BANK NIFTY inches closer to 50,000-mark, hits fresh all-time high

Upstox

2 min read • Updated: April 29, 2024, 6:08 PM

Summary

Closing above 49,000, the BANK NIFTY formed a strong bullish candle on the daily chart. Options data suggests a range of 49,000 to 49,800 for the April 30 expiry.

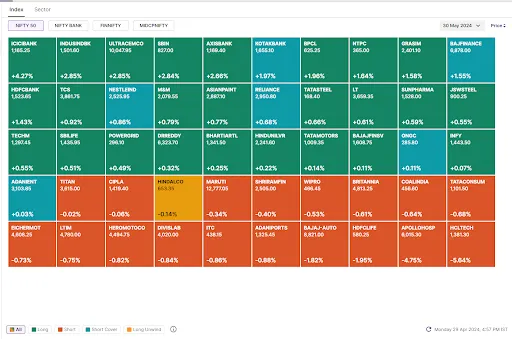

Markets erased Friday's losses and resumed their upward march, led by gains in banking stocks. The NIFTY50 reclaimed the 22,500-mark on a closing basis, rising 1% to 22,643. The SENSEX gained 1.2% to close at 74,671.

-

Top gainer and loser in NIFTY50: ICICI Bank (+4.3%) and HCL Tech (-5.8%)

-

The broader markets extended the winning streak to six consecutive days, with the NIFTY Midcap 100 rising 0.4% and the Smallcap 100 gaining 0.2%.

-

Top gainer and loser in NIFTY Midcap 100: Supreme Industries (+14.2%) and Nykaa (-0.3%)

-

Top gainer and loser in NIFTY Smallcap 100: Tejas Networks (+8.2%) and National Aluminium (-0.3%)

The BANK NIFTY surged past 49,000-mark to record its highest close ever and a fresh all-time high. Key banking stocks such as SBI, ICICI Bank and Axis Bank led the rally. Looking ahead to the 30 April expiry, the 48,900-49,000 zone, which coincides with the previous all-time high, will act as immediate support for the index.

Key highlights of the day:

🧱UltraTech Cement (+2.7%) reported a 35% increase in net profit to ₹2,258 crore for Q4 FY24, beating street expectations. The profit was driven by healthy demand for building materials and reduced operating costs.

💻HCL Technologies slipped over 5% after the company’s net profit saw a marginal uptick of 0.3% YoY to ₹3,995 crore in Q4 of FY24. The company also lowered its revenue guidance for FY25 between 3% to 5%.

🏥Apollo Hospitals plunged 4% on Monday after its subsidiary Apollo HealthCo sold a 16.8% stake to Advent International. Investors raised concerns about the valuation assigned to Apollo HealthCo in the deal.

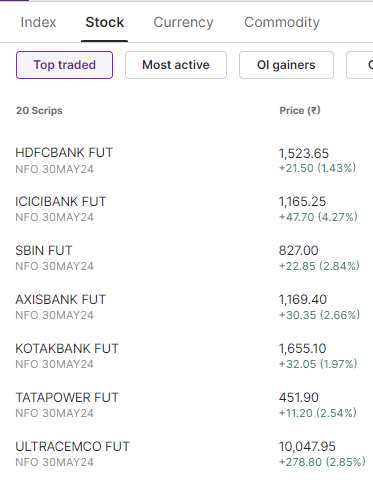

Top traded futures contracts

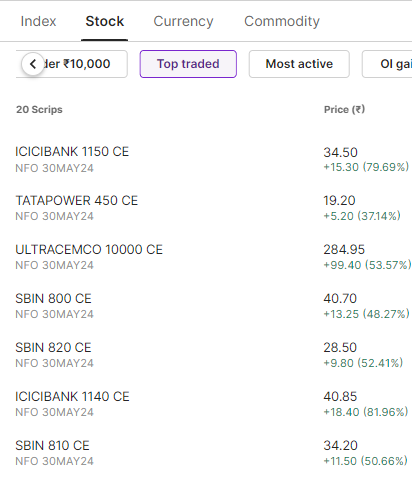

Top traded stock options contracts

4 trading insights from NIFTY 200🔍

📉Open = High (Bear power): Apollo Hospitals, Max Financial Services, Sun TV and Hero MotoCorp

📈Open = Low (Bull power): Reliance Industries, IDBI, Zydus Lifesciences, IDBI and Supreme Industries

🏗️Fresh 52 week-high: ICICI Bank, AB Capital, State Bank of India, Axis Bank and Tata Power

⚠️Fresh 52 week-low: N/A

And that's it for today's F&O recap! Get the full scoop on market trends and curated scans at https://pro.upstox.com/

See you tomorrow!