Trade setup for 2 April: NIFTY50 faces doji test, banking strength key at all-time high

Upstox

4 min read • Updated: April 2, 2024, 8:09 AM

Summary

The NIFTY50 formed a doji candlestick pattern on the daily chart on 1 April. A doji is considered as a neutral candlestick pattern. For more clues, traders can watch today's price action closely as a close above or below the doji will provide more directional clues.

Asian markets update 7 am

The GIFT NIFTY is trading 72 points lower, indicating a negative start for the Indian equities today. Asian markets are trading in the green despite negative cues from Wall Street. Japan's Nikkei 225 is up 0.4%, while Hong Kong's Hang Seng Index climbed 2%.

U.S. market update

U.S. stocks closed mixed on Monday following the release of the Personal Consumption Expenditures price index on Good Friday. Treasury yields rose after Federal Reserve Chairman Jerome Powell reiterated on Friday that economic growth remains strong and the Fed is in no rush to cut interest rates.

The Dow Jones declined 0.6% to 39,566, while S&P 500 fell 0.2% to 5,243. The Nasdaq Composite added 0.1% to close at 16,396.

NIFTY50

April Futures: 22,602 (▲0.5%)

Open Interest: 1,97,945 (▼7.1%)

The NIFTY50 ended the first day of the April F&O series on a positive note, reaching a fresh all-time high. After a gap-up start, the NIFTY50 consolidated its gains and traded sideways throughout the session.

On the daily chart, the NIFTY50 has formed a doji candlestick pattern, indicating indecision among investors near the all-time high. The doji is considered as a neutral candlestick pattern. For more clues, traders can watch today's close carefully as a close above or below the doji will provide more directional insights.

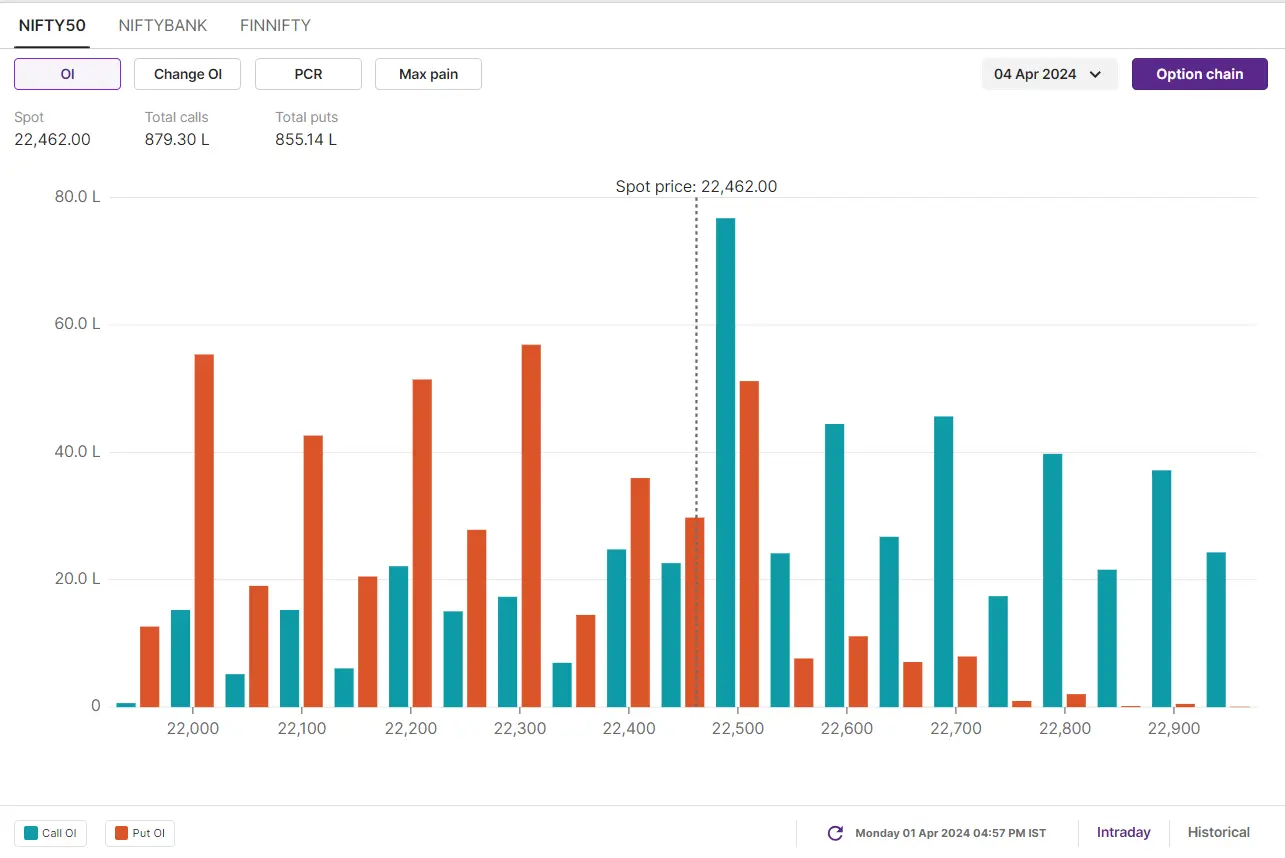

The April 4 options chain shows significant open interest at the 22,500 and 23,000 call strikes. Conversely, the put base is concentrated at the 22,300 and 22,000 strikes. Based on this positioning, traders expect the NIFTY50 to trade between 22,000 and 22,700.

BANK NIFTY

April Futures: 47,913 (▲0.8%)

Open Interest: 1,26,526(▼41.5%)

The BANK NIFTY extended its winning streak for the third consecutive day, closing above Thursday's high. The index protected its morning gains and consolidated around the 47,500-mark.

On the daily chart, the BANK NIFTY closed above the key 47,500 level and is trading above all of its major daily moving averages (20 and 50) ahead of the RBI's monetary policy meeting scheduled for the 3rd and 5th of April. Immediate resistance for the index is currently at 48,200.

Open interest (OI) build-up for 3 April expiry shows significant call base at 48,000 and 47,500 strikes. On the other hand, the base of put writers remained at 47,000 and 47,500 strikes. Based on the options data, traders are expecting BANK NIFTY to trade between 46,500 and 48,200 this week.

FII-DII activity

Foreign Institutional Investors (FIIs) turned net sellers and sold shares worth ₹522 crore, while the Domestic Institutional Investors (DIIs) purchased shares worth ₹1,208 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: Bharat Electronics, Hindustan Copper, Indus Towers and JSW Steel

Short build-up: Eicher Motors and Titan

Under F&O ban: NIL

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.