Short straddle option strategy

A short straddle is a neutral market strategy which has no directional bias. It is a net credit strategy (premium collected) and is deployed when traders believe that the underlying asset will not make a significant move higher or lower until the expiration of the contracts.

How to deploy a short straddle

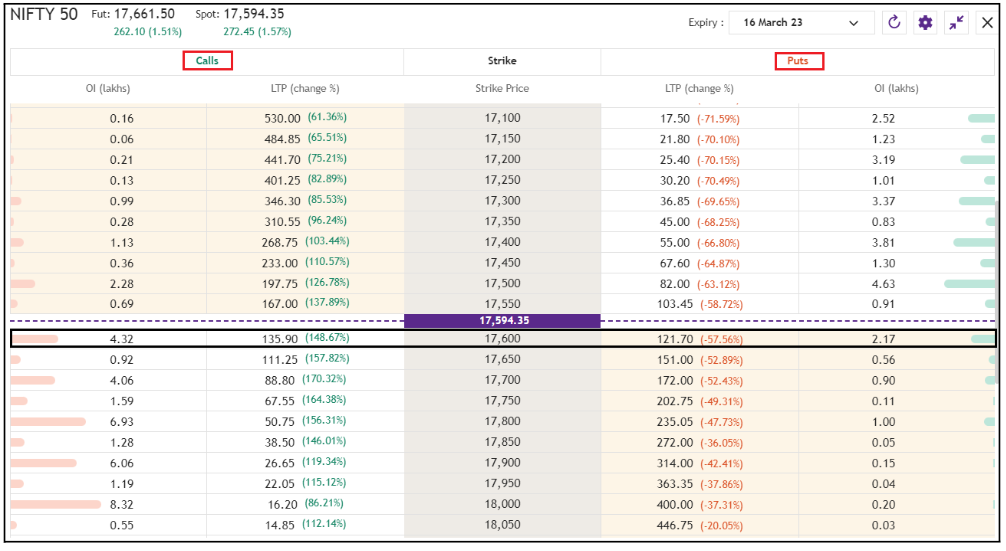

A short straddle can be initiated by selling both call and put options of the same strike price and same expiry. Let’s understand this strategy with the help of an example of the Nifty50 index.

Mr. Alok, a trader, holds a neutral to sideways view on the Nifty50 index, which is currently trading at 17,594 as of 3 March. Keeping a range bound view in mind, he sells an at-the-money call option and at-the-money put option of 17,600 strike expiring on 16th March for the premium of ₹135 and ₹121 respectively. The lot size of the Nifty50 index is 50 shares.

Break even points

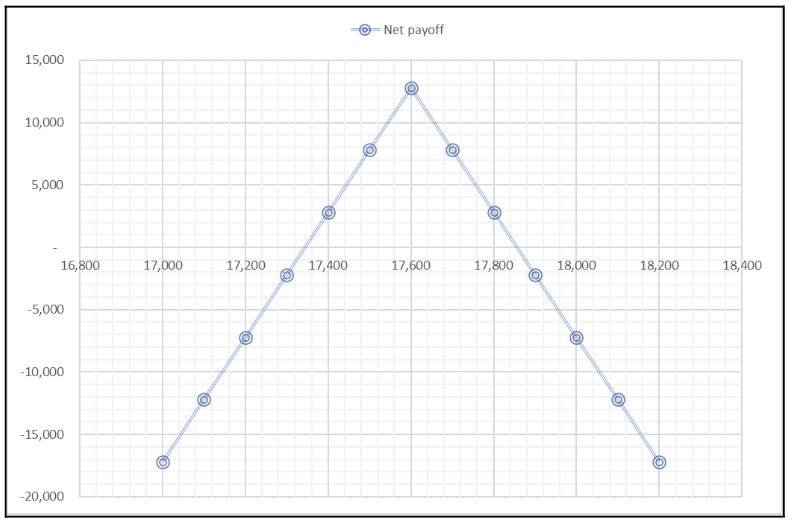

The short straddle strategy consists of two breakeven points, upper and lower. It is the combined premium of the two options above and below the strike price.

