PB Fintech Q4 Results Highlights: Net profit at ₹60.1 crore, reports profit for second straight quarter, revenue up 25.4% YoY

Upstox

5 min read • Updated: May 7, 2024, 7:24 PM

Summary

PB Fintech Q4 Results LIVE: PB Fintech Limited, the parent company of Policybazaar, reported Q4 net profit of ₹60.1 crore. The company break-even for second straight quarter.

PB Fintech Q4 Results Live Update at 6:45 pm: Business highlights for key segment

PB Fintech Q4 Results Live Update at 6:40 pm: Q4 result highlights

-

The company said total insurance premium for the quarter was ₹5,127 crore, an ARR of ₹20k crore insurance premium, led by growth in new health & life insurance business.

-

Revenue of our core online marketplaces, Policybazaar and Paisabazaar, grew 39% to ₹2,375 crore, while improving their Adjusted EBITDA to ₹324 crore YoY for FY24.

-

Consolidated revenue grew 34% YoY to ₹3,438 crore, profit after tax improved from a loss of ₹488 crore to a profit of ₹64 crore YoY.

PB Fintech Q4 Results Live Update at 6:35 pm: The revenue from operations grew 25.4% year-on-year to ₹1090 crore compared to ₹869 crore the year ago period.

PB Fintech Q4 Results Live Update at 6:30 pm: PB Fintech, the parent company that houses online marketplaces Policybazaar and Paisabazaar reported Q4 net profit of ₹60.1 crore.

PB Fintech Q4 Results Live Update at 4:58 pm: PB Fintech Limited, the parent company of Paisabazaar and Policybazaar, will release its financial results for January-March quarter of financial year 2023-24 (Q4 FY24) shortly.

PB Fintech Q4 Results Live Update at 4:40 pm: On which Stock Exchanges are the shares of PB Fintech listed and traded?

The equity shares of PB Fintech are listed and traded on the National Stock Exchange (NSE) and BSE. Stock Exchange codes are

- NSE: POLICYBZR

- BSE: 543390

PB Fintech Q4 Results Live Update at 4:10 pm: Tuesday trading stats

- Close: ₹1,246 (-2.8%)

- Open: ₹1,282

- High: ₹1,293

- Low: ₹1,231

- Total m-cap: ₹56,262 crore

- Free float m-cap: ₹37,696 crore

PB Fintech Q4 Results Live Update at 3:35 pm: Shares of PB Fintech closed 2.8% lower at ₹1,246.9 on the NSE.

PB Fintech Q4 Results Live Update at 2:55 pm: What category of business does Paisabazaar fall under?

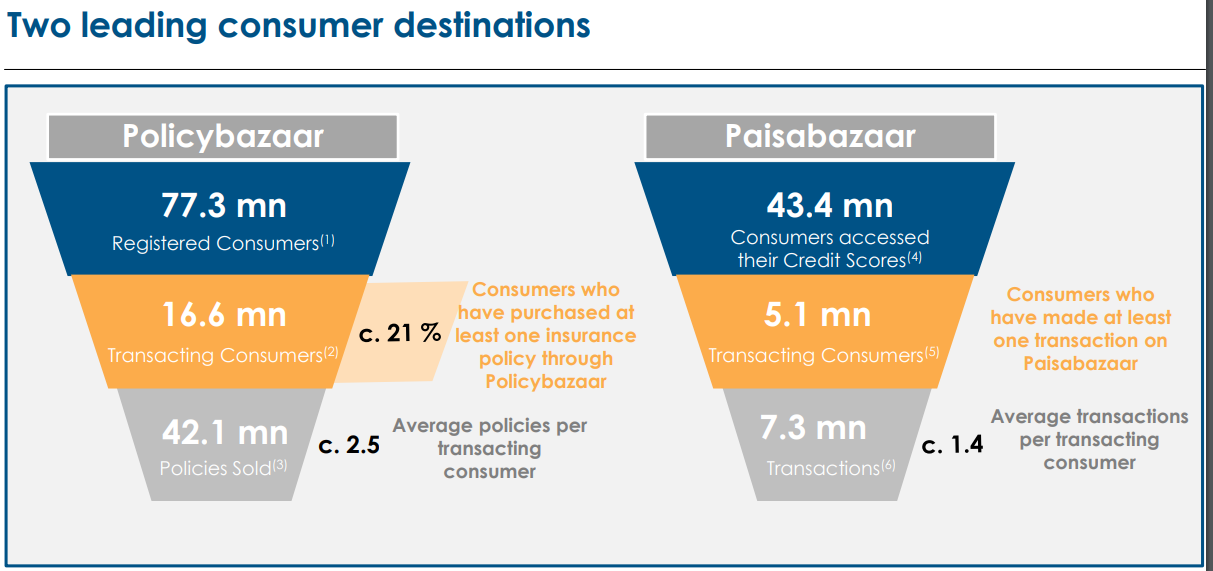

PB Fintech's, Paisabazaar Marketing and Consulting Private Limited, operates in India’s online credit industry as an independent digital lending platform that enables Consumers to compare, choose and apply for personal credit products.

