NIFTY50 protects 20-DMA, ends Feb series above 21,900

Upstox

2 min read • Updated: February 29, 2024, 5:39 PM

Summary

The NIFTY50 once again found support at its 20-day moving average and closed above key support of 21,900. This is in line with the analysis of our morning trade setup blog. We highlighted that yesterday's decline needs a follow through price action to confirm the trend. The experts believe that the index is still consolidating in the range of 22,300 and 21,850.

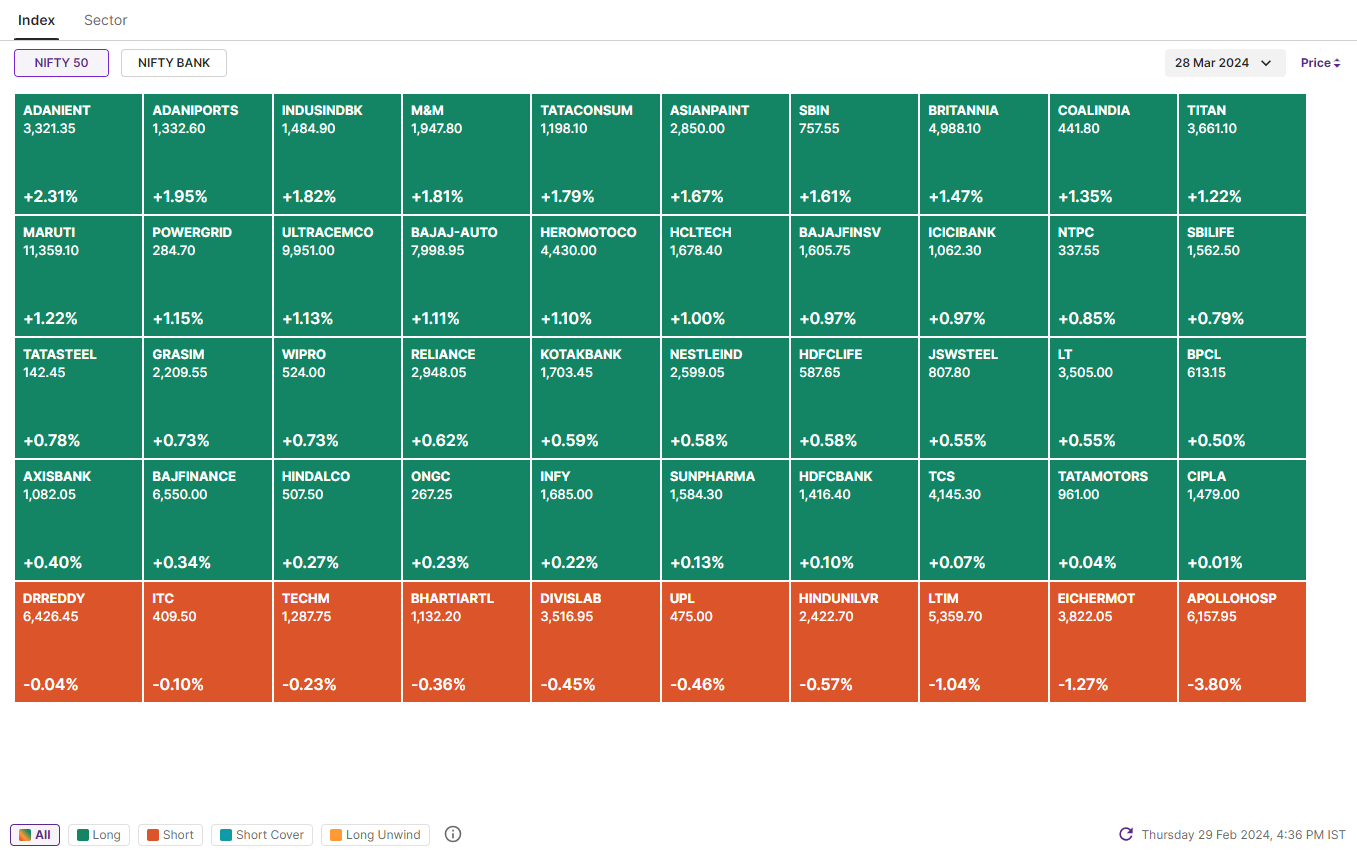

Markets traded in a range on the monthly expiry of F&O contracts and closed flat. The NIFTY50 protected its 20-day moving average and ended the day 0.1% higher at 21,982, while the SENSEX gained 0.2% and ended the day at 72,500.

