Anand Rathi Wealth IPO — All you need to know

Anand Rathi Wealth provides wealth solutions and is one of the top three mutual fund distributors in India in the non-bank category.

Offer Details

-

Start Date: 2 December 2021

-

End Date: 6 December 2021

-

Price band: ₹530

-

₹550 per share

-

Minimum investment: ₹14,850

-

IPO size: ₹659 crore

Business highlights

-

Its private wealth (PW) arm caters to over 6,500 families in the high-networth (HNI) segment, which is supposedly under-served and less price sensitive.

-

It’s assets under management (AUM) have grown at over 20% in the last three years and currently stand at over ₹29,000 crore

-

Under its other two verticals

-

Digital Wealth (DW) and Omni Financial Advisors (OFA)

-

digitally serves large mass affluent investors and independent financial advisors, respectively.

-

It has presence in 11 major Indian cities and serves its clients through more than 230 relationship managers.

Financial Information

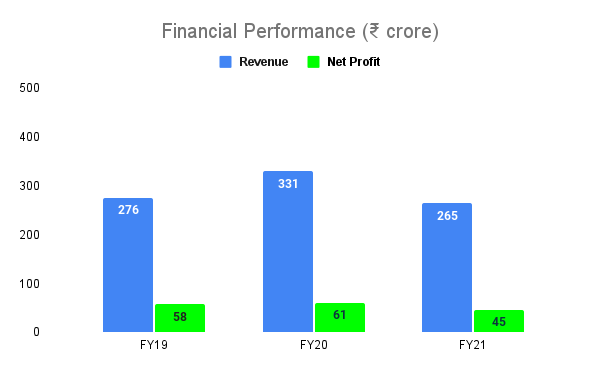

It’s financial performance in fiscal ‘21 dipped due to the pandemic-related disruption. However, the profit bounced back in fiscal ‘22. In the first five months of FY22, the net profit stood at ₹51 crore supported by lower expenses.

Strengths

-

A well-known brand in the wealth management and financial services space

-

Presence across the customer value chain

-

Ultra-HNI, HNI and mass affluent

-

Has a sticky customer-base with about 55% of its clients being associated with it for over three years

-

Deploys in-house research and analytical tools for allocating assets and selecting securities based on client’s profile

Risks

-

The fall in mutual fund total expense ratio and the increasing popularity of direct plans could impact its mutual fund distribution business

-

The volatility or fall in the markets could impact demand for its services

-

The wealth management industry is highly competitive

-

Wealth management and mutual fund industries are tightly regulated. This means the company faces the risks of non-compliance

Opportunities

-

India’s AUM-to-GDP ratio in 2020 stood at 16% vs the global average of 63%

-

India’s low mutual fund penetration leaves room for growth

-

India’s pool of millionaires is expected to grow at a rate of 13% till fiscal 2025

-

Rising preference for financial assets versus physical assets augurs well for financial services providers