Banking woes stall NIFTY50 at 22,500

Upstox

2 min read • Updated: March 11, 2024, 6:53 PM

Summary

The NIFTY50 has formed a bearish engulfing candlestick pattern on the daily chart, indicating a possible pause or reversal. Experts see a consolidation at higher levels with weakness in the broader markets. Immediate support for the NIFTY 50 is seen in the 22,200-22,250 region.

Markets snapped their two-day winning streak to close lower ahead of the release of U.S. inflation data. The NIFTY50 lost 0.7% to close at 22,332 and the SENSEX lost 0.8% to close at 73,502. The broader markets extended the fall after a day's respite. The NIFTY Midcap 100 and Smallcap 100 lost 0.3% and 1.2% respectively.

Barring Pharma (+0.04%), all the major sectors witnessed profit booking and closed in the red. PSU Bank (-1.5%), Metal (-1.4%) and Private Bank (-1.0%) were the key laggards.

The NIFTY 50 has formed a bearish engulfing candle on the daily chart, indicating a possible pause or consolidation. However, the experts believe that the index may continue to consolidate at higher levels with a positive bias, given the ongoing underperformance of the broader markets. They see immediate support for the NIFTY50 in the 22,200-22,250 region.

Key highlights of the day:

🔥Tata Chemicals fell over 10% on reports that parent company Tata Sons is exploring ways to avoid an IPO.

✈️Indigo rebounded over 6% from its intraday low to close higher on reports that the co-founder Rakesh Gangwal planned to sell a portion of his stake.

🚁HAL (+1.5%) were in focus after the government approved induction of 34 Dhruv helicopters that the company will manufacture.

Top traded Futures contracts

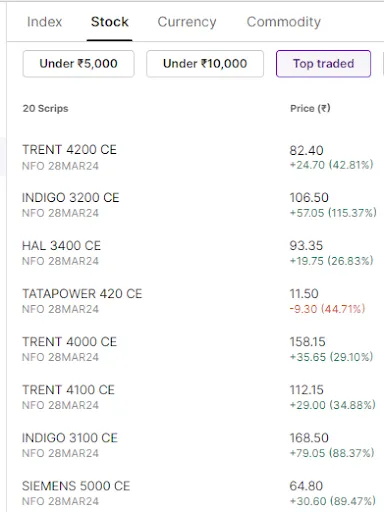

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Tata Steel, GAIL, Vedanta, Indraprastha Gas and Samvardhana Motherson

📈Open = Low (Bull power): TCS, Shree Cement, Siemens, Bharti Airtel and M&M Financial

🏗️Top five fresh 52 week-high: Zydus Lifesciences, HAL, Cipla, Siemens and Trent

⚠️Fresh 52 week-low: N/A

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!