Ruchi Soya FPO - All you need to know

Saddled with ₹12,000 debt and heavy losses, Ruchi Soya was grappling with bankruptcy proceedings in 2017. Following this, a prolonged battle ensued between the bidders with Ramdev-owned Patanjali Ayurved emerging as a winner in 2019.

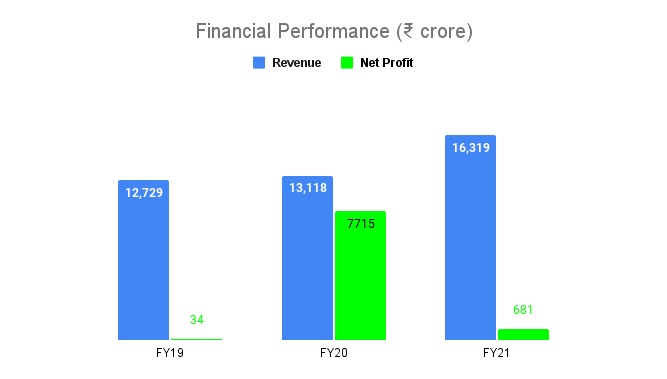

The new owners have quickly scripted a turnaround after taking over the diversified fast-moving consumer goods (FMCG) company. The company has turned profitable and its debt has been sizably reduced.

Subsequently, shares of the company, which were again listed on the exchanges in 2020, have seen strong traction. Now, Ruchi Soya is all set to launch a follow-on public offer (FPO) to further reduce debt and reportedly dilute the promoter’s stake to meet the market regulator’s norms.

Offer details

-

Start date:

-

End date:

-

Price band:

-

Minimum investment:

-

FPO size:

Timeline

-

Allotment:

-

Refund:

-

Credit of equity shares:

-

Listing:

All about the FPO

Ruchi Soya is one of the largest FMCG players in India with a strong presence in branded refined edible oil and soya food segments. The company owns and operates Ruchi Gold – the largest selling palm oil brand in India. It also sells refined oil under brand names such as Nutrela, Mahakosh, Sunrich and Ruchi Star.

It is also one of the largest manufacturers of soya foods in India and owns the popular brand Nutrela. In fact, in the palm and soya segments, the company has a presence across the value chain ‒ sourcing, supplying, manufacturing, branding and distribution. Ruchi Soya has also expanded its footprints overseas and exports value-added soya products to more than 36 countries.

In addition to edible oil and soya, it has a presence in the biscuit, cookies, rusks, noodles and breakfast cereals segments and sells them under Patanjali brand. The company also sells nutraceutical and wellness products under the joint branding of Patanjali and Nutrela.

Besides these segments, the company also has other business verticals such as oleochemicals, edible soya flour, honey and atta (flour); oil palm plantation and wind power.

Financials

Revenue: 13%; Net Profit: 197% (FY19-21 CAGR)

Strengths

-

A leader in the branded soya chunks space with a market share of 40%

-

FPO proceeds will help to reduce debt and thereby improve the balance sheet

-

Operates in segments with higher costs and longer gestation periods, which creates entry barriers

-

Has one of the largest refining capabilities (11,000 tonnes per day).

-

Product portfolios cater to a wide range of tastes, preferences, price points and consumer segments

Risks

-

Rising input costs due to the Russia-Ukraine conflict may hurt profitability

-

Significantly (around 85% in 9MFY21) depends on the sale of edible oil products for revenue

-

Requires sizable amount of working capital for operations and growth

-

Operates in highly competitive FMCG space

Good to know

India’s branded edible oil market is expected to grow at a CAGR of 6.6% between FY20 and FY25. Being a major player in the market, Ruchi Soya could benefit from consumers’ growing preference for branded oil products.

FAQsHow can you pre-apply for Ruchi Soya’s FPO?

Pre-applying for Ruchi Soya’s FPO means applying for this public issue before it goes live. However, pre-apply for Ruchi Soya’s FPO isn’t open currently.

When does pre-apply for Ruchi Soya’s FPO open and how can you pay for it?

The pre-apply for Ruchi Soya’s will begin two days before its launch date. After pre-applying, once the FPO goes live, you will receive a UPI mandate. Accept it, to block the FPO application amount and successfully place your bid.

How can you apply for Ruchi Soya’s FPO?

You can apply on Upstox’s website and app, once the FPO opens for subscription.

When does Ruchi Soya’s FPO open and close for the subscription?

Ruchi Soya’s FPO is open for subscription between 24 March 2022 and 28 March 2022.

What’s the lot size and minimum investment needed for Ruchi Soya’s FPO?

The details about the lot size haven’t been announced yet.

What is the price band for Ruchi Soya’s FPO?

The price band for Ruchi Soya’s FPO isn’t available currently.

What’s the size of Ruchi Soya’s FPO?

The size of Ruchi Soya’s FPO is ₹4,300 crore.

How many bids can I place for Ruchi Soya’s FPO?

You can place up to three bids for an application.

Can these bids be placed at different times during the FPO subscription period?

No, the bids have to be placed at one go. If you want to add an additional bid, then you would have to delete your application and re-apply.

When will Ruchi Soya shares be credited to your demat account?

The date for crediting of shares to the demat account has not been announced yet.

Which exchanges will Ruchi Soya FPO shares list on?

NSE and BSE

When will Ruchi Soya FPO shares be available for trading?

The allotment date has not been announced yet.