Markets remain in stalemate: NIFTY50 flat, Mid and Smallcaps slide

Upstox

2 min read • Updated: March 12, 2024, 6:45 PM

Summary

According to options data, the NIFTY50 has immediate resistance at 22,500 and traders are expecting the range-bound movement to continue between 22,000 and 22,600 for this week's expiry.

Indian markets closed flat on Tuesday, supported by buying in few large-cap stocks. The benchmark NIFTY 50 was flat at 22,335 while the SENSEX was marginally higher by 0.2% at 73,667.

However, sentiment in the broader market remained weak. The NIFTY Midcap 100 and Smallcap 100 indices fell by over 1% and 2% respectively. Notably, the Smallcap index has now corrected almost 10% from its recent all-time high.

Barring IT (+0.6%), all the major sectoral indices extended their declines and closed in the red. Real Estate (-3.7%), PSU Banks (-2.5%) and Metals (-1.7%) were the worst performers.

The NIFTY50 index ended the day with a doji pattern, reflecting indecision in the market. Index heavyweights like HDFC Bank (+2.2%), TCS (+1.6%), Reliance Industries (+0.6%) and Infosys (+0.7%) provided crucial support.

As mentioned in our morning trade setup blog, the immediate support zone for the NIFTY50 lies between 22,200 and 22,250. A decisive close below this zone and the 20-day moving average (DMA) could trigger a further decline towards the next support level, the 50-DMA, currently around 21,900. On the upside, immediate resistance remains at 22,500.

Key highlights of the day:

💸AB Capital’s (+1.9%) board approved the merger of its subsidiary Aditya Birla Finance with itself to create a large NBFC.

🔥ITC slipped over 1% after reports suggested that the British American Company (BAT) may sell a part of it stake in the company this week.

💻Oracle Financial Services (+1.9%) shares jumped in India, tracking the parent company's gains, after Oracle Corp's Q3 results beat Wall Street’s estimates.

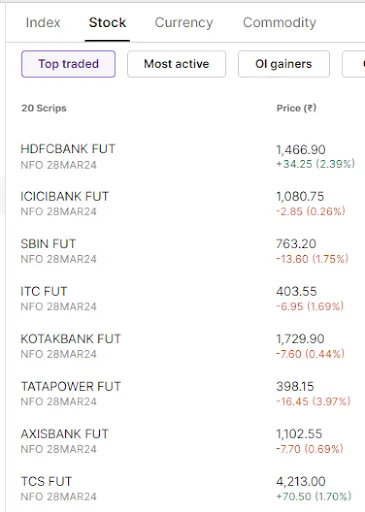

Top traded Futures contracts

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): ITC, UltraTech Cement, Godrej Consumer Products and Navin Fluorine

📈Open = Low (Bull power): N/A

🏗️Top five fresh 52 week-high: TCS and Interglobe Aviation (Indigo)

⚠️Fresh 52 week-low: SBI Cards

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!