Why the Rupee is going to Appreciate Massively in the Near Future

Here's a chart of the value of the Indian Rupee (INR) against the US Dollar (USD) over the past 5 years.

- going from Rs. 45 per USD to the current rate of Rs. 66 per USD. That is a massive depreciation!

But like all trends, corrections and reversals always occur. With the case of the Rupee, it was a matter of time before there were enough reasons for a turnaround to happen. And that time, as it turns out, is right now.

Why the Rupee Will Appreciate Against the US Dollar

The Reserve Bank of India has a strong influence on the value of the Rupee. Granted, the RBI cannot "control" the value of the Rupee, unlike China's government, but it can

- and does

- utilize the tools at its disposal to keep a careful eye on the currency's value.

Over the past 5 years, the RBI was focused on getting India' economy bustling again. At the same time, the RBI had a mandate to keep inflation levels low (at 6% or lower) through January of 2016. In order to accomplish both, RBI Governor Raghuram Rajan kept interest rates high, while pushing for initiatives to push business growth in the country.

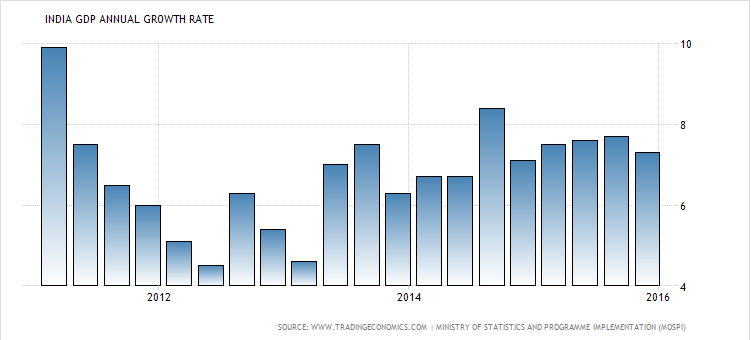

The hard work paid off. India's GDP has consistently beaten expectations and is on pace for a 8% growth year on year in the near future. Here is how India's GDP has held up over the past 5 years.

As you can see, from 2012 onward, the economy has picked up significantly. And so we have a situation where, while interest rates were relatively high, inflation has been kept low and GDP has maintained a strong upward pace.

As you can see, from 2012 onward, the economy has picked up significantly. And so we have a situation where, while interest rates were relatively high, inflation has been kept low and GDP has maintained a strong upward pace.A lot of this growth, inevitably, came as a result of the Rupee's low value against other currencies. It was in the best interest for the RBI to keep the Rupee valued low so that India's goods and services became more competitive against those of China and other export driven countries.

But now, the tide is turning. With the latest announcement of the RBI cutting rates by 25 basis points, the markets are going to surge. At some point in time, the RBI will hold off on cutting interest rates. India has already started importing more and more goods, which in due time will create inflation worries. At that time, the RBI has no choice but to keep interest rates high. This, in turn, will force the RBI to use the monetary policy tools at its disposal to keep the Rupee strong.

And so, keeping all this in mind, look for the Rupee to begin turning around very soon.