NIFTY50 ends at 50-DMA, Volatility index hits 52-week high

Upstox

2 min read • Updated: May 7, 2024, 7:48 PM

Summary

After confirming the bearish engulfing candle on 6 May, the NIFTY50 slipped below the 50-day moving average and surrendered the low of bearish engulfing candle. This indicates near-term weakness in the index with immediate support in the 22,100-22,150 zone.

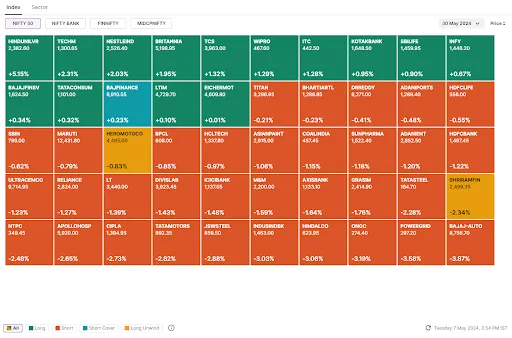

The markets extended the losing streak for the third consecutive day and closed lower on Tuesday. The NIFTY50 index fell 0.6% to end the day at 22,302 while the SENSEX lost 0.5% to close at 73,511.

Except for FMCG (+2.0%) and IT (+0.7%), all the major sectoral indices ended in red. Realty (-3.4%), Metals (-2.3%) and PSU Banks (-2.3%) declined the most.

On the daily chart, the NIFTY50 briefly dropped below its critical 50-day moving average (DMA), but regained its footing to close above this important level. Experts remain cautious about the short-term outlook of the NIFTY50, noting that it remains weak. Immediate resistance for the index is at the 22,500 level, while support is in the 22,100-22,150 range.

-

Top gainer and loser in NIFTY50: Hindustan Unilever (+5.2%) and Bajaj-Auto (-3.9%)

-

The broader markets also extended their losses into a third day. The NIFTY Midcap 100 index was down 1.9% and the Smallcap 100 index fell 1.8%.

-

Top gainer and loser in NIFTY Midcap 100: CG Power (+4.7%) and ACC (-2.3%)

-

Top gainer and loser in NIFTY Smallcap 100: Westlife Foodworld (+3.9%) and Just Dial (-5.7%)

Key highlights of the day:

🥫FMCG sector was in focus after the management of all the major companies highlighted notable demand recovery in the rural markets. Shares of Hindustan Unilever (+5.2%), Dabur (+5.1%) and Marico (+9.7%) were in the spotlight.

💊Lupin slipped over 4% despite company’s net profit for Q4 rose 52% YoY to ₹359 crore for FY24. However, the result was below street estimates.

⛽Bharat Petroleum and Hindustan Petroleum will consider the issuing the bonus shares on 9 May.

Top traded futures contracts

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): SRF, GMR Infra, Steel Authority of India, Lupin, Union Bank and NMDC

📈Open = Low (Bull power): Bajaj Holdings

🏗️Fresh 52 week-high: Godrej Consumer Products , CG Power, Colgate Palmolive, Siemens and Supreme Industries

⚠️Fresh 52 week-low: Zee Entertainment, Dalmia Bharat and Syngene International

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!