Markets in bear grip in a shortened trading week

Upstox

4 min read • Updated: January 25, 2024, 9:24 PM

Summary

BSE-listed companies together lost ₹8 lakh crore in market mayhem on January 23. Zee Entertainment plunged over 30% on Tuesday after termination of the merger deal with Sony. FPIs sold shares worth more than ₹10,000 crore on a net basis this week.

It was a shortened trading week and the D-Street missed the cheer. Here’s a quick recap of the stock markets in a week that saw just three trading days.

Stock markets remained in a bear grip as the benchmark indices, Nifty and Sensex, dropped 1% to end in red for the second straight week.

Markets were closed on Monday and Friday due to a partial bank holiday on Monday on account of the Ayodhya Ram Mandir consecration ceremony and Republic Day.

Indian stocks however saw full action of volatility despite fewer trading days. Markets fell for the second week in a row with benchmark indices sliding to a month’s low levels this week.

Benchmark Sensex closed lower by 359.64 points this week at 70,700.67, mainly dragged by more than 1,000 points drubbing on Tuesday. Nifty ended 101.40 points lower at 21,352.60 level on Thursday.

Continued selling by foreign investors hurt the market sentiment. FPIs sold shares worth more than ₹10,000 crore on a net basis this week. Domestic investors on the other hand turned saviours and capped deep losses in Indian benchmark stock indices. Losses in blue-chips like HDFC Bank, ICICI Bank and IT shares also dragged the key indices.

Markets opened the week on Tuesday on a low note. Sensex tanked 1073 points to close below the 71,000 level for the first time since December 20, 2023. Nifty plunged by 333 points to close below 21,300 level.

Broader market indices witnessed sharper losses of up to 3%. All key sectors, except for pharma, declined with realty, metal and energy shares emerging as the worst losers.

High valuation concerns, mixed Q3 results and the tensions in the Middle East and Red Sea triggered profit-taking by investors. BSE-listed companies together lost ₹8 lakh crore in market mayhem on January 23.

A booster dose by the Chinese central bank and a recovery in the United States markets provided succour to Indian stocks on Wednesday. Nifty and Sensex gained around 1% driven by gains in metal, energy and IT shares. Banking and realty shares faced losses.

The market valuation of BSE-listed companies increased to ₹371.2 lakh crore. Investors recovered around ₹5.2 lakh crore in a single session. However, the recovery was short lived as Indian stocks slipped into the red on Thursday. While global cues were mixed, selling in banking, IT, pharma, FMCG and financial services shares dragged the key indices around 1%.

Sectoral indices Nifty Bank, IT, Financial Services and Auto turned losers this week. Higher valuation concerns and expectation of a rate cut only in the second half of 2024 roiled rate sensitive shares.

