What are defensive and cyclical sectors?

Upstox

8 min read • Updated: January 30, 2024, 7:18 PM

Summary

Defensive sectors, like FMCG and Pharma, offer stable returns even during economic downturns due to consistent demand and stable financials. Cyclical sectors, such as Auto and Realty, fluctuate with the economy, offering high growth in good times but struggling during slumps. Choosing between them depends on risk tolerance and investment goals, considering factors like market share, financial health, and economic trends.

Key takeaways

- Stocks in the defensive sectors (like FMCG and Pharma) are stable and perform well even during economic downturns. Cyclical sectors (like Auto and Realty) fluctuate with the economy.

- Defensive sectors often have consistent demand and stable financials, while cyclical sectors can offer high growth in good times but may struggle during economic slumps.

- The choice of investing between defensive and cyclical stocks can be based on your risk tolerance and investment goals.

- One can consider factors like market share, financial health, and economic trends when investing in these sectors.

Imagine you have a limited amount of money. Would you rather spend it on a new car or a vacation, or would you use it for essential things like food, bills, and medicine?

This analogy extends to investment decisions. In the world of investing, where there is no free lunch, every decision comes with its own set of trade-offs. Choosing between defensive and cyclical sectors in investment involves balancing factors such as growth, risk, volatility, returns, and time horizon.

To resolve this dilemma, we'll explore:

- The characteristics and key attributes of defensive and cyclical sectors, along with empirical examples.

- Performance comparison of stocks in these sectors against macroeconomic fundamentals.

- The advantages and disadvantages of investing in both defensive and cyclical sectors.

- Strategies for portfolio construction: balancing cyclical and defensive stocks.

- Key considerations for a well-rounded portfolio.

What is a defensive sector?

In simple English, the word 'defensive' means to guard or to protect. Essentially, companies or stocks within the defensive sector are characterised by relatively stable returns, consistent earnings, and regular dividend payments across business cycles. These sectors demonstrate resilience during economic downturns, often maintaining operational profitability. FMCG, Utilities, Pharma and Healthcare are typical examples of defensive sectors, primarily because there is a constant demand for their products, regardless of the economic cycle.

Key attributes of a defensive sector

Defensive stocks or sectors are marked by several distinct features:

- Low stock price volatility (with a beta* of less than 1).

- Low seasonality, which implies steady deand growth even during economic downturns.

- Stable returns throughout various economic cycles.

- Less negative impact on overall financial performance during economic downturns.

- High dividend yield and a consistent dividend-paying policy.

Example of a defensive sector: FMCG

The FMCG business is a classic example of a defensive sector characterised by:

- Low volatility (beta < 1)

- Low seasonality, implying steady demand growth even during economic downturns.

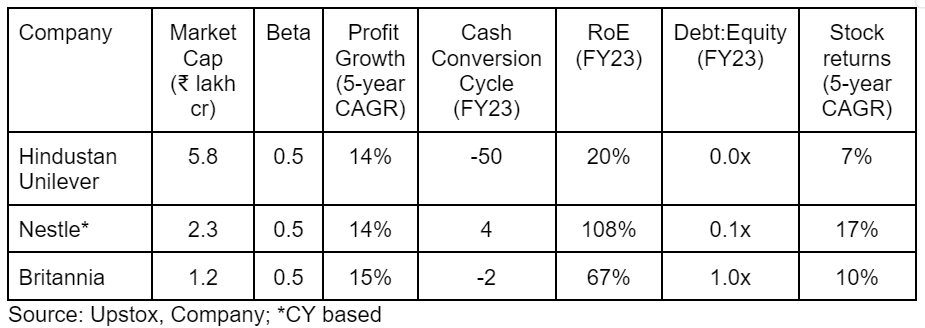

For instance, the financial performance metrics of the top FMCG companies, as shown in the table below, demonstrate most players achieving steady double-digit profit growth CAGR over the past five years (FY18-23). These companies exhibit healthy balance sheets, reflected in:

- Low or negative cash conversion cycles

- High double-digit return ratios (RoE)

- Low debt vs equity

- Strong brand equity

Consequently, FMCG companies command premium valuations

Performance of FMCG stocks

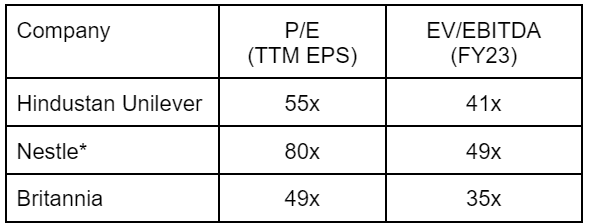

Companies in the FMCG sector often have high valuations, which you can see in their P/E ratios above 60 and P/B ratios in double digits, as shown in the table below.

