Budget 2024: Check key differences between old and new tax regimes

Upstox

4 min read • Updated: January 23, 2024, 2:29 PM

Summary

In Budget 2023-24, the new tax regime was made the default regime for personal taxation for the assessment year (AY) 2024-25.

The announcements on income tax are keenly observed by all during the Union Budget presentation every year. All eyes will be on Finance Minister Nirmala Sitharaman for any announcement on taxation affecting individual taxpayers as she will be presenting the Budget 2024 on 1 February.

This year, FM Sitharaman will present an Interim Budget as the Lok Sabha elections are scheduled to be held in April-May. The full Budget is expected to be presented by the new government in July after the general elections.

There are speculations the government may introduce some additional tax waivers or exemptions under the old tax regime for low tax slabs. However, the Finance Minister has already made it clear that there will be no ‘spectacular announcement’ in the Interim Budget.

Finance Minister Nirmala Sitharaman in the Union Budget 2023-24 announced a major change in income tax regime for salaried persons.

The new income tax regime was rolled out by the government on April 1, 2020, as an optional scheme. However, it was made the default regime for personal taxation for the assessment year (AY) 2024-25. It means a taxpayer will have to select the old tax regime to claim various deductions and tax benefits.

Also, under the new tax regime, no tax is levied on taxpayers with an annual income of up to ₹7 lakh.

The two tax regimes sometimes lead to confusion among taxpayers about which scheme is more beneficial. While the new tax regime is hassle-free and offers less tax rate, the old one allows a host of tax advantages though the exemption limit remains lower.

To make it simple for you to understand, here are the key differences between the two tax regimes:

Key differences old tax regime new tax regime

Deductions

Under the new tax regime, a standard deduction of ₹50,000 is allowed on salaried income from April 1, 2023. This deduction was accessible solely under the old tax regime. With the rebate under Section 87A of the Income Tax Act, 1961, tax-free income under the new regime amounts to ₹7.5 lakh.

In addition to this, those receiving family pension can claim a deduction of ₹15,000 or one-third of the pension, whichever is lower.

The old tax regime offers no such tax rebate. It continues with the same old structure of rebate up to ₹5 lakh. Taxpayers, however, can claim a host of deductions allowed under various sections of the I-T Act. The deductions help to bring down the total tax liability.

Major deductions include ₹1.5 lakh under the 80C such as EPF contribution, house rent allowance (HRA), leave travel allowance (LTA), public provident fund (PPF) and life insurance. Besides, a taxpayer can claim deductions under Section 80TTA/80TTB on interest from savings account deposit and entertainment allowance. Interest paid on home loan for self-occupied property or vacant home, and deductions under Chapter VI-A and 80CCD (NPS) can also be claimed under the old tax regime.

Paperwork

The new tax regime is hassle-free and simple, saving one from the trail of paperwork. The collection of proofs that are required to claim various deductions allowed under the old tax regime could be a difficult task for many taxpayers.

Tax rates

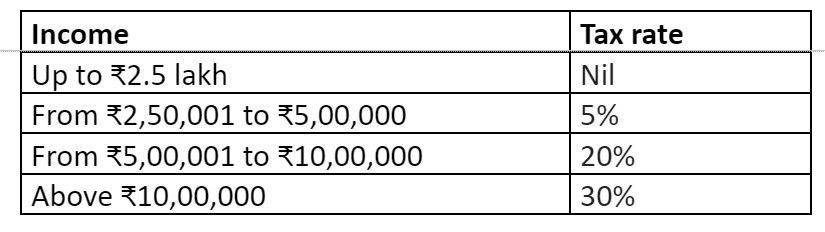

There is a difference in the number of tax slabs under the new regime and the older one. The old tax structure offers seven tax slabs with different tax rates for incremental income of ₹2.5 lakh.

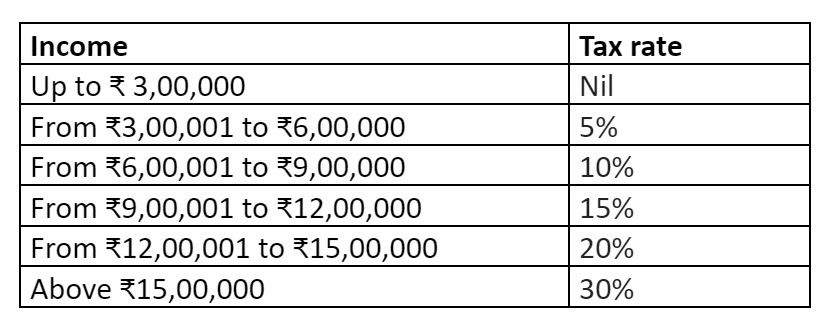

However, six tax slabs have been introduced under the new tax regime. There is no tax for income up to ₹3 lakh. Tax rate increases by 5 percentage points for every ₹3 lakh incremental income.

**Tax slabs under the new regime **

The tax slabs are applicable for taxable income of more than ₹7 lakh.

Tax slabs under old tax regime (for individuals below 60 years)

Surcharge on high income

The new tax regime offers a surcharge of 25% on income above ₹5 crore. The lower surcharge brings down the effective tax rate for high networth individuals to 39% from 42.74%.

The surcharge under the old tax regime remains at 39%.

Exemption limit

The basic tax exemption limit under the old tax regime is ₹2.5 lakh while the new regime structure starts from ₹3 lakh.

Tax rebate

A tax rebate on taxable income of up to ₹5 lakh is allowed under the old tax regime. The same under the new tax regime introduced under Section 87A is for income up to ₹7 lakh.

LTCG benefit

No long-term capital gains (LTCG) benefits are listed under the new tax regime.