Market News

Week ahead: Inflation data, Q3 earnings among key market triggers as NIFTY50 nears 23,000 support level

.png)

6 min read | Updated on January 12, 2025, 12:02 IST

SUMMARY

The market trend in the upcoming week is likely to be shaped by third-quarter earnings, inflation data from the U.S. and India, and rising crude oil prices. Traders should closely monitor the index's price action around the critical support zone 23,000. A decisive close below this level could signal further weakness in the market.

NIFTY50 traders should keep a close watch on critical support zone of 23,000–23,200 level.

Markets snapped their two-week winning streak, ending the previous week on a negative note. The NIFTY50 index formed a bearish engulfing candle on the weekly chart, declining over 2%. The sharp drop was fueled by a strengthening U.S. dollar, rising bond yields, and sustained selling pressure from foreign investors.

The broader market suffered even steeper losses, marking its worst performance since October 2024. The NIFTY Midcap 100 index fell over 5%, while the Smallcap 100 index plunged more than 7%, reflecting heightened selling pressure in mid and small-cap stocks.

The sectoral performance further underscored the market's weakness. IT (+2.0%) was the lone gainer, while all other major indices ended in the red. PSU Banks (-8.0%) and Real Estate (-7.8%) were the worst-hit sectors, dragging down the overall market sentiment.

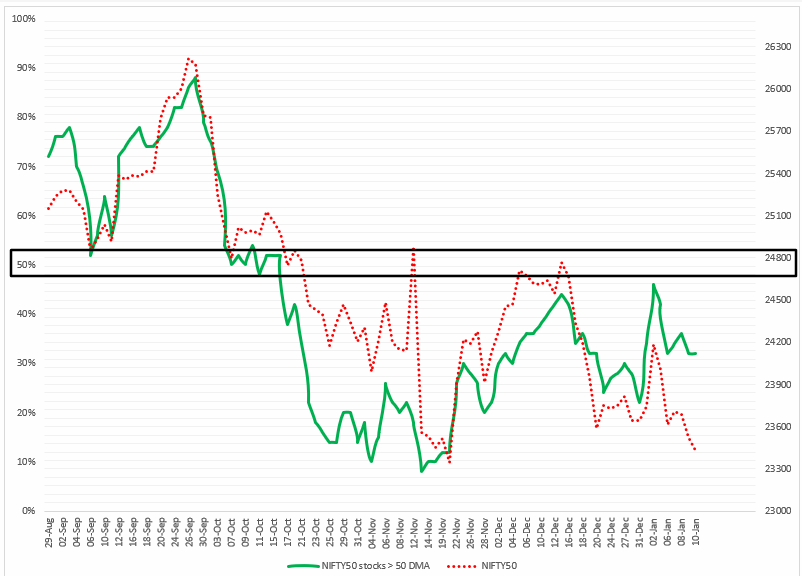

Index breadth

The breadth indicator, which measures the percentage of NIFTY50 stocks trading above their 50-day moving average (DMA), remained weak at around 30%. This means nearly 70% of the NIFTY50 stocks are trading below their respective 50 DMAs, signalling weakness.

As mentioned in last week’s blog, the trend is likely to stay weak unless the breadth indicator crosses the critical 50% mark.

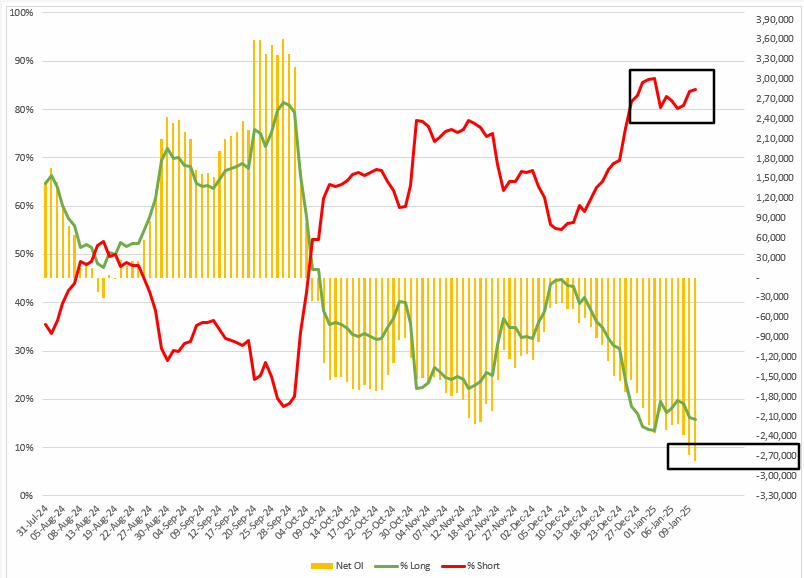

FIIs positioning in the index

Foreign Institutional Investors (FIIs) maintained their bearish stance in index futures last week, with a significant 82% of their positions on the short side, keeping the long-to-short ratio at 18:82. This reflects continued negative sentiment, as the net open interest in index futures increased by over 25% week-on-week to -2.7 lakh contracts.

