Battle at 50-DMA: NIFTY50 rebounds, BANK NIFTY tests support

Upstox

4 min read • Updated: March 15, 2024, 8:40 AM

Summary

The NIFTY 50 managed to defend its crucial 50-day moving average (50-DMA) on the weekly F&O expiry. Supported by buying in IT heavyweights like TCS and Infosys, the index closed above the psychological level of 22,000. However, analysts caution that the index remains range bound between the 20 and 50-DMAs. A breakout on either side will provide further direction.

Asian markets update 7 am

Indian equities may start the day on a negative note, mirroring the downward trend in Asian indices. The GIFT NIFTY is trading 0.5% lower, suggesting a weak start. Japan's Nikkei 225 is down 0.3% and Hong Kong's Hang Seng Index slipped 0.9%.

U.S. market update

U.S. stocks fell on Thursday following the release of a stronger-than-expected inflation report. The Producer Price Index (PPI), which measures wholesale prices, rose 0.6% in February, up from 0.3% in the previous month. Following the report, 40% of traders now expect the Federal Reserve to hold interest rates steady in June, a significant increase of 25% from last week.

The Dow Jones Industrial Average fell 0.3% to 38,905, while the S&P 500 lost 0.2% to close at 5,150. The tech-heavy Nasdaq Composite slipped 0.3% to 16,128.

NIFTY50

- March Futures: 22,264 (▲0.6%)

- Open Interest: 2,58,153 (▲6.0%)

The NIFTY50 protected its 50-day moving average and witnessed support based buying on the weekly expiry of F&O contracts. Led by gains in IT heavyweights such as TCS and Infosys, the index reclaimed the psychologically important 22,000 level.

As we pointed out in yesterday's chart, the index protected its 50-day moving average and the swing low of 21,860 and closed above them. However, according to the experts, the index is not out of the woods yet. It is tightly packed between the 20 and 50 DMAs, and a break on either side will provide further directional clues. Traders are advised to wait and watch the price action around these levels for further clues.

