Strike Prices

Introduction to Strike Prices

Multiple strike prices are one of the features that make options a unique asset class. This is what enables you to use options for speculation, hedging, and as an extra income stream. But before we get there, let’s first understand the concept of strike prices.

What is a strike price?

Let’s say the Nifty50’s current price is 21997. You, a buyer, expect the index to rise from here. You want to benefit from the up-move by trading in index options. The market offers a wide choice of prices at which you can buy index options. That means you can strike a deal in the Nifty near 21997 or a price above or below it. Pretty unique, isn’t it? In equity or in futures, you don’t get such a choice.

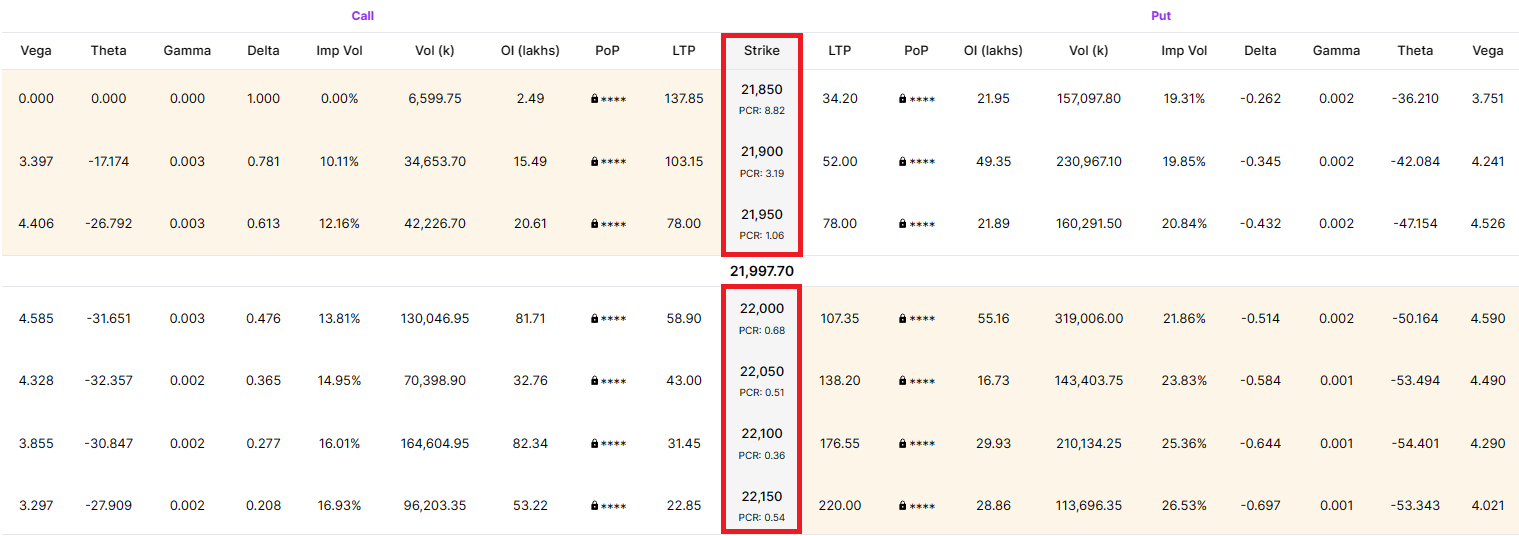

Your choices will probably look like the following table. Look at the column in the center highlighted in red.

Illustration 1: Nifty50 strike prices

Source: Upstox Option Chain for Nifty

Source: Upstox Option Chain for NiftyAccording to the chart in our example, you can buy Nifty at 22000 (nearest its current price), or at 21900, or even at 22100, or at any other available price. (For the sake of understanding strike prices, we will only discuss buying call options here).

Each of these predetermined prices provided by the stock exchange is called the strike price. It is the price at which the buyer agrees to buy and the seller agrees to sell. The strike price is also called the exercise price.

