Commodities 101: Introduction to Commodities

Introduction to commodities

Due to the recent downturn in the global economy, it has resulted in lower sentiments for investors, especially in the emerging markets, which has left investors wondering whether investing in equities is a good decision or not. Investors have started exploring other investment opportunities apart from traditional investments. This article gives the user a basic introduction to commodities, one of the other alternatives in the hands of investors.

A commodity can be a metal, agricultural product and can also be natural resources. Investments in commodities do not need to take physical delivery; you can trade the same in commodity future exchanges. This blog will give you a basic introduction to commodities.

What Are Commodities?

Commodities are physical products. Trading in physical commodities is primarily limited to a smaller group of entities. Most investors invest in commodities using commodity derivatives. The prices of commodity derivatives are to a significant extent a function of the underlying commodity prices.

Many trade commodities for hedging purposes. Other investors, sometimes referred to as speculators, trade commodity derivatives in search for profits based largely on changes or expected changes in the prices of underlying commodities.

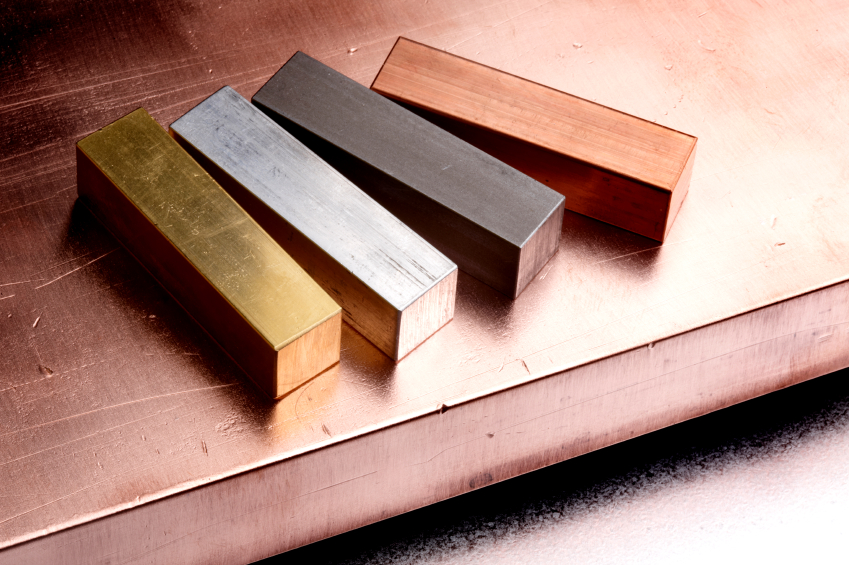

Commodities include precious and base metals, energy products, and agricultural products. The increasing industrialization of India, China and other emerging markets has driven a strong demand for commodities globally. Developing markets are requiring an increasing amount of oil, steel, and other materials to support manufacturing and industrial development.

Commodity derivatives may be attractive to investors not only for potential profits but also because of the perception that commodities are an effective hedge against inflation and that commodities are effective for portfolio diversification.

Commodity Prices And Investments

Commodity spot prices are a function of supply and demand, cost of production and storage, value to users, and global economic condition. Demand for commodities is determined by the needs of end users and the action of non-hedging investors.

The process of arriving at a figure at which a person buys and another sells a future contract for a specific expiration date is called price discovery. The prices are freely and competitively derived. Future prices are therefore considered to be superior to the administered prices.

When studying Futures contracts, it is essential to distinguish between investment assets and consumption assets. An investment asset is an asset that is held for investment purposes by most investors. ** Stocks** and ** bonds** are examples of investment assets. Gold and silver are also examples of investment assets. However, investment assets do not always have to be held exclusively for investment. For example, silver is widely used for industrial purposes. A consumption asset is an asset that is held primarily for consumption. It is not usually held for investment. Examples of consumption assets are commodities such as oil and copper.

Categories of Commodities

-

Metals (gold, silver, copper etc.)

-

Energy (crude oil, natural gas, etc.)

-

Agricultural (coffee, cotton and sugar, etc.)

Uses of Commodity Futures

Properly developed commodity markets give an opportunity for all three kinds of participants: hedgers, speculators and arbitragers.

-

Hedging

-

Many participants in the commodity future market are hedgers. They use the future market to reduce a particular risk that they face.

-

Speculation – means anticipating future price movement to make profits from it. The main objective of speculation in a commodity futures market is to take risk and profit from the anticipated price changes in future price of an asset.

-

Arbitrage – If the price of the same asset is different in two markets, there will be operators who will buy in the market where the asset sells at a discount and sell in the market where it is more expensive.

Commodity investments improve your portfolio diversification. The improvement comes not just from returns but also from reducing the risk of losing money during stressful market environments, such as inflation at its peak. Beyond the potential for higher returns and lower volatility benefits to an investor, the commodity as an asset class may offer inflation protection. Commodities provide diversification benefit because commodities return tends not to be highly positively correlated with securities returns.