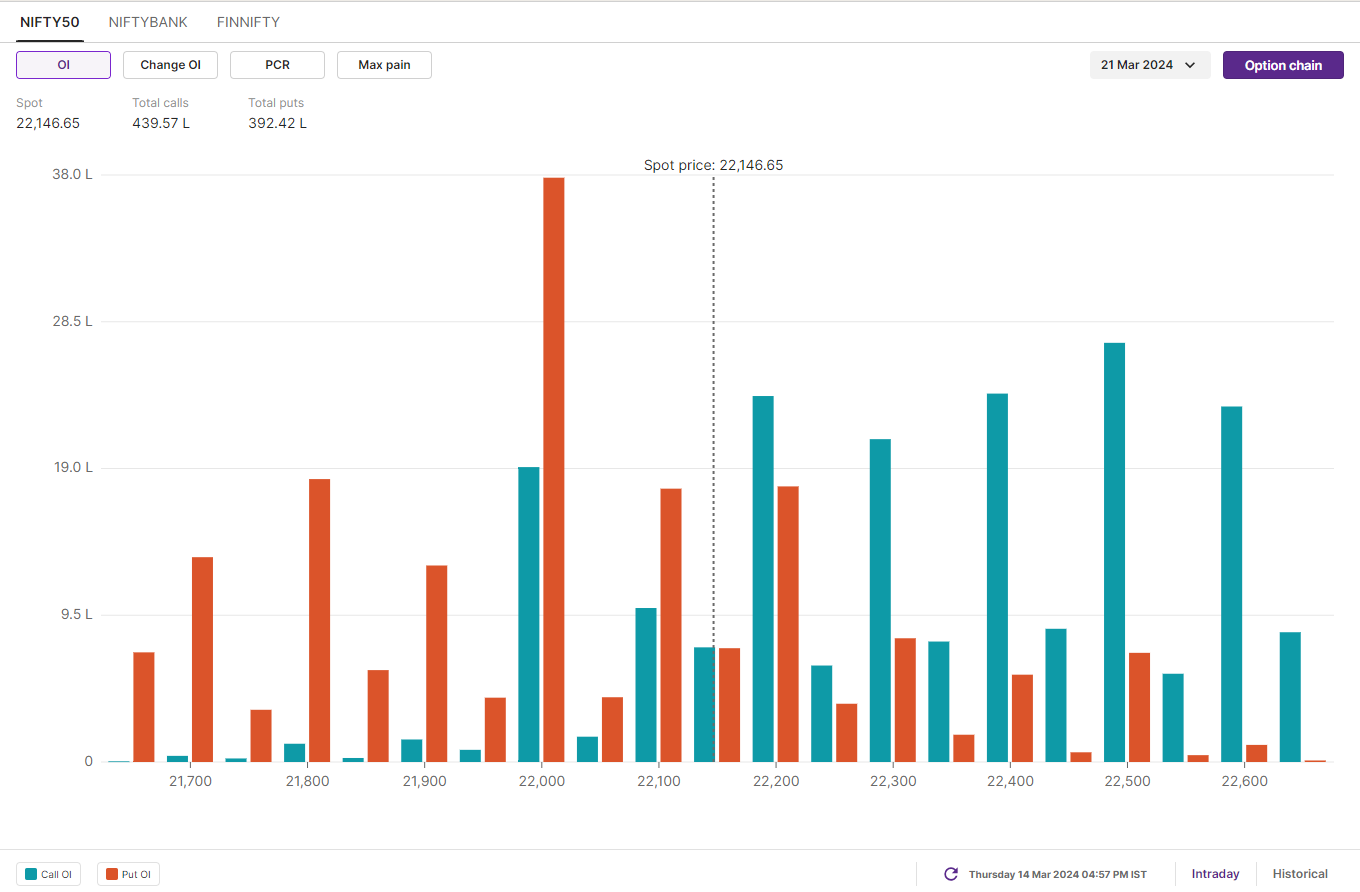

Meanwhile, the initial OI build-up for the 21 March expiry shows a significant call base at the 23,000 and 22,500 strikes. Conversely, the put base is established at the 22,000 and 21,500 strikes. As per the initial build-up, the NIFTY50 is expected to trade between 21,600 and 22,800 next week.

BANK NIFTY

- March Futures: 46,996 (▼0.1%)

- Open Interest: 1,31,100 (▼2.0%)

The BANK NIFTY underperformed other major indices, extending its losing streak to five days. The index formed another doji candle on the daily chart, highlighting traders' continued indecision. This is the second doji in the last three days.

On the daily chart, the BANK NIFTY closed below its 20 DMA (around 47,000) and found support at its 50 DMA (around 46,500). This level is currently acting as an important support level. Traders are advised to closely monitor the price action around these DMAs to gauge the direction of the trend. As the recent doji candlestick indicates indecision, a clear close above or below this candle will provide further clues.

For BANK NIFTY's 20 March expiry, the open interest build-up shows a significant base at the 47,000 & 47,500 call option strikes and 47,000 & 46,500 put option strikes. Based on the initial build-up, traders are eyeing BANK NIFTY’s trading range between 48,000 and 45,500 for the 20 March expiry.

FII-DII activity

In the cash market, the Foreign Institutional Investors (FIIs) reamined net sellers and sold shares worth ₹1,395 crore, while the Domestic Institutional Investors (DIIs) purchased shares worth ₹139 crore. To track the ratio of long and short open positions of FIIs in the index, log in to https://pro.upstox.com/

Stock scanner

-

Long build-up: Hero MotoCorp, REC Limited, Bharat Electronics and HCL Tech

-

Short build-up: NMDC and Axis Bank

Catch up on yesterday’s trading insights from NIFTY 200! Don't miss our market recap blog, offering valuable insights in a concise format. Click here to read and stay informed

To access a specially curated smartlist of most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.