Why are so many strike prices provided?

Options have multiple uses. You can use options for speculation, hedging, or in combination with a stock in your portfolio to earn extra income. You can choose from various strike prices based on your view of the underlying stock or index. This would depend on factors like:

- The direction of movement (up, down, sideways)

- Size of the movement

- The expiry date of the contract

- The entry price of the portfolio stock to be hedged

But as we already saw, the strike price is not the price you pay to buy an option. Then why is it so significant? Let's take a look.

The strike price-option value link

The value of an option equals the difference between the strike price and the underlying stock or index. This difference helps you gauge whether an option is ‘in-the-money,’ ‘at-the-money,’ or ‘out-of-the-money.’ If the underlying stock or index price is above the strike price (for a call option), then the option has ‘intrinsic value.’ This difference is the ‘intrinsic value’ of the option. If the option were to expire today, the intrinsic value is what the option contract would be worth.

If the underlying stock or index price is below the strike price (for a call option), the option has no intrinsic value. An option will not have a negative intrinsic value; the lowest amount of intrinsic value is 0. If an option has intrinsic value, it is ‘in-the-money.’ If it doesn’t, it is ‘out-of-the-money.’ We will discuss these concepts of ‘moneyness’ in the next lesson.

Let’s assume that the Nifty is trading at an even 22000. Thus, the value of a call option with a strike price of 22200 should be at least ₹200, given that the current price is 22000.

Key Formula:

- Current price - Strike price = Intrinsic value of call option

22200 - 22000 = 200

21000 - 22000 = 0

Since value cannot be less than 0.

Do note that intrinsic value is not the option price or option premium. Option price also includes a time value component. We will discuss time value and option prices in an upcoming chapter.

Are all strike prices available at the same intervals?

