NIFTY50 Outlook (January 23-25): Q3 earnings, F&O cues, US GDP data & other key factors to watch this week

Upstox

4 min read • Updated: January 23, 2024, 8:02 AM

Summary

For the January monthly expiry, the maximum call writing was seen at the 22,000 and 21,700 strikes.

Indian markets tumbled last week, weighed down by the HDFC Bank's disappointing Q3 results. The NIFTY50 plunged 1.5%, while the BANK NIFTY fell a steeper 3.5%. Despite the overall slump, Midcaps bucked the trend and gained 1.2%, while Small caps remained subdued, closing 0.2% lower.

Among the Nifty sectoral indices, Oil & Gas (+3.5%) and PSU Banks (+3.3%) were the top gainers, while Private Banks (-3.9%) and Financial Services (-3.6%) were the top losers.

Index breadth

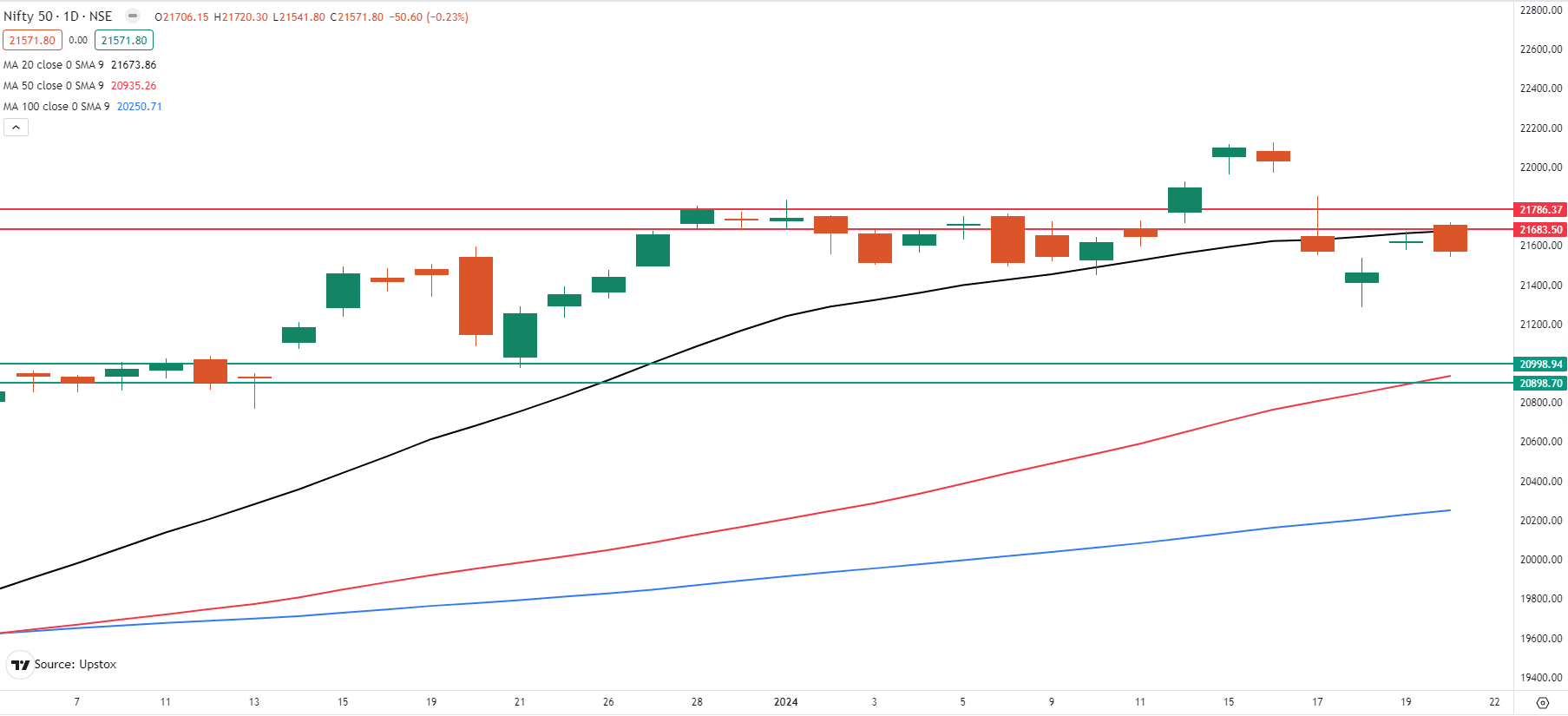

The NIFTY50's break below its 20-day moving average last week and the subsequent formation of a bearish engulfing pattern on the weekly chart paint a worrying picture of potential downward momentum.

Adding to the bearish sentiment is the dwindling number of NIFTY50 stocks trading below their respective 20 SMAs. From a comfortable 67% a week ago, the proportion has now shrunk to 50%, indicating a shift towards caution.

