Weekly wrap 4 to 7 March: Sensex scales 74K peak, Nifty breaches 22,500 level; top highlights from the week

Upstox

5 min read • Updated: March 9, 2024, 2:27 PM

Summary

Benchmark stock indices NIFTY50 and SENSEX breached fresh lifetime highs in this holiday-shortened week despite consolidation in the broader market. NIFTY50 breached the record 22,500 level for the first time to hit its lifetime high of 22,523.65 intraday on Thursday SENSEX hit a new peak at 74,245.17.

_73718.png)

- Benchmark indices hit record highs for two days in a row.

- Tata Motors stocks in focus after announcement of demerger of its passenger and commercial vehicle businesses.

- IIFL Finance tanks 20% after RBI restrictions on gold loan business.

It’s that time of the week again! From benchmark indices scaling new highs to Tata Motors remaining in focus after its demerger announcement, here’s a quick recap of major developments in the markets this week.

Benchmark stock indices Nifty and Sensex breached fresh lifetime highs in this holiday-shortened week despite consolidation in the broader market.

Nifty breached the record 22,500 level for the first time to hit its lifetime high of 22,523.65 (intra-day) on Thursday Sensex hit a new peak at 74,245.17.

Nifty, however, settled just below the 22,500 level at 22,493.55, which is its all-time closing high. Sensex too closed at all-time high of 74,119.39. Both indices advanced around 0.5% on weekly basis.

While the broader market saw some consolidation during the week, rotational buying by investors mainly in largecaps helped the key indices continue their record-breaking run. Nifty and Sensex closed at record levels on both Wednesday and Thursday to end the holiday-shortened week on new highs.

Stock markets started the week on a positive note. Nifty in a range-bound trade extended the winning streak to a fourth day and settled at record levels. Sensex also advanced gains to the fourth day after strong GDP growth numbers boosted demand for energy and banking shares.

Nifty and Sensex took a breather on Tuesday, falling a little over 0.20% as investors booked profits at record-high levels. Stock markets rebounded on Wednesday on buying in private banks and FMCG shares. Sensex scaled the 74,000 level for the first time. Buying in auto, PSU and energy shares aided the gains.

Volatility ruled the stock markets on Thursday. Key indices recovered from early lows to hit record highs in intra-day. Metal, consumer durables and media shares fueled the gains while oil & gas and private banks fell on profit booking.

In the broader market, smallcap and midcap shares remained under pressure due to higher valuations. PSU, bank, auto, metal, and financial services shares gained on a weekly basis with sectoral Nifty indices rising up to 6%.

