India’s Fiscal Deficits Through the Lens of History

Upstox

5 min read • Updated: January 24, 2024, 2:23 PM

Summary

A fiscal deficit occurs when the exchequer’s expenditures exceed its revenues. In this article, we shed light on how India’s fiscal deficits have evolved, tracing its correlation with the Gross Domestic Product (GDP).

Key takeaways -

- The Sukhamoy Chakravarty Committee (1982-1985) recommended the adoption of fiscal deficit reporting.

- Until 1990-91, India leaned towards socialism, with significant government spending on long-term projects, leading to a persistent high fiscal deficit.

- Economic reforms in 1991 ushered in reducing government intervention and initiating disinvestment to control fiscal deficits.

- The Fiscal Responsibility and Budget Management (FRBM) Act in 2003 set targets for fiscal discipline.

- India’s fiscal deficit is expected to come down to 5.9% in the Budget estimates for FY23-24. Finance Minister Nirmala Sitharaman is expected to further reduce it to 5.3% in the upcoming Union Budget 2024.

India is a rapidly evolving economy that has witnessed dynamic shifts in its fiscal landscape over the years. Various milestones have marked the country’s economic journey since its independence. One of the key indicators of a government’s financial health and its management of resources is Fiscal Deficit. A fiscal deficit occurs when the exchequer’s expenditures exceed its revenues. In this article, we shed light on how India’s fiscal deficits have evolved, tracing its correlation with the Gross Domestic Product (GDP).

A look back

Until 1991-92, the Central Government’s budget did not disclose the fiscal deficit; instead, it reported the ‘budgeted’ or uncovered deficit – the excess of total expenditure over total receipts, financed through 91-day Treasury Bills and cash balance drawdown, as stated in Explanatory Note to Budget at a Glance, 1996-97.

The Sukhamoy Chakravarty Committee (1982-1985) recommended the fiscal deficit’s adoption as a more accurate reflection of the government’s credit demands. Six years later, Dr Manmohan Singh, then Finance Minister, introduced the fiscal deficit in the 1990-91 Economic Survey, foreshadowing the IMF structural adjustment program in 1991. It officially entered the Central Government Budget documents in 1991-92.

Post-Independence

After independence, policymakers believed in significant government spending for vital long-term projects, which the private sector might not undertake due to extended gestation periods. Until 1990-91, India leaned heavily towards socialism despite being a mixed economy. Government control extended to key sectors like banking, civil aviation, and mining. This protectionist approach led to the government bearing the burden of funding capital expenditures, resulting in a persistent high fiscal deficit.

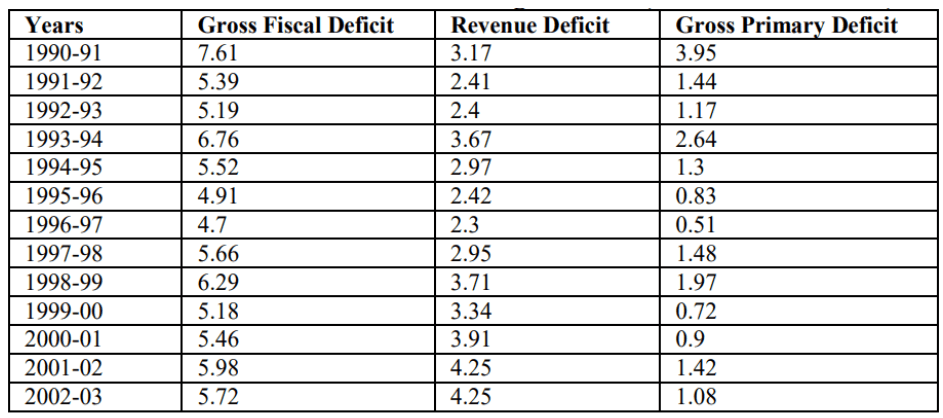

The table below shows that the central government’s fiscal deficit rose sharply from 5.55% of GDP in 1980-81 to 8.13% in 1986-87 and stood at 7.61% of GDP in 1990-91. During this period, fiscal balances rapidly deteriorated, primarily due to the unchecked expansion of non-planned revenue expenditure, especially on interest payments and subsidies, which surged throughout the 1980s. The escalating interest payments played a significant role in driving up the revenue deficit as a percentage of GDP, climbing from 1.36% in 1980-81 to 2.48% in 1987-88, and further to 3.17% in 1990-91.