FMCG valuation ratios

Source: Upstox, Company; *CY based; TTM = Trailing Twelve Months

Source: Upstox, Company; *CY based; TTM = Trailing Twelve Months

What is a cyclical sector?

Cyclical sectors, and the companies within them, often experience a greater negative impact on their financial performance during economic downturns compared to defensive sectors. For instance, when GDP growth slows down, inflation is high, and geopolitical tensions are present, the demand in cyclical sectors usually drops. This is because people spend less on non-essential items due to lower disposable incomes.

Demand in these sectors often varies with the seasons. For example, automobile sales typically weaken during the monsoon season or the July-September quarter. This seasonal trend is in contrast to the January to March quarter, when many companies launch new products.

Key attributes of a cyclical sector

Cyclical sectors are characterised by a few notable features. Firstly, there's a sharp rise or fall in demand that closely follows the economic and business cycles. Seasonal factors also impact demand. For instance, cement demand often drops during the monsoon season due to a slowdown in construction activities. Additionally, companies in these sectors tend to perform strongly during economic upswings but may experience weaker performance during downturns.

Commonly recognised cyclical sectors include:

- Financial Services

- Automobiles and Auto Components

- Realty

- Metals

- Capital Goods

- Consumer Durables

Example of a cyclical sector across business cycles

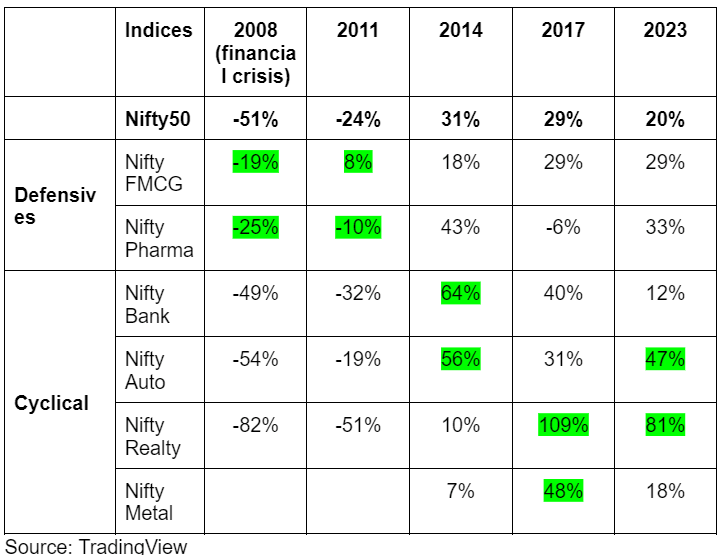

Analysing the data from the table below, we can observe distinct trends in the performance of various sectors compared to the Nifty50 across different years, particularly during key economic events.

Historical sectoral vs Nifty50 performance

During the 2008 financial crisis, all sectors underperformed compared to their usual standards, with the Nifty50 itself dropping by 51%. Cyclical sectors like Nifty Bank, Auto, and Realty were hit hard, with Nifty Realty plummeting by a staggering 82%. In contrast, defensive sectors like Nifty FMCG and Pharma fared relatively better, declining by 19% and 25% respectively, indicating their resilience during economic downturns.

In 2011, a year marked by market volatility, Nifty FMCG and Pharma showed positive growth, contrasting with the significant negative performance in cyclical sectors like Nifty Bank and Realty. This trend highlights the defensive nature of sectors like FMCG and Pharma, which tend to be less affected by economic downturns.

The year 2014 saw a significant economic upturn, with cyclical sectors rebounding strongly. Nifty Bank and Auto reported impressive gains of 64% and 56%, respectively, outperforming the Nifty50’s 31% rise. This illustrates the high sensitivity of cyclical sectors to positive economic changes.

By 2017 and 2023, we see a more mixed performance. In 2017, Nifty Realty notably surged by 109%, and by 2023, it had grown by 81%, indicating a strong recovery and growth in the real estate sector. Nifty FMCG and Pharma maintained steady growth in these years, reinforcing their stability as defensive sectors.

