Electric vehicle sales to jump by 66% in India in 2024, Tata Motors held 2/3rd of market share in 2023: Report

Upstox

3 min read • Updated: April 8, 2024, 8:10 AM

Summary

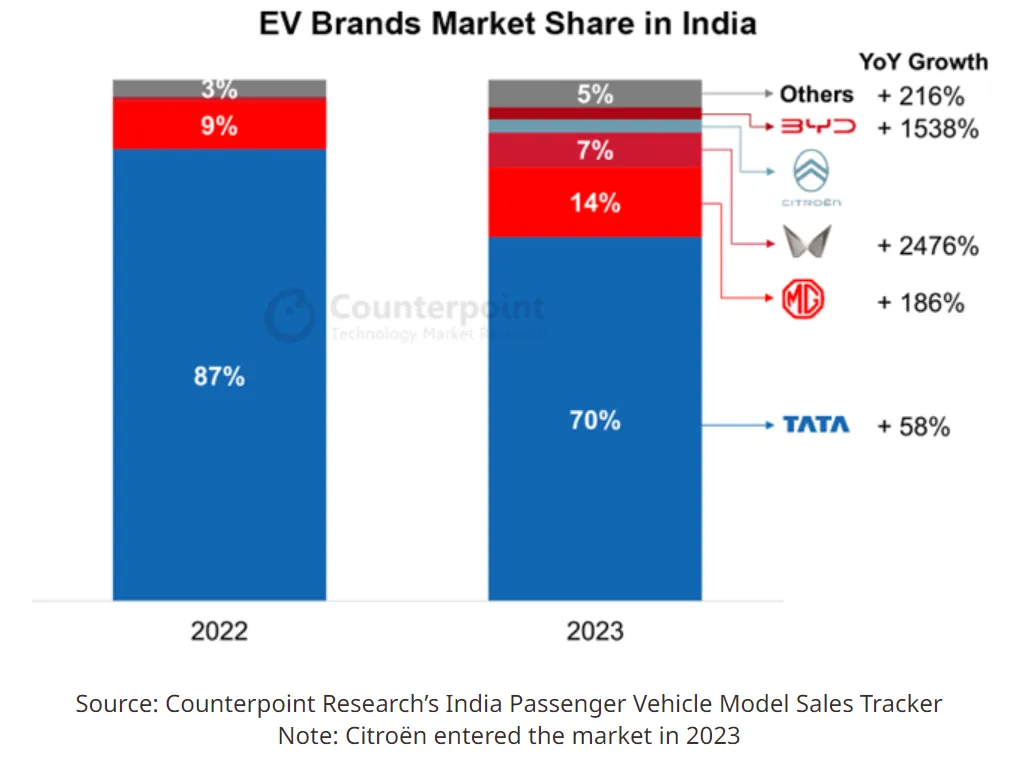

Mahindra & Mahindra recorded a massive 2,476% increase in market share in 2023, whereas premium EV maker BYD logged a 1,583% surge, as per the report released by Counterpoint Research. Tata Motors held a market share of 70% during the year, lower as compared to 87% in 2022, it pointed out.

The sale of electric vehicles (EVs) is expected to jump by 66% in calendar year 2024, as compared to the preceding year, as per a report released by Counterpoint Research. Tata Motors, the current EV segment leader in the domestic market, held two-third of the market share in 2023, it added.

At the end of 2024, EVs would comprise 4% of the total passenger vehicles (PVs) sold during the year, the study claimed, adding that the momentum is expected to grow stronger by the end of this decade. Looking at 2030, EVs are projected to constitute nearly one-third of India’s total PV sales, it said.

The report noted that Maruti Suzuki’s entry into the EV market is expected to shake up Tata Motors’ dominance. Maruti, which holds around 40% of the market share in the PV segment, has planned to launch its first EV in 2025.

According to Counterpoint Research, Vietnamese EV major VinFast’s move to set up a production plant in Tamil Nadu also highlights the growing interest and investment in EV manufacturing in the country. “All this not only signifies increased competition but also reflects the evolving landscape of the automotive industry toward sustainable and eco-friendly technologies,” it said.

The rise in EV battery manufacturing, supported by key players like Ola, Reliance New Energy and ACC Energy Storage, alongside the Make in India initiative, “will lower manufacturing costs and boost EV sales”, said Liz Lee, the associate director of the research agency.

“Government initiatives such as the PLI scheme for Advanced Chemistry Cells (ACC) and the recent reduction in import duties on EVs under $35,000 to 15% are game changers. All this not only opens doors for Tesla but also signals India’s readiness to welcome significant investments and foster a new ecosystem for EVs and their component suppliers. It is a clear sign that India’s journey to become a major player in the global EV market is accelerating,” Lee added.

How EV sales grew in India in 2023

While the overall sales in the passenger vehicles segment grew by 10% year-on-year in 2023, the sale of EVs “nearly doubled to account for 2% of the overall PV sales”, the report said. This surge can be attributed to multiple factors, including increasing urban consumer interest, government initiatives, infrastructure development, and concerns over climate change, it added.

With a strong portfolio and strategic tie-up with Uber, Tata Motors “held more than two-thirds of the country’s EV market in 2023 but lost some share to Mahindra & Mahindra and BYD”, it noted.

Mahindra & Mahindra recorded a massive 2,476% increase in market share, which can be attributed to its aggressive marketing efforts around the all-electric SUV XUV400 launched in 2023, the report stated, adding that the company was also the fastest growing EV brand during the year.

Mahindra is followed by MG Motor and BYD, with the latter securing a position among the top five EV brands in India, Counterpoint Research said.

With just two models in its India line-up – e6 MPV and Atto 3 SUV, BYD grew over 1,500% in 2023, the research agency said in a release. The company’s recent launch of the Seal model is expected to further enhance the brand’s market presence, it added.

Overall, the Indian market share of BYD increased by 1,538% and MG Motor’s share increased by 186%. Tata Motors held 70% of the market, which is lower as compared to 87% a year earlier. On the other hand, Mahindra’s market share increased to 14% from 9% in 2022.