Tarsons Products IPO: All you need to know

Incorporated in 1983, Kolkata-based Tarsons Products manufactures laboratory products that are used in various research organisations, pharmaceutical companies, academia institutes, hospitals and diagnostic centres.

The company plans to go public and here’s all you need to know about this IPO.

**Offer detailsIPO Size: ₹**1,023 crore

Fresh Issue:₹150 crore Offer for sale:₹873 crore Price band:₹635-₹662 per share

Face value:₹2 per share

Fresh Issue:₹150 crore Offer for sale:₹873 crore Price band:₹635-₹662 per share

Face value:₹2 per share

IPO TimelineStart Date: 15 November 2021

End Date: 17 November 2021

Tentative Allotment Date: 23 November 2021

Tentative Refund Credit: 24 November 2021

**Tentative Share Credit in Demat:**25 November 2021

Expected Listing Date: 26 November 2021

End Date: 17 November 2021

Tentative Allotment Date: 23 November 2021

Tentative Refund Credit: 24 November 2021

**Tentative Share Credit in Demat:**25 November 2021

Expected Listing Date: 26 November 2021

Registrar Information (RTA)

Registrar Name – KFin Technologies Private Limited

Contact – Piyush Khater, Tel: +91 33 3522 0300

Email – piyush@tarsons.in

Contact – Piyush Khater, Tel: +91 33 3522 0300

Email – piyush@tarsons.in

Key Highlights

-

Tarsons Products is a labware company engaged in designing, development, manufacturing and marketing of consumables and reusables laboratory products.

-

It has five manufacturing facilities located in West Bengal and has a product portfolio of more than 300 diverse products with 1,700 stock-keeping units.

-

Its products are available pan-India through authorised distributors and some its end customers include marquee names such as Dr. Reddy’s, Syngene International, Metropolis Healthcare and Indian Institute of Chemical Technology among others.

-

The Indian laboratory equipment market (glass and plastic ware) size is about ₹2,350 crore and is expected to grow at about 8% CAGR between 2020-2025.

-

Glassware and plasticware products command equal market share currently, but it is expected that share of plasticware will rise to 75% due to benefits such as ease of handling, lower costs and shatterproof properties. Tarsons is a leading domestic company in the plasticware market.

-

Meanwhile, the global laboratory market size is about ₹1.1 lakh crore and is expected to grow at a CAGR of about 5% between 2020-2025. Tarsons derived about 33% of revenues from exports in FY21.

-

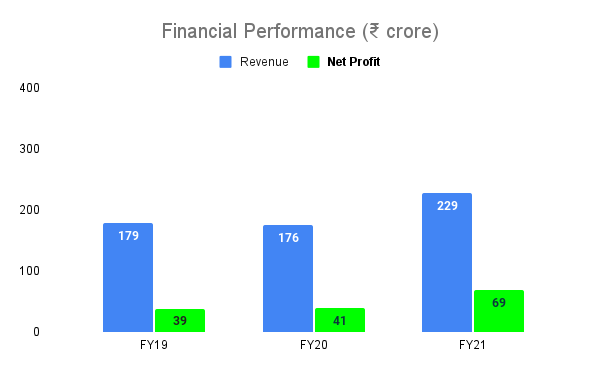

Between FY19 and FY21, Tarsons’ revenues and net profit grew at a CAGR of 13% and 33% respectively.

Financial information

Here’s the consolidated financial information for the last three years:

Strengths

-

The company has a market share of about 12% in the labware space in India, which is dominated by multinational companies such as Thermofisher, Corning, etc.

-

Serves top-league clients such as Dr. Reddy’s, Syngene International, Metropolis Healthcare and Indian Institute of Chemical Technology among others.

-

Has a strong domestic distribution network of over 141 authorized distributors as well as 45 overseas distributors as of March 31, 2021. Its top 10 distributors represented about 55% of the total revenues, indicating a reasonable diversification of sales.

-

Consistently growing revenue and profit over the past three years

Risks

-

More than 75% of raw materials are imported from UAE, USA, Singapore and Taiwan. Any disruptions in supply can majorly impact manufacturing.

-

All its manufacturing facilities are located in West Bengal. Unforeseen political, social, economic or environmental hiccups in these areas can impact the business negatively

-

Of the five manufacturing facilities, the land at Jangalpur facility (which makes up about 58% of total revenues) is yet to receive requisite approval for non-agricultural land and therefore may be subject to regulatory action and litigation.

-

It continues to face strong competition from multinational companies and fragmented local players.

Opportunities

-

As per the Frost & Sullivan Report, domestic plastic labware products’ market size is expected to grow at a CAGR of 16% and reach ₹2,575 crore by 2025.

-

The Indian government is encouraging R&D in the pharmaceutical industry and wants the country’s sector to compete with the likes of the USA and Europe

-

Tarsons is working on setting up a new manufacturing facility in West Bengal. This will boost its manufacturing capabilities and also help it launch new products

How to apply

Select the IPO you want to apply for from the list of open issues. Enter your correct UPI ID and select the investor type. The quantity should be a multiple of the lot size. If you wish to apply at the cut-off price, simply click on the checkbox next to ‘Cut-off price’. You will receive an SMS from the NPCI confirming your bid and requesting you to accept the mandate on your UPI app. We have noticed a significant delay in UPI payment SMS/notifications from NPCI. Request you to be patient. Please ignore this message if you’ve accepted the mandate.

How to check your IPO allocation

Tarsons Products allotment status will be available on or around 23 November 2021. The allotted shares will be credited to the demat account by 25 November 2021. We will provide you with the link to check the allocation’s status as soon as the registrar makes it live. This may happen after the IPO is closed (after 23 November 2021).