Overall, this data demonstrates the contrasting nature of cyclical and defensive sectors in response to economic fluctuations, with cyclical sectors showing higher volatility and defensive sectors providing more stability during market downturns.

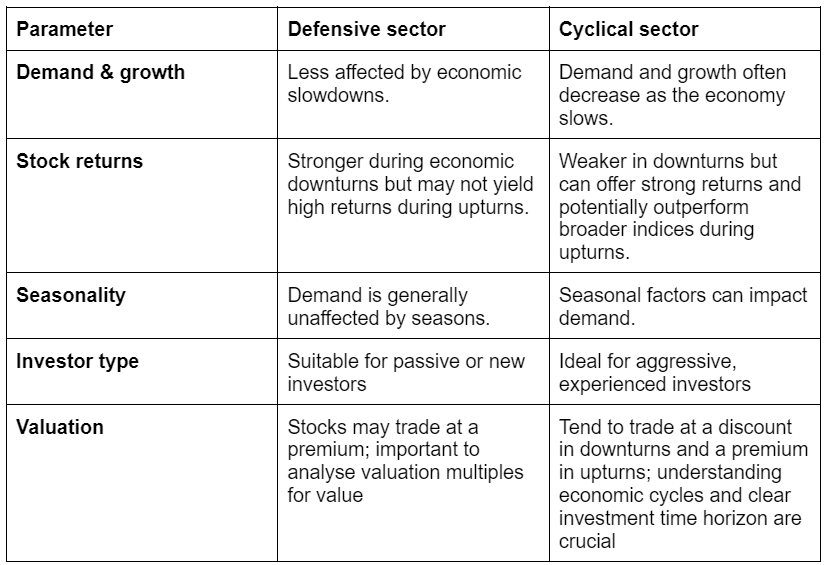

Investing in defensive & cyclical sectors

With a good understanding of the sector, you're now equipped to take advantage of specific opportunities to maximise your returns. Before investing in either defensive or cyclical sectors, it's crucial to consider several key factors:

- Your investment goals

- Your risk tolerance

- Your investment time frame

- Your knowledge about the sector(s)

Pros and cons of defensive and cyclical sectors

Building your portfolio: Cyclical vs defensive stocks

Before deciding whether to invest in cyclical stocks, defensive stocks, or a mix of both, consider the following key points for building your portfolio:

Key considerations for defensive stocks

- Look for a diverse brand portfolio

- Assess geographic distribution

- Consider market share

- Evaluate the quality and consistency of earnings and cash flows

- Check for a strong balance sheet, including cash reserves, low debt, and high return ratios

- Examine the consistency and amount of dividend yield

- Perform quantitative valuation to ensure potential for 'value.'

- Assess qualitative factors like management track record, investor relations, and corporate governance

Key considerations for cyclical stocks

- Determine the sector's position within the current economic cycle

- Assess the company's financial health, focusing on the balance sheet

- Analyse leverage (debt-to-equity ratio), interest coverage, and return profiles (RoCE, RoE).

- Review the profit and loss statements, including operating margins, fixed costs, break-even points, and net profit.

- Study these financials across at least two business cycles to gauge sector and stock performance against historical averages and market indices.

- Evaluate historical valuations during economic upturns and downturns.

- Look into qualitative aspects of valuation, such as management track record, investor relations, and corporate governance.

Critical factors for building your portfolio

When starting to build your portfolio, consider these essential points:

- Risk Appetite: How much risk are you comfortable taking?

- Investment Goal: What are your return expectations?

- Holding Period: Do you plan to invest short-term, medium-term, or long-term?

- Domain Expertise: Your understanding and experience of the market and specific sectors.

Based on your risk tolerance, market knowledge, and expected returns, start choosing stocks from both cyclical and defensive sectors. For instance, an experienced investor looking for high growth and high returns over a 2-3 year period might prefer more cyclical stocks. Conversely, a new or conservative investor seeking stable returns might lean towards defensive stocks.

No matter your sector preference, investment goal, or risk level, diversifying your stock portfolio is always wise. Spread your investments across different sectors and asset classes, such as equities, bonds, gold, real estate among others, to minimise risks.

And remember, as John Maynard Keynes, the father of macroeconomics, wisely said, markets can remain irrational longer than you can stay solvent. So, manage your investments and risks wisely.