Summary

Imagine stumbling upon hidden cash you didn't even know existed! With LIC's official system, policyholders can check for unclaimed funds by following a simple step-by-step approach, potentially reclaiming overlooked assets. Just remember, all payments owed to policyholders through unclaimed amounts will be electronically routed to their respective bank accounts only as per RBI-approved methods.

Ever had the feeling that you have some spare change left under your couch cushions? Well, even in the world of finance, there's a couch-cushion equivalent, and it's called unclaimed funds. And this could be your Life Insurance Corporation (LIC) money linked to your life insurance policies. Parked in some unclaimed funds’ vault, it's the unclaimed cash that is meant to go to the policyholders or their nominees.

But here's the twist: At times, these funds linger untouched, collecting dust. This is either due to your oversight in claiming the money or because the intended recipient remains unaware of it. Imagine finding out you've got a stash of cash you didn't even know about! Nobody wants to leave money lying around, right?

Unclaimed funds transparency: Insurers' regulatory responsibility

As per the regulations, every insurer must exhibit details concerning any unclaimed amount exceeding INR 1,000 on their respective websites (this obligation persists even beyond 10 years). Furthermore, insurers are required to establish a mechanism on their websites, enabling policyholders or beneficiaries to confirm the unclaimed amounts owed to them. The Insurance Regulatory and Development Authority of India (IRDAI)‘s circular spells out these processes - from how unclaimed sums are paid to how communication is handled with policyholders, all the way to accounting methods to the utilisation of investment income, and other related procedures.

And under the Senior Citizens' Welfare Fund (SCWF) Act, if policyholders have funds lying untouched for over a decade, those funds have to be shifted over to the SCWF. The rules get into the nitty-gritty of who needs to send these funds to the SCWF and even lays down the ground rules for how it's all managed. This ACT requires each and every insurer to make public any unclaimed amounts of INR 1,000 or more on their own websites. This display requirement goes on, even after a whole ten years have passed. Not just that, they've got to set up a feature that lets you check whether you're owed any unclaimed amount.

The Draft Red Herring Prospectus (DRHP) has revealed that as of September 2021, LIC held unclaimed funds totalling approximately INR 21,539 crore, which also encompasses the interest accrued on the outstanding unclaimed sum. These unclaimed funds have just been waiting for their owners to come knocking. The forgotten coins of yesteryears hiding in the nooks and crannies of your financial history must be recovered. You need to crack the code and reclaim what's rightfully yours.

Unclaimed LIC funds recovery: A simplified step-by-step approach

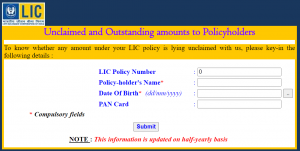

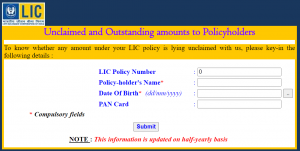

So, let's dive in and rescue your funds. LIC has established an official system on its website for policyholders to check if they possess any unclaimed or outstanding policy dues. Here’s what you need to do:

First, you need to check if you have any unclaimed LIC funds. For this:

-

Access the LIC website.

-

Scroll down to the bottom of the page.

-

Click on “Unclaimed Amounts of Policyholders” among the links at the bottom. This action will redirect you to LIC's unclaimed policy page.

-

Provide the required details:

-

LIC policy number

-

Policy-holder's name - mandatory

-

Date of birth (dd/mm/yyyy format) - mandatory

-

PAN card

5. Click on “Submit” after filling in the details. The screen will then display the details regarding any unclaimed amount associated with your policies, if applicable.

### **Once it is established that you have unclaimed funds resting with the LIC:**

6. Download the LIC app from the Google Play Store, contact the insurer's phone helpline or visit the nearest LIC office.

7. Provide the necessary policy details, upload your documents, and complete the know your customer (KYC) process.

8. Validate your identity.

9. Witness the release of your unclaimed LIC funds!

But do not forget, all payments due to policyholders as unclaimed amounts will be routed through their respective bank accounts using electronic modes approved by the RBI.

Unclaimed funds: Reclaim, invest, and secure your financial future

So, there you have it. Whether you left your money in the LIC coffers unintentionally or just did not know about it, it's time to act. With a few simple steps and a little effort, you can navigate through the process, connect with the right channels, and ensure that these funds find their way back to you - where they rightfully belong. Don't let your money sit idly, any longer. Embark on this journey of claiming your unclaimed LIC funds, and then consider the possibilities for

investment. By acting today, you can not only recover your funds but also potentially grow them into something even more substantial. Unlock the true potential of your unclaimed money and make your financial future brighter.

Disclaimer

The investment options and stocks mentioned here are not recommendations. Please go through your own due diligence and conduct thorough research before investing. Investment in the securities market is subject to market risks. Please read the Risk Disclosure documents carefully before investing. Past performance of instruments/securities does not indicate their future performance. Due to the price fluctuation risk and the market risk, there is no guarantee that your personal investment objectives will be achieved.

### **Once it is established that you have unclaimed funds resting with the LIC:**

### **Once it is established that you have unclaimed funds resting with the LIC:**