Central Government Deficits as Percentage of GDP (1980-81 to 1990-91)

Liberalization Era

India’s economic landscape saw a turning point in the 1991 economic reforms. The policies were more market-oriented in the liberalisation era and aimed to reduce government intervention. The new approach involved liberalizing licensing and initiating the disinvestment of public enterprises and holdings. The economic policy had substantial positive effects on both the revenue and primary deficits. This had dual outcomes: it reduced capital expenditure and increased capital receipts.

Consequently, in the post-1991 era, there was a consistent decline in the fiscal deficit as a percentage of GDP, dropping from 7.61% in 1990-91 to 4.71% in 1996-97.

Central Government Deficits as Percentage of GDP (1990-91 to 2002-03)

The Introduction of the FRBM Act

In the early 2000s, India embarked on a path of fiscal consolidation. Efforts were made to contain the fiscal deficit and bring it in line with GDP growth. The adoption of the Fiscal Responsibility and Budget Management (FRBM) Act in 2003 was a significant step in this direction.

The FRBM Act set a medium-term goal of balancing current revenues and expenditures, capping the fiscal deficit at 3% of GDP with a phased reduction plan. It aimed to enhance transparency by mandating annual reports to Parliament on economic assessments, taxation, and expenditure strategies, along with three-year rolling targets for revenue and fiscal balance. Quarterly progress reviews were also required. Starting from April 1, 2000, the Act targeted a 0.5% reduction in the gross fiscal deficit each fiscal year, resulting in a declining fiscal deficit as a percentage of GDP.

Central Government Deficits as Percentage of GDP (2002-03 to 2015-16)

Recent Trends:

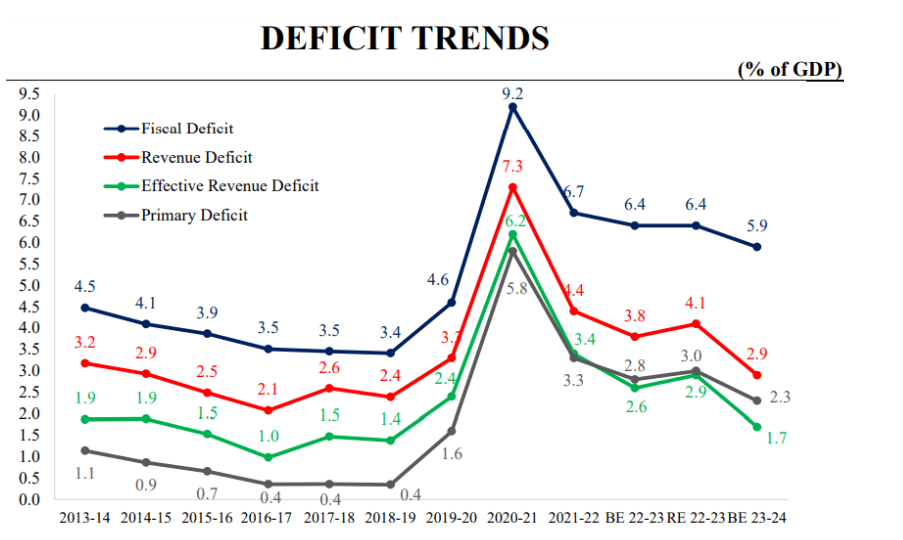

Over the past decade, India has experienced variations in its fiscal deficit-GDP ratio. Despite attempts to maintain fiscal discipline, external factors and domestic challenges have impacted this trajectory. The COVID-19 pandemic, in particular, presented unparalleled challenges, prompting the government to roll out economic stimulus packages. These measures, while essential for mitigating the pandemic's impact, contributed to an expansion of the fiscal deficit.

Consequently, the government’s fiscal deficit surged to 9.2% of GDP in FY20-21 in response to the repercussions of the COVID-19 outbreak. Neverthelss, through judicious financial policies and effective management, the government succeeded in reducing the fiscal deficit to 5.9% in the Budget estimates for FY23-24.

Central Government Deficits as Percentage of GDP (2014-15 to 2023-24)

In the upcoming Union Budget 2024, Finance Minister Nirmala Sitharaman is expected to opt for a further reduction in fiscal deficit to 5.3% of India’s GDP, through capital expenditure-driven growth instead of expenditure compression. Most economists believe the government will meet the FY24 commitment to reduce the fiscal deficit to 5.9%.

Conclusion:

From the post-independence time to the era of economic liberalization and the challenges posed by global crises, the Indian government’s fiscal deficits have mirrored the dynamics of the country’s economic landscape. A nuanced understanding of these historical trends is crucial for formulating effective policies that promote sustainable economic growth while maintaining fiscal prudence.