NIFTY50 cracks below 50-DMA as IT stocks plunge

Upstox

2 min read • Updated: March 19, 2024, 5:52 PM

Summary

Based on options data, fresh open interest at call option strikes of 22,000 and 22,200 indicates immediate resistance for the NIFTY50. On the other hand, the put writers have a base at the 21,500 strike, which will act as immediate support.

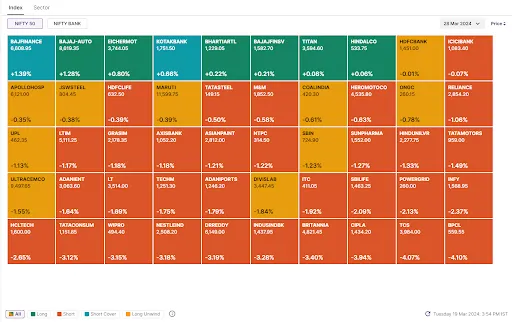

Markets slipped over one percent on Tuesday, dragged down by technology heavyweights like TCS and Infosys which fell over 4% and 2%, respectively. The NIFTY 50 slipped below its 50-day moving average (DMA) to close at 21,817, down 1%. The SENSEX also lost 1% to close at 72,012.

Broader markets continued their downward spiral, with the NIFTY Midcap 100 and Smallcap 100 both down over 1%.

All major sectoral indices closed in the red amid broad-based selling. IT stocks were the worst hit, falling nearly 3%, followed by Pharma and FMCG, both down over 2%.

After holding firm for four months, the NIFTY50 finally succumbed to selling pressure and closed below its key 50-DMA and also below its swing low of 21,860. This is in line with our morning analysis, which highlighted the lack of follow-through price action since January. The experts now see support at 21,500, with immediate resistance at the 20-DMA at 22,200. This creates a crucial zone to watch for further directional cues.

Key highlights of the day:

📉Tata Consultancy Services fell over 4% after Tata Sons, the holding company of TCS, sold 2 crore shares worth nearly ₹9,000 crore.

⭐HCL Technologies (-3%) was in focus after the company expanded its partnership with U.S. based semiconductor company, CAST for customised chips.

⛽Oil marketing companies extended their decline for the third consecutive day after the government announced a ₹2 per litre cut in petrol and diesel prices on Friday. Shares of BPCL, Hindustan Petroleum and IOC have all fallen nearly 5% since the announcement.

⚡Bharat Heavy Electricals (-2%) bagged an order from NTPC to setup a 1,600MW thermal power plant in Singrauli, Uttar Pradesh.

Top traded futures contracts

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Tata Consumer, Dr Reddy's, Wipro, HCL Tech and Indian Oil Corporation

📈Open = Low (Bull power): HDFC Bank and Fsn E-Commerce (Nykaa)

🏗️Fresh 52 week-high: Bharti Airtel and Interglobe Aviation (Indigo)

⚠️Fresh 52 week-low: Zee Entertainment, Bata India and Hindustan Unilever

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!