What is time decay and how does it impact my options trade?

Upstox

3 min read • Updated: January 20, 2024, 8:44 PM

Summary

Time decay is an artifact of intrinsic vs. extrinsic value.

From time-to-time, we either receive great questions or see interesting ones asked online in various forums. We realize that these are probably very common questions for both new and experienced traders alike.

Question: I’ve read that option premium can lose value over time. What exactly is this and is there a way to tell how much the option will lose? Can it be avoided?

An option will lose value over time and this is known as “time decay” or “theta decay”. Time decay is an artifact of intrinsic vs. extrinsic value. Once an option expires, it will only have the intrinsic value – the difference between the underlying price and strike price. Prior to expiry, there will also be time value or extrinsic value. The further away from expiry that an option contract is, the more time value it will have as part of its option price. This is because there is more time for the underlying to move and make the option valuable. If the volatility is higher, then there will also be more extrinsic value because the underlying is moving more which creates an even better chance of the option becoming valuable.

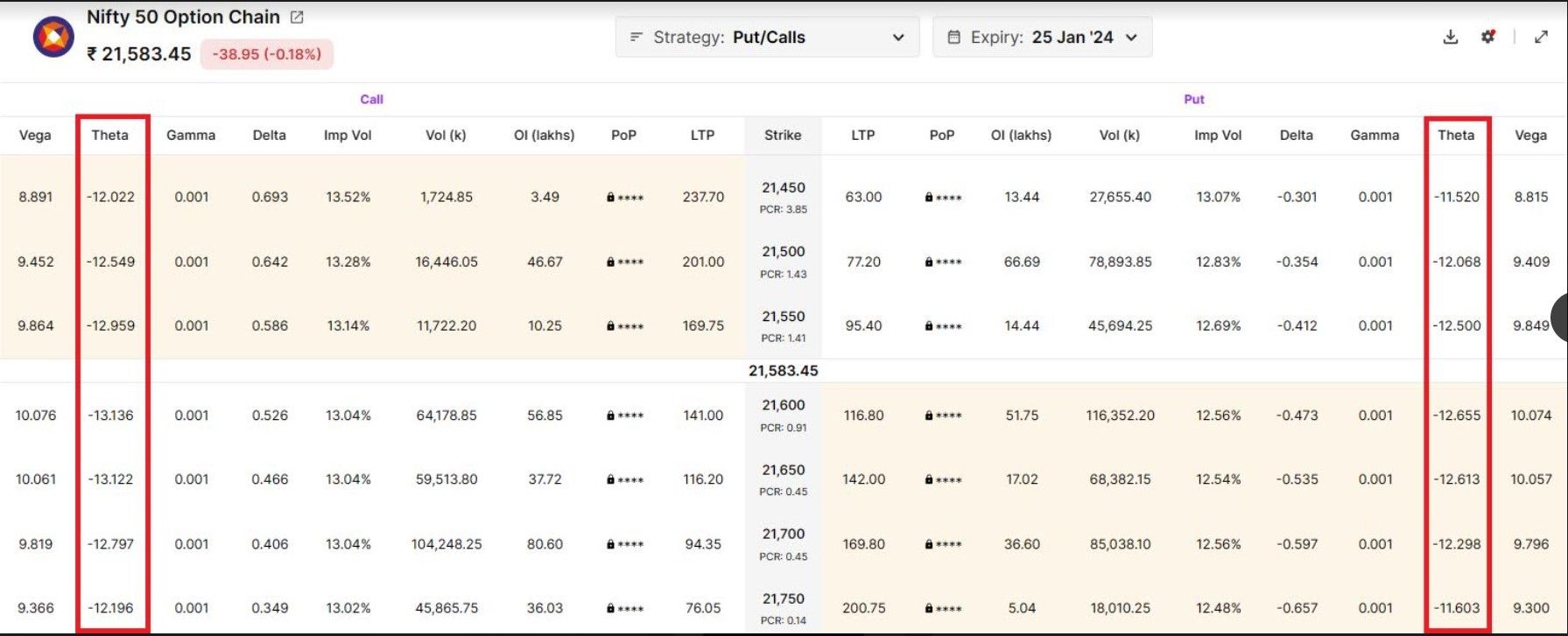

If you look at the option chain, you should find the value for ‘theta’. Theta is one of the option Greeks and is the amount that the option contract will lose in premium if you hold overnight. Theta is a negative value for both calls and puts. If you look at various expiries, you can see that theta is higher both as a value and as a percent of the premium the closer to expiry that you are.

For example, as of the time of writing, the 21600-strike call on the Nifty expiring in one week (25 Jan 2024) has a price of ₹141.00 and theta of -13.136. The same strike on the next monthly expiry (29 Feb 2024) has a price of ₹473.50 and theta of -4.737. This means that in one day, the 1-week contract will lose 9.3% of its value and the further out expiry will lose 1.0% of its value.

Since many option traders focus on the current week expiries or even expiration day (0DTE), time decay is a critical consideration. If the underlying doesn’t move in your favor today, then you need to be aware that it needs to move even more tomorrow in order to turn a profit. If instead, you were trading a longer-term contract, this amount would be less. The trade-off is that the longer-term contract will cost more.

Lastly, you can’t avoid time decay – if you are an option buyer. If you sell options, time decay will still occur but it is favorable to you. You want to be able to buy back the option for as little as possible. As time passes, this will lower the value of the option which is a good thing for option sellers. Of course, the option could still expire with intrinsic value if the underlying moves against you.