NIFTY50 forms doji, traders cautious ahead of Fed meeting and Powell speech

Upstox

2 min read • Updated: March 20, 2024, 6:57 PM

Summary

Uncertainty hangs over the NIFTY50 as it forms a doji candle ahead of the weekly expiry and tonight's press conference by Fed Chairman Jerome Powell. Experts believe that the 50-DMA between 21,930 and 21,950 will act as immediate resistance for the NIFTY50. On the other hand, 21,700 will act as immediate support for tomorrow's expiry.

Markets recovered from the day's low to close the volatile session flat. Positive global cues, strong direct tax collections and buoyancy in select auto stocks capped the fall. Both the NIFTY 50 and SENSEX gained 0.1% to close at 21,839 and 72,101 respectively.

The broader markets also halted their decline and both the NIFTY Midcap 100 (-0.01%) and Smallcap 100 (+0.05%) closed flat.

-

Supporting sectors: Oil & Gas (+1.2%), Realty (+0.6%), FMCG (+0.4%) and Auto (+0.2%) were the top gainers.

-

Selling pressure: Metal (-0.7%), Private Banks (-0.2%) and Pharma(-0.2%) declined the most.

Uncertainty hangs over the NIFTY50 as it forms a doji candle after closing below its 50-day moving average (DMA). This neutral pattern reflects investors' indecision ahead of the outcome of today's U.S. Fed meeting and the press conference by Fed Chairman Jerome Powell.

With the weekly options expiry looming, traders are advised to be cautious. The 50-DMA between 21,930 and 21,950 zone will act as immediate resistance for the NIFTY50. On the other hand, 21,700 will act as immediate support for tomorrow's expiry.

Key highlights of the day:

🚘Maruti Suzuki zoomed past the 12,000-mark (+2.8%) for the first time and hit a 52-week high.

🧱Ultratech Cement (+0.2%) was in focus after the company received approval from the Competition Commission of India for its acquisition of Kesoram Cement.

⛽BPCL (+1.6%) made headlines by signing a four-month deal with oil major BP to secure 1 million barrels of U.S. WTI crude oil per month from June.

💊Aurobindo Pharma rose over 2% after the company received the US FDA approval for new allergy nasal spray.

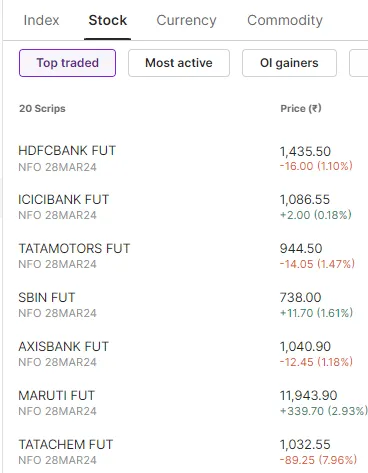

Top traded futures contracts

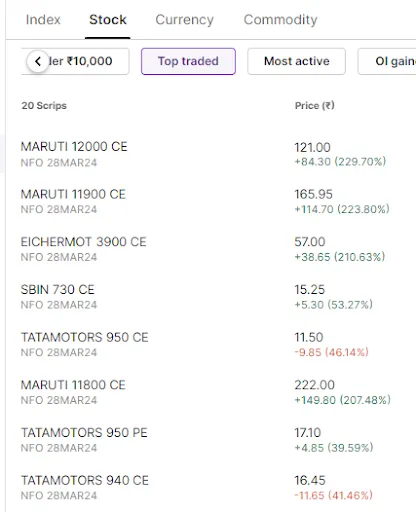

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Laurus Labs, PI Industries, Sun Pharma, Navin Fluorine and Crompton Greaves

📈Open = Low (Bull power): Eicher Motors, Maruti Suzuki, ICICI Prudential and Info Edge (Naukri)

🏗️Fresh 52 week-high: Maruti Suzuki and CG Power

⚠️Fresh 52 week-low: Page Industries, Hindustan Unilever, Zee Entertainment and Bata India

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!