Upper breakeven: Strike price of call option + net premium received

In case of our example: 17,600+ 256= 17,856

Lower breakeven: Strike price of put option

Lower breakeven: Strike price of put option

- net premium received

In case of our example: 17,600 - 256= 17,344

Maximum Gain

The maximum gain for Mr. Alok in this strategy is limited to the amount of premium received by selling both the call and put option strikes which is ₹256 (₹135+₹121). At expiration, if the underlying settles exactly at the selected strike price, then the strategy will make maximum profit. In such a case, both the options expire worthless and the trader pockets the entire premium. It is to be noted that the lot size of an options contract for the NIFTY 50 index is 50.

The maximum gain for Mr. Alok in this strategy is limited to the amount of premium received by selling both the call and put option strikes which is ₹256 (₹135+₹121). At expiration, if the underlying settles exactly at the selected strike price, then the strategy will make maximum profit. In such a case, both the options expire worthless and the trader pockets the entire premium. It is to be noted that the lot size of an options contract for the NIFTY 50 index is 50.

17,600 CE sold for premium of ₹135

17,600 PE sold for premium of ₹121

Premium received: ₹256 (135+121)

Maximum profit: ₹12,800 (256*50)

17,600 PE sold for premium of ₹121

Premium received: ₹256 (135+121)

Maximum profit: ₹12,800 (256*50)

However, if the underlying fails to close exactly at the selected strike price, the trader will still make some profit. The strategy will remain in profit till the difference between the price of the underlying and strike price is less than the premium received. Simply put, the strategy will be in profit if the underlying settles between the break even points of the strategy.

Maximum loss

The maximum loss for Mr. Alok in this strategy is undefined. Meaning, the risk is undefined beyond the credit received by selling both call and put option strikes. As shown in the image above, if the Nifty50 index breaches the lower or upper breakeven point of the strategy the losses can be significant.

The maximum loss for Mr. Alok in this strategy is undefined. Meaning, the risk is undefined beyond the credit received by selling both call and put option strikes. As shown in the image above, if the Nifty50 index breaches the lower or upper breakeven point of the strategy the losses can be significant.

Deploying a short straddleWhat works in favourProfits from range bound movement

As mentioned above, the strategy gives traders an opportunity to earn income even if the stock or index doesn’t make a significant movement and remains in a defined range with low volatility.

Time decay

After deploying a short straddle strategy, traders receive the net premium (credit). So, every day as contracts near expiry, the net premium received keeps shrinking as far as the underlying stays in a defined range, which means that the time decay works in favour of the strategy.

Fall in implied volatility

The strategy benefits from a decline in implied volatility. The strategy is initiated when the implied volatility is higher and is expected to fall closer to the expiry.

As mentioned above, the strategy gives traders an opportunity to earn income even if the stock or index doesn’t make a significant movement and remains in a defined range with low volatility.

Time decay

After deploying a short straddle strategy, traders receive the net premium (credit). So, every day as contracts near expiry, the net premium received keeps shrinking as far as the underlying stays in a defined range, which means that the time decay works in favour of the strategy.

Fall in implied volatility

The strategy benefits from a decline in implied volatility. The strategy is initiated when the implied volatility is higher and is expected to fall closer to the expiry.

What works against

A sharp movement in the underlying

After deploying the Short Straddle strategy, if the underlying makes a sharp move on either side and goes beyond the break even points, then the strategy will make a loss. Knowing this, it is advisable to deploy the strategy when you believe the underlying will remain in a narrow range till the expiry of the contract.

Higher cost to deploy the strategy

Since Short Straddle involves selling both the option contracts, the execution cost of the trade is slightly higher than the spread or single-leg strategies.

Complex than the spread strategies

As a beginner in options, short straddle is a complex strategy that requires full-time monitoring of the underlying. Before initiating a Short Straddle, a trader should fully understand the role of the option strikes involved. If the timing and the view about the underlying is incorrect, then the strategy can make an undefined loss.

Higher cost to deploy the strategy

Since Short Straddle involves selling both the option contracts, the execution cost of the trade is slightly higher than the spread or single-leg strategies.

Complex than the spread strategies

As a beginner in options, short straddle is a complex strategy that requires full-time monitoring of the underlying. Before initiating a Short Straddle, a trader should fully understand the role of the option strikes involved. If the timing and the view about the underlying is incorrect, then the strategy can make an undefined loss.

In a nutshell, the Short Straddle can be an extremely useful options strategy if utilised well as per the behaviour and movement of the underlying.

Want a pre-curated Short Straddle strategy and decode the matrix behind it? Upstox has got you covered. Upstox has introduced Ready-made Option Strategies, a safer way to trade in NIFTY 50 and BANK NIFTY options. Click here to know more.