Data Patterns: All you need to know

Founded by former ** table tennis** champion and an IIT-Madras graduate Srinivasagopalan Rangarajan, Data Patterns makes electronics for the defence and aerospace sector. It has a consistent track record of profitable growth, which is supported by a scalable business model. Its ₹580 crore order book is nearly 2.5 times its FY21 revenues. Data Patterns is all set to launch a ₹588 crore IPO and list on the exchanges soon.

Offer details

-

Start date: 14 December 2021

-

End date: 16 December 2021

-

Price band: ₹555-₹585

-

Minimum investment: ₹14,625

-

IPO size: 588 crore

All about the IPO

In 1998, India’s defence space was going through a spate of ** reforms**. Also, the government decided to pump more ** money** into the defence sector to step up the efforts to modernise it. Against this backdrop, Data Patterns was incorporated in 1998.

Since then, the company has grown multifold and contributed strongly to strengthen India’s defence. Data Patterns has built systems which have found application in various programmes and platforms including Tejas Light Combat Aircraft , the Light Utility Helicopter and BrahMos missile programme.

The company offers a wide range of strategic defence and aerospace electronics solutions, including processors, power, radio frequencies and microwave, embedded software and firmware and mechanical engineering.

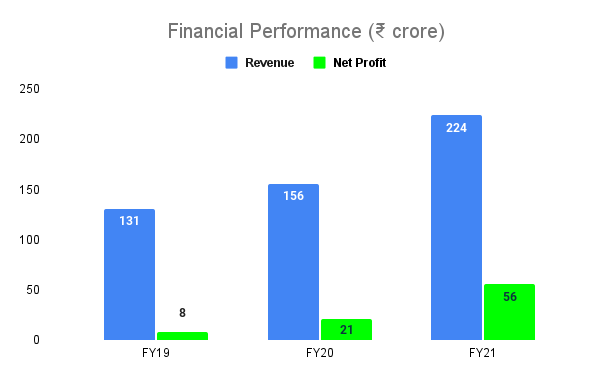

Financials

Revenue: 30.7%; Net Profit: 164% (FY19-21 CAGR)

The company has demonstrated strong financial performance over the last three years, driven by a surge in demand for defence solutions.

Strengths

-

Is among the few vertically integrated defence and aerospace electronics solutions provider

-

Offers products and solutions across the entire spectrum of defence and aerospace platforms

-

space, land, air and sea

-

Recorded the highest EBITDA margin, ROCE and ROE among key Indian defence and aerospace companies in FY21

-

Has a order book of ₹582 crore as of September 2021

-

Makes complex technology-based products, providing it a moat

Risks

-

High dependence on contracts from the government sector. In FY21, 52% of its sales came from government entities

-

Limited number of customers. Around 89% of its revenue came from five customers in FY21

-

Significant working capital requirements

-

Decline in government’s defence spends or termination of contracts could adversely hit the business

Good to know

India is one of the top five defence spenders in the world currently. Also, India’s defence electronics market is expected to grow from $1.8 billion in 2021 to $6.9 billion in 2030. This could also be beneficial for the company.