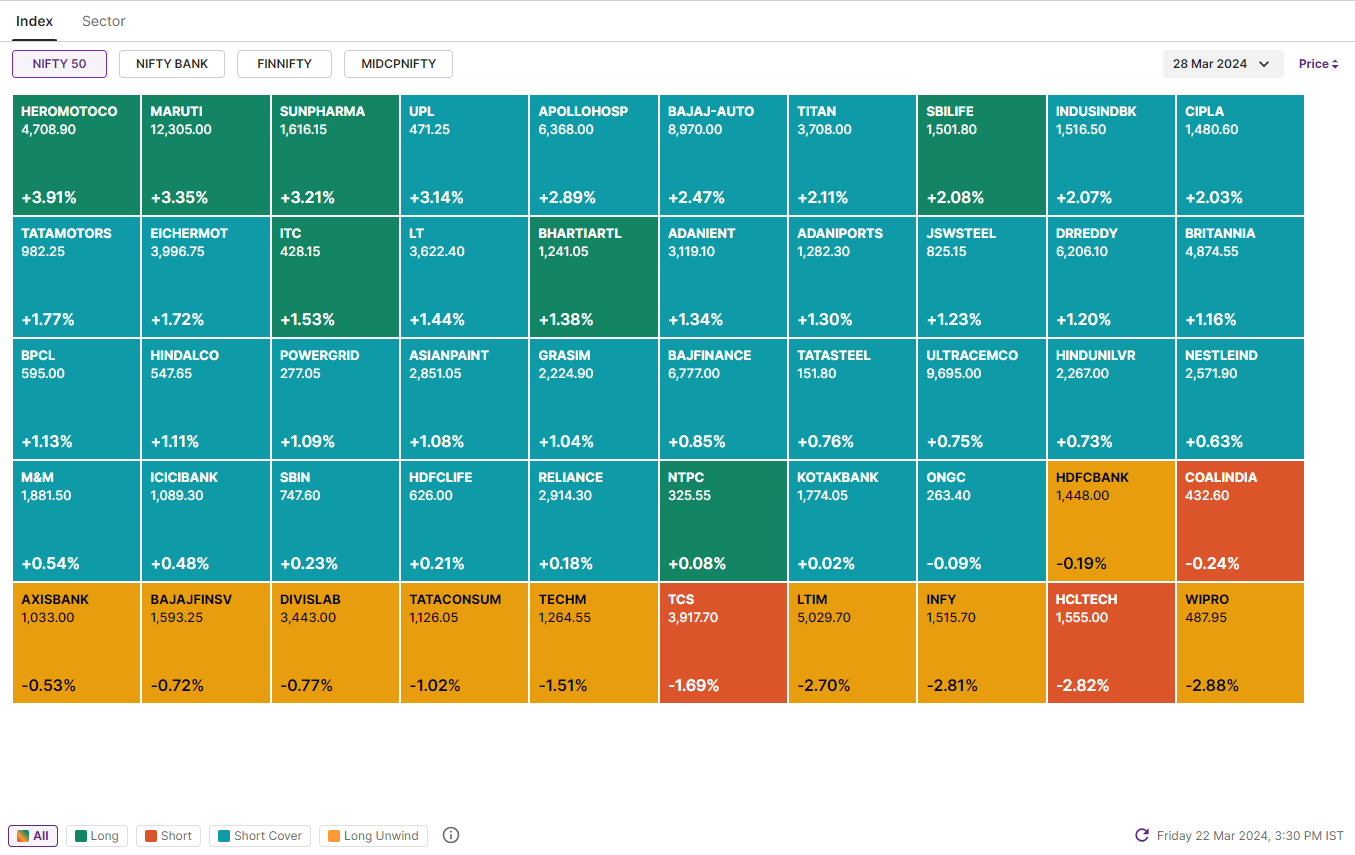

Markets reversed opening losses to close higher, extending Thursday's gains. The rebound was led by gains in auto, metals and real-estate stocks. The NIFTY50 gained 0.3% and closed at 22,096, while the SENSEX added 0.2% and ended the day at 72,831.

Broader markets extended the gains for the second day with NIFTY Midcap 100 and Smallcap 100 gaining 0.5% and 0.6% respectively.

With the exception of IT (-2.3%), all the major sectoral indices closed in the green. Real Estate (+1.7%) and Auto (+1.6%) were the strongest performers.

Our morning blog highlighted the importance of this week's closing level for the NIFTY50. Last week, a bearish engulfing candle pattern formed on the weekly chart, suggesting a potential downward trend. However, the index defied this bearish signal.

After an initial dip during the week, the NIFTY50 staged a significant recovery, rising from the 21,700 level to recoup most of its losses for the week. Notably, the index gained 0.3% for the week, effectively negating the bearish engulfing pattern. This positive close is significant because, as mentioned above, confirmation of bearish engulfing usually requires the following week's close to be lower as well.

However, experts caution that the NIFTY50 isn't out of the woods yet. They point to the 22,200 level (around the 20-day moving average) as immediate resistance for the bulls, while immediate support is at 21,900. Unless the bulls can decisively close above 22,200, the trend could remain sideways in the upcoming truncated week.

Key highlights of the day:

💻IT stocks tumbled after Accenture cut its FY24 revenue guidance (1-3% YoY) due to slow decision making and weak spending. Shares of TCS, Infosys and HCL Tech fell in the range of 1.5% to 3%.

🛜Reliance Industries (+0.2%) was in focus for Reliance Jio's IPL offer. Jio is offering 50 days of free broadband service to JioFiber and JioAirFiber users until 30 April.

🏍️Bajaj Auto (+2.3%) extended its gains after the company’s MD Rajiv Bajaj confirmed that the company will launch its first CNG motorcycle in June.

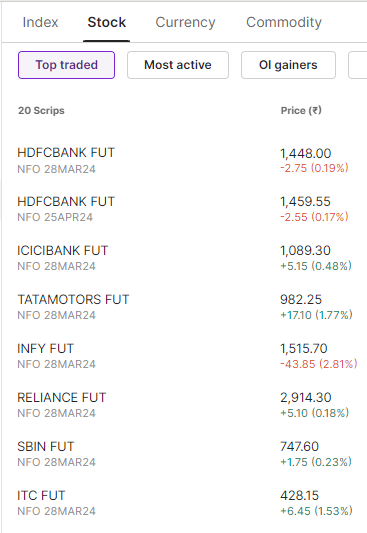

Top traded futures contracts

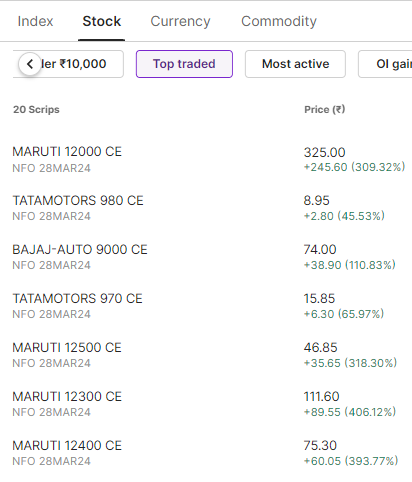

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Voltas, CG Power, Info Edge (Naukri), Max Healthcare and Max Financial Services

📈Open = Low (Bull power): Maruti Suzuki, ITC, Larsen and Toubro, PI Industries and LIC Housing Finance

🏗️Fresh 52 week-high: Indus Towers, Maruti Suzuki, Avenue Supermarts (DMART), Pidilite Industries and Bajaj-Auto

⚠️Fresh 52 week-low: Hindustan Unilever

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you on Monday!