Medplus IPO - All you need to know

MedPlus Healthcare Services is the second largest pharmacy retailer in India, after Apollo Pharmacy. It was founded in 2006 by Gangadi Madhukar Reddy, a medical doctor and an MBA from Wharton School, who set up stores initially in Hyderabad.

The company has transformed into an omni-channel retailer. Its customers can buy medicines from its stores, website and mobile app. The company’s revenue has gone up steadily and it is a profitable company. Medplus is now all set to launch its ₹1,398 crore IPO on December 13.

Offer details

-

Start date: 13 December 2021

-

End date: 15 December 2021

-

Price band: ₹780-₹796 per share

-

Minimum investment: ₹14,328

-

IPO size: ₹1,398 crore

All about the IPO

While studying in Wharton School of Business, Dr Madhukar Gangadi, the founder and CEO of Medplus, came across a startling World Health Organisation report. This report claimed that a large amount of Indian medicines may be spurious. Spurred by this report and concerned about the ramifications this might have on the health of the Indian consumer, Madhukar opened Medplus’ first store in Hyderabad in 2006.

Since then, Medplus has managed to expand its footprints in several states in India. Today, it is the second largest pharmacy retailer in India in terms of revenue from operations in FY21.

Business highlights

-

Has an omni-channel model and sells medicines through its network of over 2,000 stores, website and mobile app.

-

Operates pharmacy retail stores in Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, Odisha, West Bengal and Maharashtra

-

Online sales now account for 9% of the total revenues.

Financials

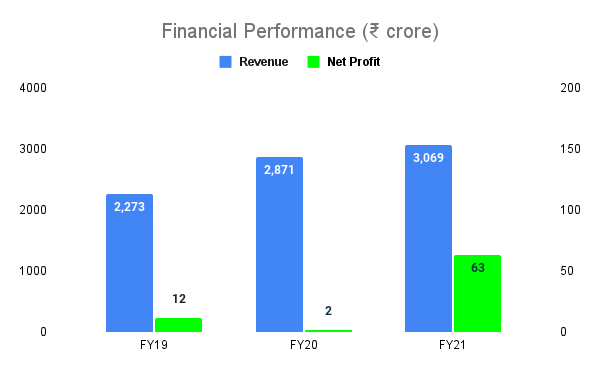

Revenue: 16.2%; Net Profit: 129.1% (FY19-21 CAGR)

Strengths

-

Well-established brand with 15 years of experience

-

With an omni-channel model, it is well equipped to compete with fast growing online pharmacies such as PharmEasy.

-

Delivers their customers’ online purchases within two hours in select cities

-

Over 75% of its new stores have achieved profitability at EBITDA level in first six months

-

Has high average revenue per store of about ₹1.6 crores, compared to industry average of around ₹23 lakhs.

Risks

-

Significant portion (75%) of the revenue comes from branded products, whose manufacturing is tightly regulated

-

Changes in prescription drug pricing and commercial terms could affect business performance

-

Failure to manage inventories and anticipate demand

Good to know

The organised retailers in India’s pharmacy and wellness space are expected to grow at a CAGR of 25% between 2020 and 2025 to $36 billion. Being the second largest and an omni-channel player, Medplus is well-positioned to take advantage of this growth. Also, the penetration of the organised pharmacy retail in India is at 11%. This leaves further room for expansion for organised players in this space.