The Axis Global Innovation fund of fund (FoF) aims to provide exposure to companies attempting to disrupt sectors such as fintech, e-commerce, healthcare and automation. We bring you what the fund is all about.

| Good to know

What is a fund of fund (FoF)? An FoF is an instrument that invests in other mutual funds, exchange-traded funds, or another diversified portfolio. The aim of a FOF is to provide exposure to a broad set of asset classes while minimising risks. |

Investment objective

The scheme aims to generate long term capital appreciation by investing in units of Schroder International Selection Fund (ISF) Global Disruption. This is an equity fund that invests in global companies which benefit from disruption in sectors like ed-tech, cloud computing, autonomous vehicles and health-tech.

Schroders is a UK-based investment management company with over £574.4billion (~₹59 lakh crore) in assets under management. Through its ISF fund, it will allocate capital to companies in the IT, communications, consumer discretionary and healthcare sectors. Over 60% of the companies are from North America, while other regions include emerging markets, Europe and Japan. Some of the companies that the fund invests in include Alphabet, Microsoft, Amazon, Apple, and Blackrock.

The fund currently has assets under management worth $343 million (~₹2,515 crore). Started in December 2018, the fund has returned a CAGR of 33.4% since inception.

Click here to invest in the NFO

Asset allocation

| Instrument | Allocation (% of total assets) | Risk profile | |

| Minimum | Maximum | ||

| Units/shares of Schroder International Selection Fund Global Disruption | 95 | 100 | Medium to High |

| Debt, Money market instruments and/or units of liquid schemes* | 0 | 5 | Low to Medium |

Scheme details

| Name | Axis Global Innovation Fund of Fund |

| Type | An open-ended fund of fund scheme investing in Schroder International Selection Fund Global Disruption) |

| Category | Fund of fund |

| Benchmark | MSCI AC World (Net TR)^ |

| Plans | Direct and Regular |

| Options | Growth and Dividend |

| Entry/exit load |

|

| Fund Manager |

|

| Minimum application amount | ₹5000 and in multiples of ₹1 thereafter. |

| Additional Purchase | ₹100 and in multiples of ₹1 thereafter. |

| Expense ratio | Up to 2.25%Asset allocation |

^The MSCI ACWI Index comprises large- and mid-cap stocks across 23 developed and 27 emerging markets. As of November 2020, it covers more than 3,000 constituents across 11 sectors. To know more, click here.

Taxation for the FoF

| Resident Investors | Non-Resident Investors | |

| Capital Gains: Long Term Capital Gains (Held for a period of more than 36 Months) | 20% with indexation | 10% (Indexation benefit not available) |

| Short Term | 30%* | 30% (40% in case of Foreign companies)* |

| Dividend | Taxed in the hands of unitholders at applicable rate under the provisions of the Income-tax Act, 1961 (Act) | Taxed in the hands of unitholders at the rate of 20% u/s 115A of the Act (plus applicable surcharge and cess) |

*Assuming the investor falls into highest tax bracket

Click here to invest in the NFO

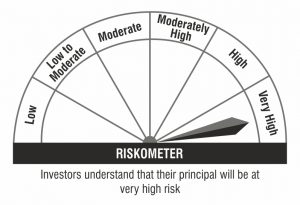

| This product is suitable for investors who are seeking**: | Riskometer |

|

|

**Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Note: The above information has been sourced from the Scheme Information Document provided by Axis Asset Management. To read the entire document, click here.

Disclaimer: The above article is purely academic in nature and aims to provide knowledge about basic trading concepts & should not be construed as an opinion or advice to invest or trade. RKSV Securities India Private Limited (brand name Upstox) is the distributor of the mutual fund. Mutual fund investments are subject to market risks; please read all the related documents and/or consult your investment advisor before investing. Past performance of an investment asset does not guarantee future returns.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.