While the benchmark NIFTY50 closed flat, the broader market indices recovered from the day’s low. Both the NIFTY Midcap 100 and NIFTY Smallcap 100 fell, advanced 0.5% and 0.6% respectively.

-

Supporting sectors: PSU Bank (+1.3%), Metal (+0.9%) and FMCG (+0.3%) advanced the most and pushed the index higher.

-

Selling pressure: Media (-0.9%) and Healtcare (-0.6%) sectors witnessed selling pressure and were the top laggards.

On the daily chart, the NIFTY50 once again found support at its 20-day moving average and closed above the crucial support of 21,900. This echoes the analysis of our morning trade setup blog, which highlighted that yesterday’s fall needs a follow-through price action to confirm the trend. The experts believe that the index is still consolidating in the range between 22,300 and 21,850. A breakout from this range will give traders a clearer direction.

Key highlights of the day:

⭐Reliance Industries (+0.6%) and Disney merged their Indian operations. This joint venture will combine the business of VIACOM18 and Star India.

🏍️Bajaj-Auto fell over 3% after it turned ex-date for the buyback. The company approved the ₹4,000 crore buyback in January.

💸Shriram Finance (+3.8%) was in focus as the stock will join the NIFTY50 pack from 28 March, replacing UPL.

🏥Apollo Hospitals (-3.8%) and other hospital stocks came under pressure after the Supreme Court ordered the government to fix standard rates for various medical procedures.

📺Zee Entertainment fell 4% after Sony India officially withdrew its merger plans. However, it recovered from the day's low and ended marginally lower.

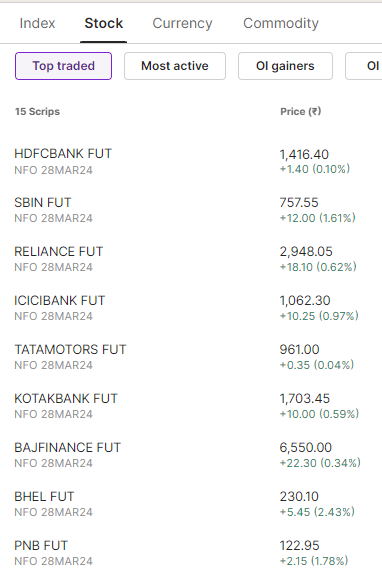

Top traded Futures contracts

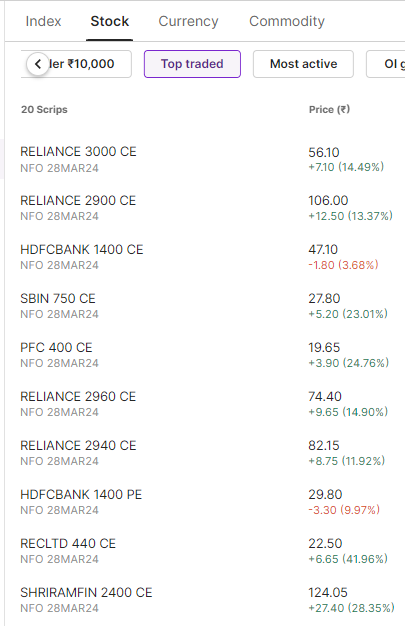

Top traded stock options contracts

6 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Apollo Hospitals, Crompton Greaves, Ramco Cements and Mazagon Dock Shipbuilders

📈Open = Low (Bull power): Sun Tv Network and Nykaa.

🏗️Top five fresh 52 week-high: Bajaj Holdings, Indus Towers, Siemens and Sun Pharma

⚠️Fresh 52 week-low: Page Industries, Navin Fluorine and Bata India

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!