Trade setup for 4 April: NIFTY50 eyes fresh high as bulls aim for 22,500 on expiry day

Upstox

4 min read • Updated: April 4, 2024, 8:36 AM

Summary

The NIFTY50 has been consolidating in a range since April and is protecting the low of 1 April on the closing basis (22,427), indicating support based buying. Both the daily and hourly chart highlights a higher high and higher low structure, suggesting positive momentum.

Asian markets update 7 am

The GIFTY NIFTY is trading higher (+0.2%), indicating a positive start for the Indian equities today. Other Asian markets are also trading in the green. Japan’s Nikkei is up 1.1%, while the South Korea’s Kospi advanced 1%. Markets in Hong Kong and China are closed for public holiday.

U.S. market update

U.S. equities closed mostly higher in a subdued session on Wednesday, following comments from Fed Chairman Jerome Powel that a rate cut is still not in sight. Fed funds futures data now suggest a 62.3% probability of a rate cut at the June meeting, down sharply from 70% a week ago.

The Dow Jones fell 0.1% to 39,127, while the S&P 500 gained 0.1% and closed at 5,211. The Nasdaq Composite rose 0.2% and ended at 16,277.

NIFTY50

April Futures: 22,542 (▼0.1%)

Open Interest: 2,02,585 (▲0.7%)

The NIFTY50 made a swift recovery from the Wednesday's low, shrugging off weak start and global cues. Despite a sharp rise in Brent crude oil prices, the index recouped all its losses on the back of buying in IT and select banking heavyweights. However, it pared most of its gains towards the close and closed flat.

On the daily chart, the NIFTY50 has been consolidating in a range since April and is protecting the low of 1 April on the closing basis (22,427), indicating support based buying. Both the daily and hourly chart highlights a higher high and higher low structure, suggesting positive momentum.

As you can see in the chart below, the NIFTY50 is confined in a range on the hourly timeframe. For today’s expiry, the traders should keep a close eye on the breach of the below highlighted range. A decisive close above or below this range will provide more directional clues.

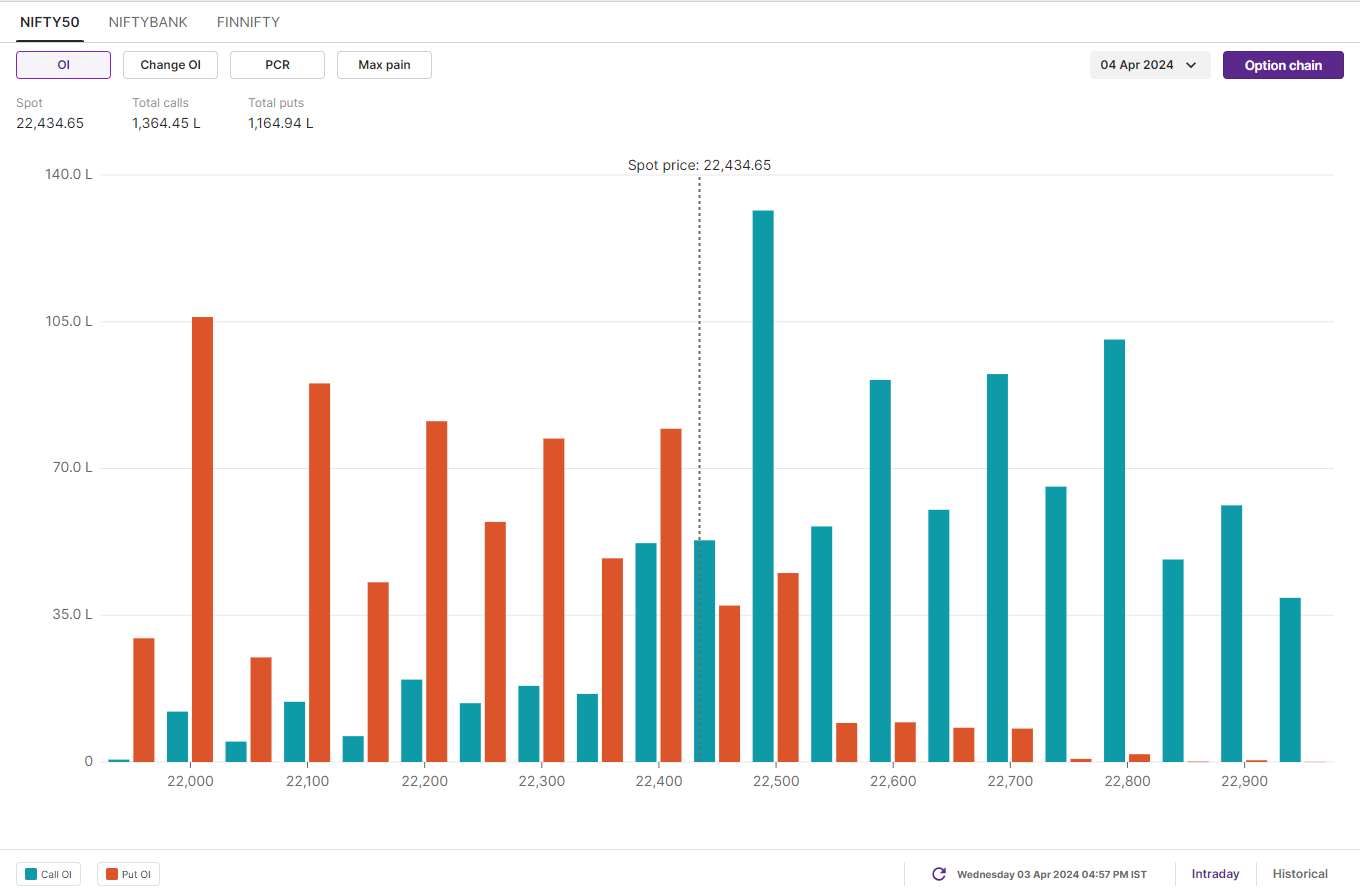

Open interest (OI) build-up for today’s expiry shows a significant call base at 22,500 and 22,800 strikes. On the other hand, the base of put writers is at 22,000 and 22,100 strikes. Based on the options data, traders are expecting NIFTY50 to trade between 22,100 and 22,700.

BANK NIFTY

April Futures: 47,912 (▲0.1%)

Open Interest: 1,36,673 (▲5.0%)

The BANK NIFTY once again displayed strength and formed a bullish engulfing candle on the daily chart. Notably, the index protected the 47,500-mark on closing, reinforcing the positive sentiment.

As highlighted in our yesterday’s blog, the BANK NIFTY remains confined within the 47,200 and 47,700 range ahead of the RBI policy announcement on Friday. The immediate resistance for the index is at 48,000 mark and a decisive break above this on the daily closing basis could signal further upmove for the index.

Initial open interest for the 10 April BANK NIFTY expiry remains scattered, with a significant call base at the 48,000 strike and a put base at the 47,500 strike. With the volatility index falling 15% ahead of the RBI policy announcement, traders are advised to take a cautious approach and monitor price action around the 48,000 and 47,500 levels for further clues.

FII-DII activity

Foreign Institutional Investors (FIIs) remained net sellers and sold shares worth ₹2,213 crore, while the Domestic Institutional Investors (DIIs) bought shares worth ₹1,102 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/ ➡️F&O➡️FII-DII Activity➡️FII Derivatives

Stock scanner

Long build-up: Punjab National Bank, Laurus Labs, National Aluminium and AU Small Finance Bank

Short build-up: DLF, Nestle India and Kotak Mahindra Bank

Under F&O ban: Hindustan Copper, Steel Authority of India and Zee Entertainment

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.