Has India ever presented a Budget fiscal surplus?

Upstox

3 min read • Updated: January 24, 2024, 9:36 PM

Summary

India presented its first and one of the few budget surpluses in its history. Here are the complete details

Key Takeaways:

- FY 1951 - 52 marked a historic moment with India presenting its first and one of the few budget surpluses in its history.

- The freed-up resources, estimated at ₹92 lakhs, were channeled into critical infrastructure projects like irrigation networks, dams, and power plants, laying the foundation for agricultural and industrial expansion in the years to come.

- The 1951 surplus offers valuable insights.

In the annals of India’s economic history, few events hold the same weight as the 1951 budget surplus. It wasn't the most awe-inspiring figure, nor the most recent, but yet, it stands, even today, as a testament to a budding nation's resilience and economic prowess in the strenuous years that followed independence.

For most Indians engaged in the finance and investments arena, understanding the genesis and impact of this paltry ₹92 lakh surplus offers valuable insights into India's fiscal management capabilities and its potential for sustainable growth.

Austerity in the Aftermath

Then stood an infant nation, freshly forged on the anvil of partition, distraught with economic vulnerabilities and in desperate need of infrastructure. This was the backdrop for the 1951 budget, presented by then Finance Minister C.D. Deshmukh. Recognizing the need for a delicate balance, Deshmukh adopted a "balanced budget" approach, which, for its time was a counterintuitive concept in a post-war world accustomed to deficits.

Tightening the Purse Strings

The strategy was multifaceted. Stringent expenditure control was the axiom. Administrative expenses were streamlined, non-essential spending curtailed, and resource allocation prioritized critical infrastructure projects with demonstrably high returns. Additionally, price controls on essential commodities kept inflation in check, further reducing government expenditure on subsidies.

Revenue Diversification

On the revenue side, Deshmukh explored fresh avenues. Land reforms brought about by the abrogation of the zamindari system empowered farmers and led to higher agricultural productivity. As a consequence, an increased tax revenue from the agrarian sector was anticipated. Additionally, export duty hikes on select commodities provided another income boost.

A Frugal Triumph

These combined measures paired with the government's commitment to fiscal prudence, yielded a remarkable outcome: approximately ₹92 lakh surplus – an insignificant sum by today's standards but a giant leap for the time. This surplus wasn't a stroke of idle luck, but the consequence of meticulous planning and militaristic execution.

Seeds Sown for Growth

The surplus wasn't merely a number on a balance sheet. It was an investment in India's future. The freed-up resources were channelled into projects like irrigation networks, dams, and power plants, laying the foundation for agricultural and industrial expansion in the years to come.

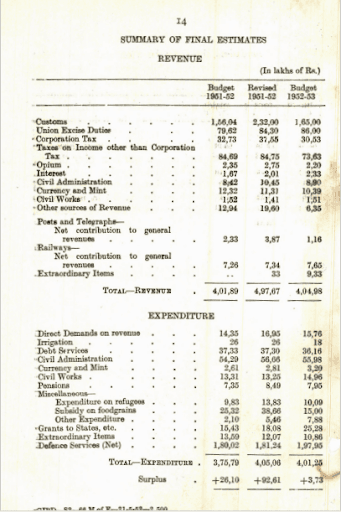

Below is an image outlining the summary of the 1951 estimations.

The 1951 surplus highlights the importance of fiscal discipline, prudent expenditure allocation, and diversifying revenue streams. As India strives towards further economic development, the principles instilled in the 1951 budget – balancing growth with fiscal responsibility – remain as relevant as ever.

Nevertheless, by visiting the multifaceted reasons behind the 1951 surplus, we can gain valuable insights into India's economic history and the complex choices it faced on the path to development.