As of January 10, the long-to-short ratio has worsened further to 16:84, a level last seen in May 2024. Traders tracking this ratio should also remain vigilant for potential short-covering rallies, which could trigger sharp moves in the market.

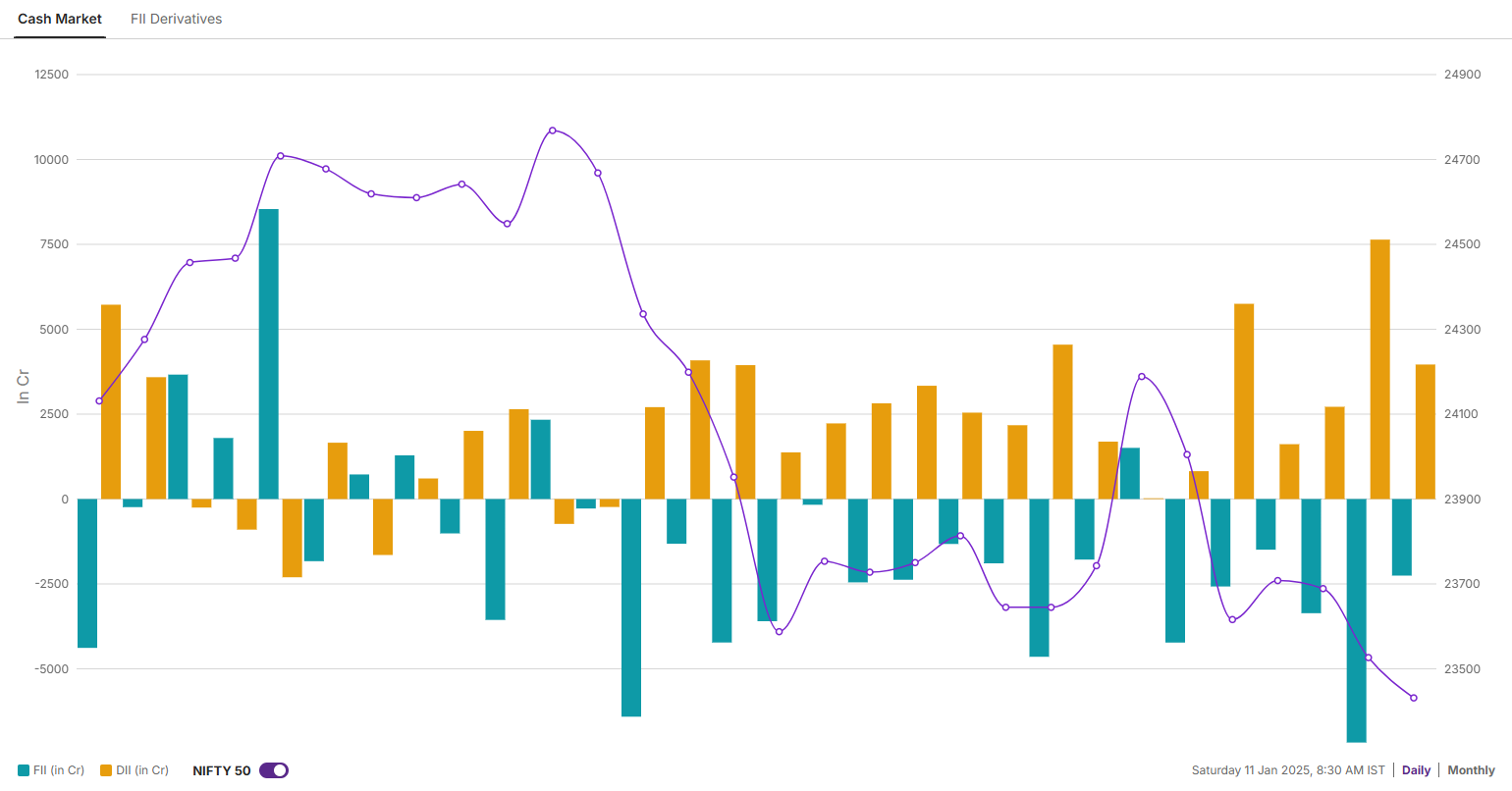

In the cash market last week, Foreign Institutional Investors (FIIs) were net sellers, offloading shares worth ₹16,854 crore. In contrast, Domestic Institutional Investors (DIIs) emerged as net buyers, acquiring shares worth ₹21,682 crore.