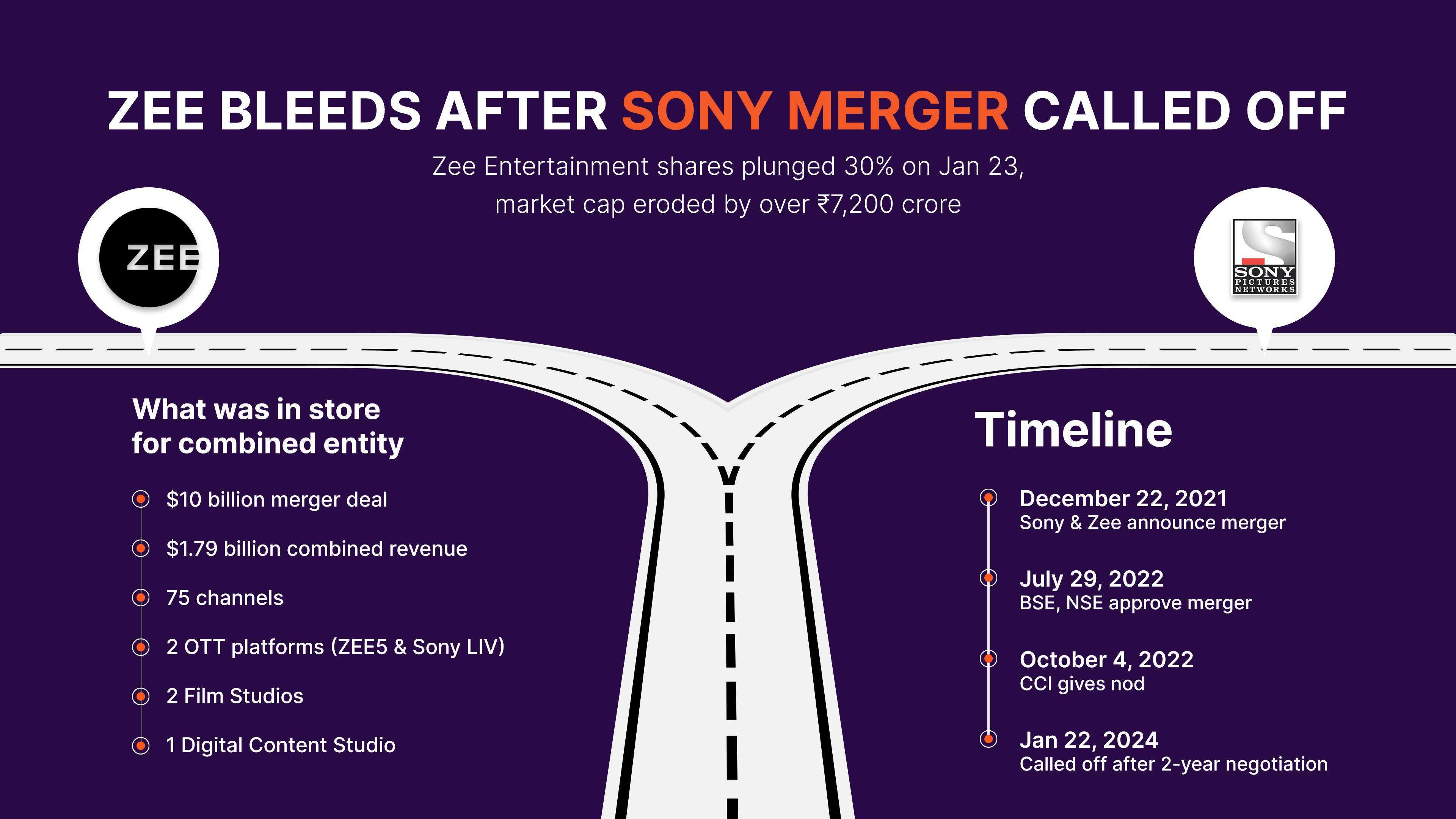

Zee Entertainment shares fall over 30%

Zee Entertainment Enterprises Ltd (ZEEL) shares tanked more than 30% this week after Japanese major Sony Group Corp pulled the plug on the proposed merger of its India unit with Zee. Sony also demanded a $90 million termination fee for breach of merger proposal, which have been contested by Zee.

The development saw ZEEL shares plunging 33% on Tuesday, its worst fall in four years. ZEEL witnessed erosion of more than ₹7,200 crore in market capitalisation in a single session.

HDFC Bank a drag on indices

HDFC Bank remained a drag on key indices this week. The stock dropped around 4% following deep losses last week. The market valuation of HDFC Bank has dropped below ₹11 lakh crore against its peak of ₹12.97 lakh crore on December 29. January proved to be the worst month for the stock since March 2020 after its quarterly results were below expectations.

SEBI FPI norms worries

Market experts believe that FPI norms by Securities and Exchange Board of India (SEBI) were one of the triggers for selling in Indian stocks by foreign investors. The SEBI norms seek more disclosures from foreign investors whose 50% of assets under management are invested in a single stock and total investment is of over ₹25,000 crore. FPIs meeting the criteria need to readjust holdings by January end.

IPO market shine

Amid the volatility, the primary market continued to shine this week. The EPACK Durable initial public offering (IPO) subscribed more than 16 times on the final day on Thursday. Nova AgriTech IPO received subscription of more than 60 times.

What lies ahead? Experts believe that the bearish sentiment is likely to prevail in the markets though investors would keep a close watch on Nifty reaching 21,500 mark. However, the monetary policy review of the European Central Bank and the fourth-quarter US GDP data next week may provide some breather.