However, there is still a glimmer of hope for the bulls. In the holiday-shortened week, the 21,700-21,800 area, which coincides with the 20-DMA, acts as a key resistance level. A bullish reversal depends on the NIFTY50 reclaiming this area. Conversely, a close below 21,448, last week's swing low, could open the gates for a decline towards the 50-DMA.

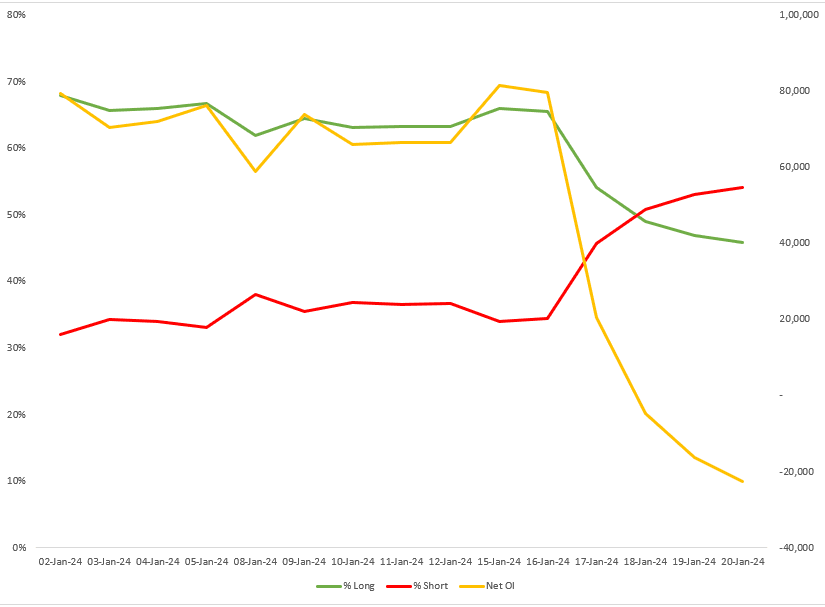

FIIs positioning in the index

Foreign Institutional Investors (FIIs) shifted their stance and turned bearish after being predominantly bullish in the previous week's index futures contracts. Their long positions fell from 66% to 47%, while their short positions rose to 53% from 34%.

Meanwhile, with the increase in bearish bets in index futures, FIIs also sold over ₹23,000 crore of shares in the cash market. As we approach the Union Budget, monitoring both FII flows and their positioning in index futures will be crucial in interpreting the future direction of the market.

Click here to track open positions of FIIs in the index futures: Login https://pro.upstox.com/ ➡️F&O➡️FII-DII activity➡️FII Derivatives

Click here to track inflows and outflows of FIIs in the cash market: Login https://pro.upstox.com/ ➡️F&O➡️FII-DII activity➡️Cash market

F&O - NIFTY50 outlook

For the January monthly expiry, the maximum call writing was seen at the 22,000 and 21,700 strikes. On the other hand, the bulls have established a base with maximum put writing at the 21,000 and 21,500 strikes. As per the options data, the trading range for the NIFTY50 in the current week is between 21,900 and 21,200.

Experts believe, the price action near the psychological 21,500 level will determine the future trend. They believe that a sustained close below this level on a daily closing basis could open the door to the 50-DMA (near 21,000). However, a close above 21,800 could turn the tide in favour of the bulls in the short term.

Click here to track the open interest and change in open interest: Login https://pro.upstox.com/ ➡️F&O➡️OI analysis➡️Nifty50➡️OI/Change in OI

📈📉Earnings blitz: The market's focus this week will be on the Q3 earnings season, which is in full swing. Several key companies, including Axis Bank, Cipla, Tech Mahindra, TVS Motor, Tata Steel, Balkrishna Industries and Bajaj Auto among many others will report their Q3 results.

📅Economic data in focus: This holiday-shortened week packs a punch! Central banks in Japan and the UK will make key interest rate decisions that could shape global markets. Meanwhile, the US economic data on GDP and home sales adds another layer of intrigue. Investors need to buckle up - volatility could be brewing!

📊Stocks in focus: As per the open interest and futures price, the stocks showing long build-up are Balkrishna Industries, Apollo Tyres, Coal India and IRCTC. Similarly, to track the OI losers login https://pro.upstox.com/ ➡️F&O➡️Futures smartlist➡️OI Gainers/OI Losers/Most active.

📓✏️Takeaway: Despite the sharp fall, the higher high and higher low structure of the Nifty50 remains intact on the daily chart. However, the breach of the index's downward channel, fuelled by HDFC Bank's woes, paints a different picture. Now in a volatile consolidation, the markets are waiting for a decisive move. As mentioned above, a decisive close below 21,448 (last week's swing low) would hand over the reins to the bears. On the other hand, a recapture of the channel could rekindle the hopes of the bulls.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.