Oil and Retail drive Reliance Industries' Q3 profit

Upstox

3 min read • Updated: January 24, 2024, 7:16 PM

Summary

Reliance Industries (RIL) had an robust December quarter, with strong earnings mainly due to excellent performance in its retail and oil and gas businesses.

Key takeaways

- Effective Management: The company achieved growth even in fluctuating market conditions through strong operational discipline.

- High Demand: There was strong demand in consumer and energy markets in India.

- Stable Oil to Chemicals (O2C) Performance: Despite market challenges, the O2C segment remained steady. However, chemical margins were affected by high feedstock costs and lower demand from China.

- Strong Consumer Platform Performance: Significant net subscriber growth and the rapid deployment of 5G infrastructure. Similarly, growth in the retail sector was fueled by festive season demand, customer-focused strategies, and an expanded product range.

- Progress in Energy Projects: Plans to launch new energy projects this year are on track.

December quarter performance

- On a year-on-year basis, Reliance’s EBITDA jumped 16.7% and the net profit rose 10.9% (see exhibit 1).

- Earnings growth led by strong Retail and Oil & Gas segments along with consistent performance in Digital Services and O2C operations.

Exhibit 1: Income statement snapshot - Q3FY24

Source: Company

Excerpts from the management commentary:

-

Retail: Solid growth momentum supported by growing footprint and increased foot traffic during the festive season (more details below).

-

Digital Services: Growing FTTH penetration and strong net subscriber additions are driving revenue growth and profitability. successfully finished the Jio True5G network's nationwide rollout in India.

-

O2C: Strong performance despite weak margin environment and a significant planned maintenance shutdown. If all major units were available during the quarter, O2C EBITDA would have been higher on a year-over-year basis and comparable on a quarter-over-quarter basis.

-

Oil & Gas: Solid expansion driven by MJ field ramp-up; KG D6 now accounts for 30% of India's gas production.

Segmental Breakup

- Retail (RRVL)

Source: Company

Source: Company

- Festive demand is leading growth across segments

- Registered 282 Mn footfalls (+40% YoY)

- Accelerated new store addition of 1,549 on YoY (252 new stores in 3Q FY24)

- Digital and New Commerce at 19% of the expanding revenue base

- Digital Services (JPL)

Source: Company

Source: Company

- Strong net subscriber addition of 38 Mn on YoY(11.2 Mn in 3Q FY24)

- Data traffic up 31.5% YoY at 38.1 Bn GB – an increasing mix of 5G traffic

- 5G now available across India, ~90 Mn subscribers migrated to Jio’s 5G network

- O2C

Source: Company

Source: Company

- Stable EBITDA supported by domestic demand and a comeback in the retailing of fuel

- However, this was offset by major unit planned maintenance shutdown, reduced chemicals downstream demand and competition

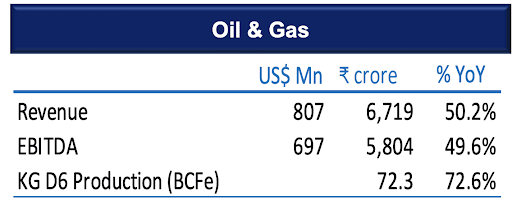

- Oil & Gas

Source: Company

Source: Company

- Highest-ever quarterly EBITDA ever

- A notable rise in the MJ field's volume of gas and condensate

- KG D6 gas production averaged 29.6 MMSCMD in 3Q FY23 compared to 19.2 MMSCMD in 3Q FY23.

Balance sheet snapshot

Source: Company

Source: Company

- RIL expects moderation in capital expenditures with completion of nationwide 5G rollout

When looking at the quarter, it's clear that RIL's varied business areas and strong operations have set it up for continuous growth. The company did really well in retail, made steady advances in digital services, and had impressive successes in oil and gas. This shows RIL's skill in handling challenges and making the most of chances in the ever-changing market.