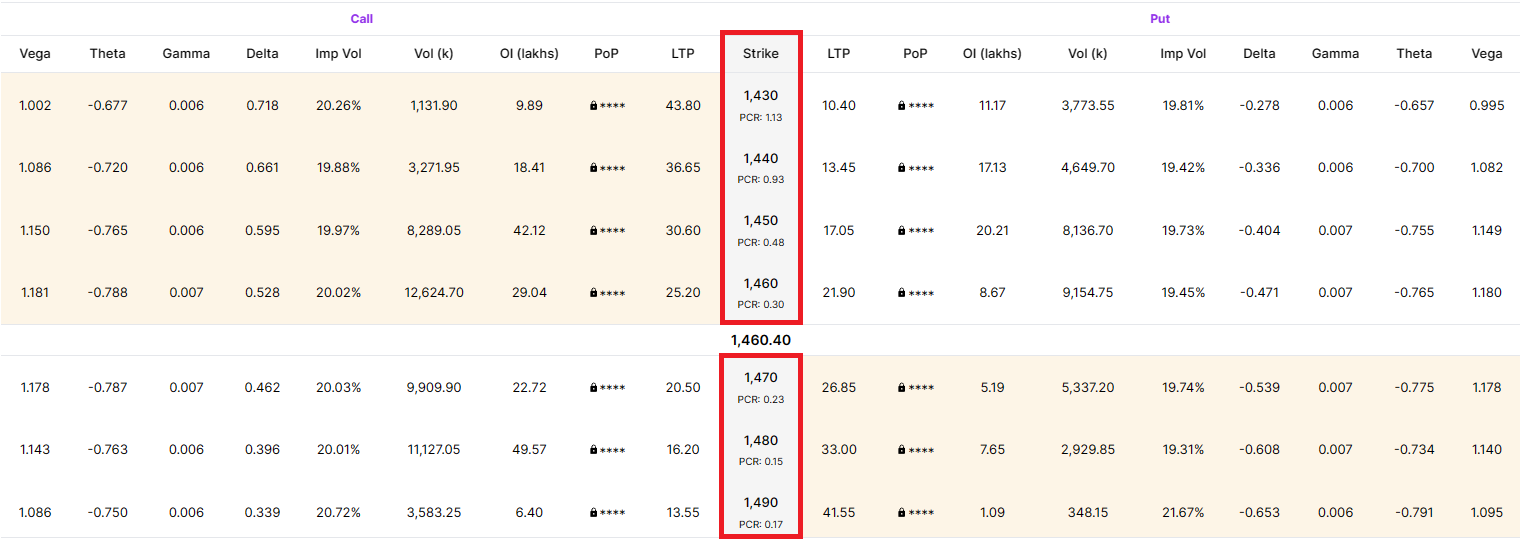

If you notice in Illustration 1, Nifty strike prices are available at an interval of 50 points, such as 21900, 21950, 22000, 22050, and so on. Similarly, strike prices for HDFC Bank are available at an interval of 10 points.

Illustration 2: HDFC Bank strike prices

The stock exchange determines the strike prices and strike intervals from time to time. The basic rule is: the higher the price level, the higher the interval.

In the case of the Nifty 50 index, the exchange provides 30 ‘in-the-money,’ 1 ‘at-the-money,’ and 30 ‘out-of-the-money’ (30-1-30) strike prices with a strike interval of 50 points.

For Bank Nifty, the exchange provides 40 ‘in-the-money,’ 1 ‘at-the-money,’ and 40 ‘out-of-the-money’ (40-1-40) strike prices at an interval of 100 points. For individual stock options, the strike scheme is based on the volatility of the underlying stock.

When you trade options and move from one strike price to the next, the price of the options changes, and so does the probability of profit.

Liquidity

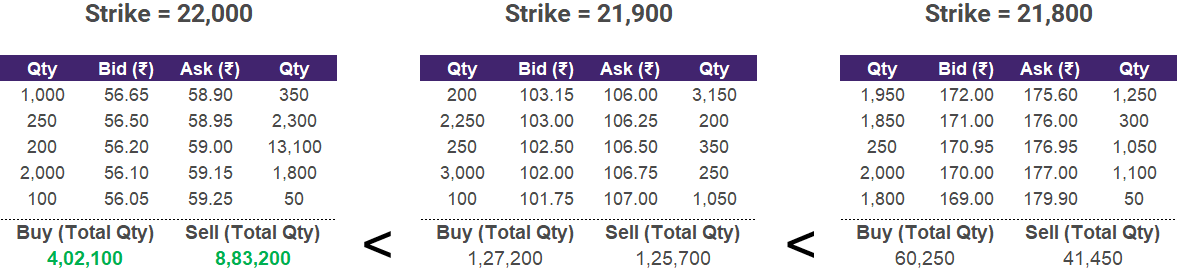

Usually, strikes closer to the current price are more liquid (i.e., have more buyers and sellers), while those far from the current price are less liquid. Let’s look at the available liquidity at three different strike prices when Nifty was at 21997.

Illustration 3: Higher liquidity at strikes near the current price

Source: NSE

Source: NSEFurther, strikes at round numbers usually have higher activity and are relatively more liquid than the ones in between. In Illustration 4, the round strike price of 22100 has more liquidity than the uneven strikes of 22050 and 22150. Higher liquidity makes it easier and quicker to buy and sell contracts at the best possible prices.

Illustration 4: Higher liquidity at round numbers

Source: NSE

Source: NSEHope that clears up strike prices for you. In the next chapter, we will tackle a closely linked topic—Moneyness.

Summary

- The strike price is the price at which the buyer and seller agree to buy or sell an option.

- Strike price is not what you would pay to buy an option. It helps determine the price or premium of the option.

- The stock exchange determines the strike prices and strike intervals. It provides multiple strike prices, which are presented in the form of an option chain.

- Strike prices closer to the current price are more liquid.

- Strike price is essential to determine the break-even point.

Is this chapter helpful?

- Home/

- Strike Prices

Source:

Source: