NIFTY50 & BANK NIFTY: Consolidation after breakout, key levels to watch

Upstox

3 min read • Updated: March 4, 2024, 8:51 AM

Summary

Experts believe that with Friday's strong move, the BANK NIFTY has broken through multiple resistance levels and can continue to build momentum. Former resistance at 46,500 and 46,300 will now act as immediate support, while resistance remains at the all-time high (48,636).

NIFTY50

- March Futures: 22,502 (▲0.2%)

- Open Interest: 2,56,795 (▼0.5%)

The NIFTY50 extended its gains to close Saturday's special session higher. NSE and BSE conducted a special short trading session to test the disaster recovery system. With low volumes, the index traded in a narrow range and consolidated its gains.

On the daily chart, the NIFTY50 formed a strong bullish candle on Friday. Experts believe that after breaking out of over a month of consolidation, the former all-time high (22,124), which acted as resistance, will now act as support along with the 20-day moving average (around 22,000).

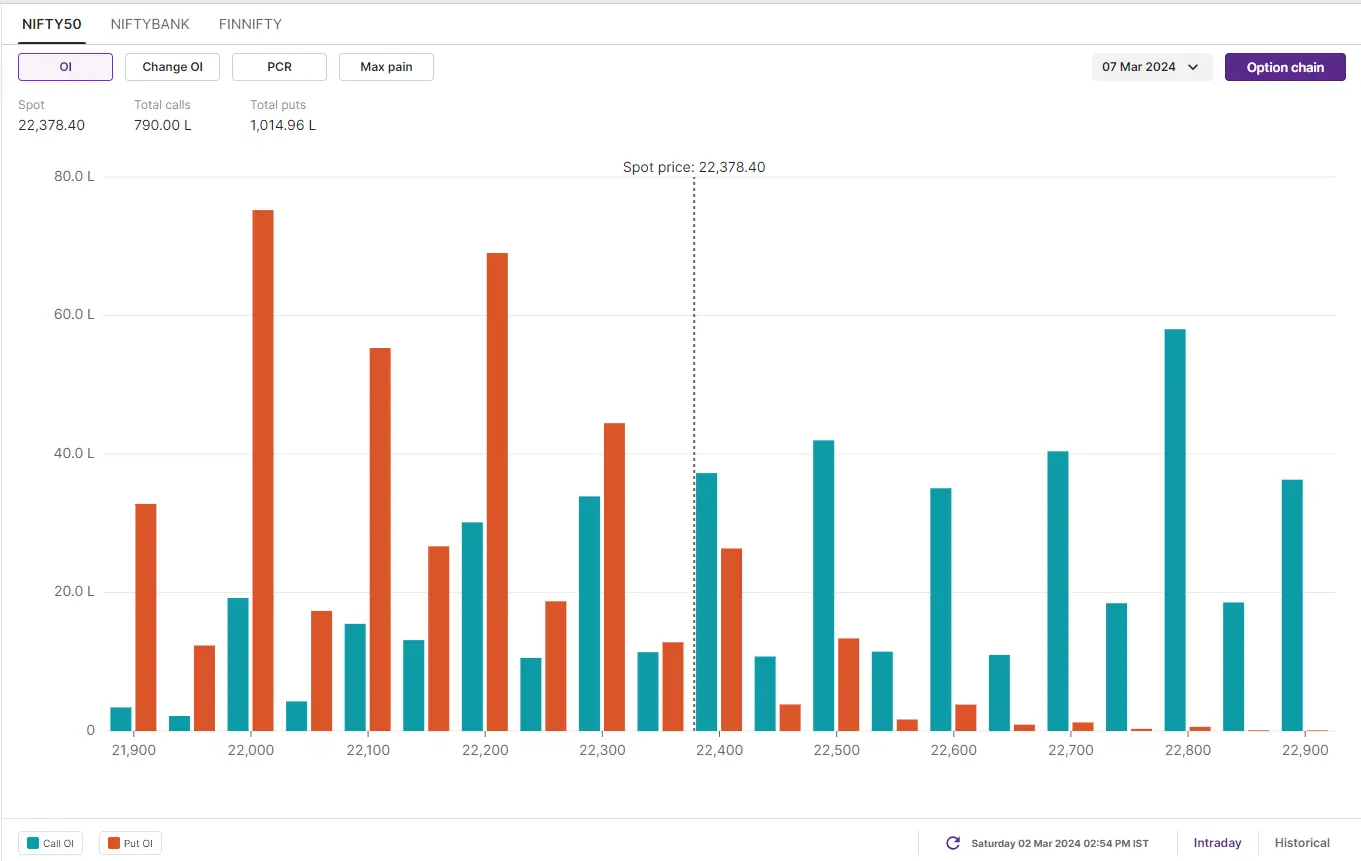

The March 7 open interest of NIFTY50 shows a significant concentration of calls on the 23,000 and 22,800 strikes. Conversely, the put base is concentrated at the 22,000 and 22,200 strikes. Based on the positioning of the OI, traders are expecting NIFTY50 to trade between 21,600 and 22,900.

BANK NIFTY

- March Futures: 47,659 (▲0.1%)

- Open Interest: 1,55,863 (▲1.4%)

The BANK NIFTY also consolidated its gains during the special session and closed flat on Saturday. As discussed in our trade setup blog on Friday, the BANK NIFTY formed a strong bullish marubozu candle, indicating the dominance of buyers.

Experts believe that with Friday's strong move, the BANK NIFTY has broken through multiple resistance levels and can continue to build momentum. Former resistance at 46,500 and 46,300 will now act as immediate support, while resistance remains at the all-time high (48,636).

For BANKNIFTY's March 6 expiry, options data shows significant open interest at the 49,000 & 48,000 call strikes and the 46,500 & 47,000 put strikes. Based on the open interest, traders are eyeing BANKNIFTY's trading range between 45,800 and 48,700 for next week.

FII-DII activity

In the cash market, both the Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) turned net sellers on Saturday. The FIIs sold shares worth ₹81 crore, while the DIIs offloaded shares worth ₹44 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/

Stock scanner

Long build-up: Havells, IEX, National Aluminium and SAIL.

Short build-up: Info-Edge (Naukri.

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.