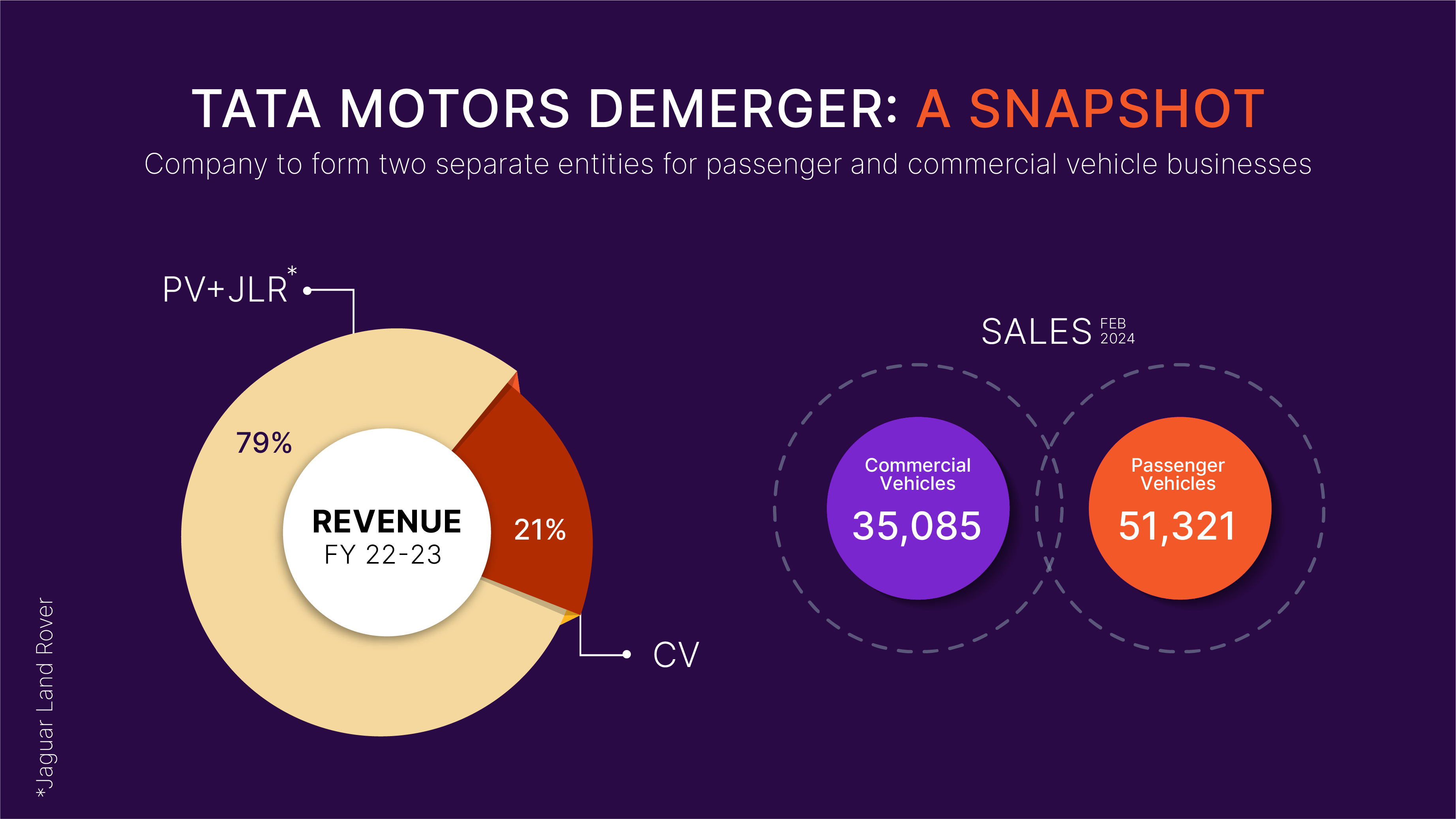

Tata Motors demerger drives stock to 52-week high

Tata Motors shares rallied to hit a year’s high level this week after the homegrown auto major announced the demerger of its passenger and commercial vehicles segments into two separate listed companies. The company board approved the proposal to bring in better synergies in the two business segments and better value creation.

Experts also gave thumbs up to the proposal saying the deal shows increased confidence of the company to take on bigger rivals like Maruti in the passenger vehicles segment. Tata Motors shares gained more than 7% on Tuesday after the demerger announcement.

IIFL Finance, JM Financial shares tank on RBI action

IIFL Finance Ltd and JM Financial shares tanked this week following RBI placing curbs on the disbursal of some categories of loans.

IIFL Finance shares tanked 20% each on Tuesday and Wednesday to hit the lower circuit as RBI banned the company from disbursing gold loans on certain material supervisory concerns. A $200 million fund infusion commitment from Fairfax India helped the stock to marginally recover on Thursday.

JM Financial slid 19% after RBI barred the company from giving loans against debentures and shares on March 5.

Bloomberg to include India bond in emerging markets index

Bloomberg, this week, said that Indian government securities “Fully Accessible Route (FAR) bonds” will be included in the Bloomberg Emerging Market (EM) Local Currency Government Index and related indices. The inclusion will be done over 10 months, starting January 31, 2025. Experts believe that the bond inclusion will lead foreign fund inflow of $5 billion.

Bulk deals fire up trading volumes

The week saw many high-volume bulk deals firing up trading numbers on exchanges. The deals included Antfin Singapore Holding paring a 2% stake in food delivery platform Zomato for ₹2,827 crore. Japanese Sumitomo Wiring Systems sold its 4.4% shareholding in Samvardhana Motherson International for ₹3,633 crore.

Kedaara Capital and Partners Group also sold 12.6% per cent stake in housing finance company Aavas Financiers for ₹1,369 crore. Singtel also sold shares worth over ₹5,849 crore of Bharti Airtel in bulk deals.

The week ahead

The stock markets were closed on Friday on account of the public holiday for Mahashivratri. What the investors will look forward to next week will be the trajectory of the broader market and the global factors.

As Nifty50 settled below 22,500 levels and Sensex scaled new highs breaching 74,000 mark, the investors will keep a watch on the broader market next week. Any further slide in benchmark indices could be a buying opportunity by investors, according to experts.