The company has partnered with large banks, NBFCs and fintech lenders who offer a wide choice of product offerings on its platform like personal loans, business loans, credit cards, home loans, loans against property and credit advisory services.

PB Fintech Q4 Results Live Update at 2:31 pm: What category of business does Policybazaar fall under as per IRDAI?

PB Fintech's subsidiary, Policybazaar Insurance Brokers Private Limited, received a certificate of registration to act as a direct insurance broker (life and general) under the IRDAI Insurance Brokers Regulations, 2018 on June 10, 2021, prior to which it was registered as a web aggregator under the IRDAI Insurance Web Aggregators Regulations, 2017.

PB Fintech Q4 Results Live Update at 2:00 pm: What is PB Fintech's primary revenue source?

PB Fintech derives revenues primarily from commissions and other fees paid by the insurer and lending partners whose insurance and credit products its consumers purchase. The commissions the company can charge its insurer partners are based on charges set forth under the Insurance Regulatory and Development Authority of India (IRDAI).

PB Fintech Q4 Results Live Update at 1:31 pm: Shares of PB Fintech were trading in the negative territory on Tuesday. The stock was down 2.7% at ₹1,247.

PB Fintech Q4 Results Live Update at 12:53 pm: Top management

- Yashish Dahiya, Chairman and CEO, PB Fintech

- Alok Bansal, Executive Vice Chairman, PB Fintech

- Sarbvir Singh, Joint Group CEO, PB Fintech

- Naveen Kukreja, Co-Founder and CEO, Paisabazaar

- Mandeep Mehta, Group CFO, PB Fintech

- Rasleen Kaur, Head, Corporate Strategy and Investor Relations, PB Fintech

PB Fintech Q4 Results Live Update at 12:30 pm: Group brands

- Policybazaar UAE

- Policybazaar

- Paisabazaar

- PB Partners

- Docprime

- QuickFixcars

- Moneywide

PB Fintech Q4 Results Live Update at 12:03 pm: What is the face value of the Shares of PB Fintech?

The face value of the equity shares of PB Fintech is ₹2 per equity share.

PB Fintech Q4 Results Live Update at 11:30 am: Trading stats

- Share price: ₹1,240 (3.3%)

- Open: ₹1,282

- High: ₹1,293

- Low: ₹1,231

- Total m-cap: ₹55,976 crore

- Free float m-cap: ₹37,516 crore

PB Fintech Q4 Results Live Update at 11:02 am: When did PB Fintech have its IPO and at what price?

PB Fintech went public on November 15, 2021 with an issue price of ₹980 per equity share and listing price of ₹1150 per share.

PB Fintech Q4 Results Live Update at 10:40 am: Shares of financial technology company were trading at ₹1,250, down 2.5%, on the NSE.

PB Fintech Q4 Results Live Update at 10:20 am: PB Fintech Limited, Policybazaar's parent company, will release its Q4 FY24 results today.

PB Fintech Q4 Results LIVE: PB Fintech Limited, the parent company of Policybazaar and Paisabazaar, will release its financial results for the fourth quarter of financial year 2023-24 (Q4 FY24) on Tuesday, May 7.

PB Fintech is the umbrella entity comprising of India’s leading marketplaces such as Policybazaar and Paisabazaar that offer end-to-end insurance and credit solutions to consumers.

Other companies that will release their Q4 results today include JSW Energy, PB Fintech, IRB Infrastructure, Dr Reddy’s Laboratories, United Breweries, Delta Corp, KEC International, Indraprastha Gas, Credit Access Grameen, Pidilite Industries, Century Textiles & Industries, IDFC, SRF, Sonata Software, Jindal Saw, Fluorine International, Jupiter Wagons, InfoBeans Technologies, Kamat Hotels (India), Graphite India, Kajaria Ceramics, Suraj Estate Developers, Navin Latent View Analytics, Max Financial Services,Chambal Fertilisers & Chemicals and Elantas Beck India.