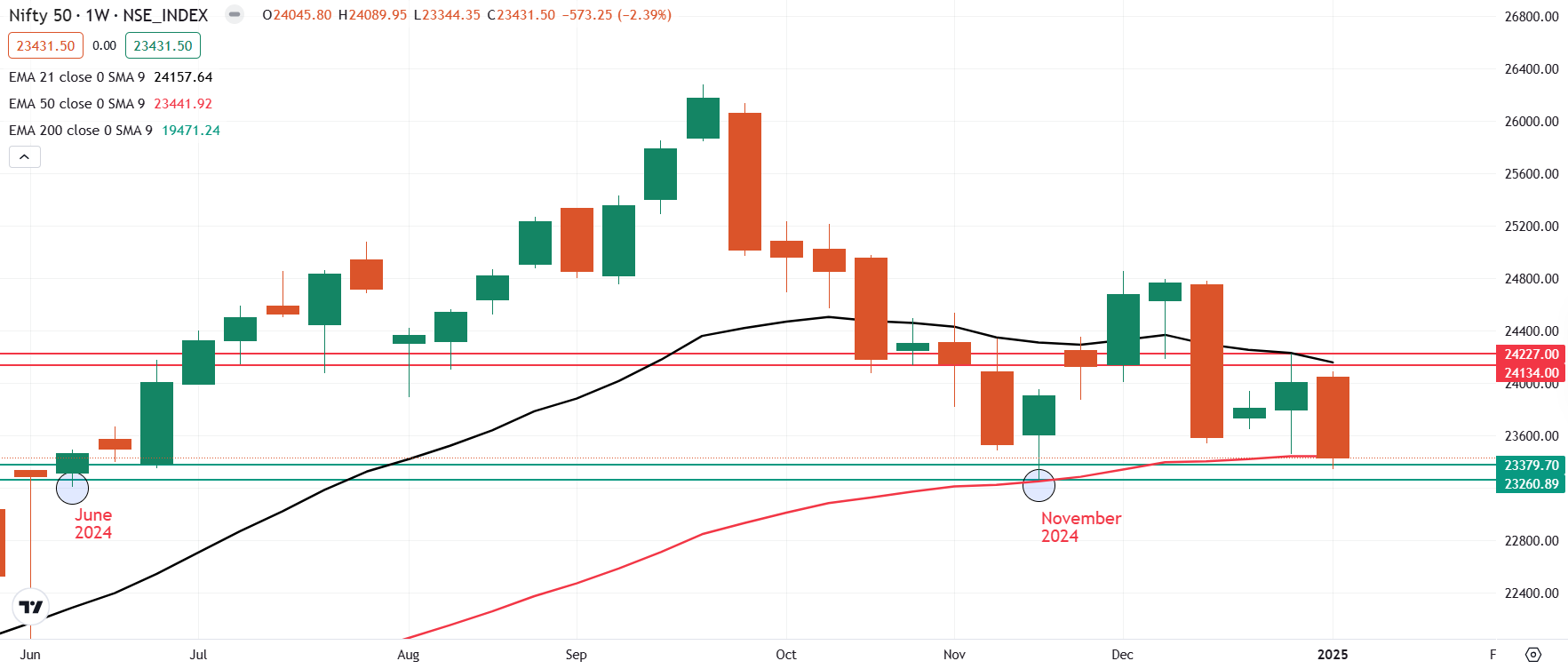

NIFTY50 outlook

The NIFTY50 index broke out of a two-week consolidation, ending the week below the previous week's low and forming a bearish engulfing candle on the weekly chart. Additionally, the index slipped below its 50-week exponential moving average, signaling increased weakness.

Traders should keep a close watch on the critical support zone of 23,000–23,200, which aligns with the swing lows of November 2024 and June 2024, the month of general elections. A daily close below this zone could extend the decline toward 22,500. Conversely, a rebound from this support and a close above 23,800 would shift the trend in favor of the bulls.

SENSEX outlook

The SENSEX also snapped its two-week winning streak and ended the week below the previous week’s low, signalling weakness. The index formed a bearish candle on the weekly chart but protected the 50 weekly exponential moving average (EMA) on a closing basis.

For the upcoming session, traders can monitor the crucial support zone of ₹77,000. This zone also coincides with the swing lows of November 2024 and June 2024, the month of general elections. A close below this zone on the daily chart will signal weakness. Conversely, a rebound and a close above ₹78,000 will signal a change in the trend.

Domestically, India will release its retail and wholesale inflation data on January 13 and 14, respectively. Retail inflation for December is projected to ease further to 5.2% year-over-year, down from 5.4% in November, reflecting moderating price pressures.

On the domestic front, several key companies are scheduled to announce their third-quarter earnings for FY 24-25. These include HCL Technologies, HDFC AMC, Oracle Financial Services, Infosys, Axis Bank, Reliance Industries, Tech Mahindra, Wipro, and SBI Life Insurance.

The rise in crude prices follows elevated levels in December, driven by colder-than-expected weather conditions. For the week, Brent Crude rose 4%, closing at $79, while West Texas Intermediate (WTI) gained 3%, ending at $76.

Investors and traders should closely watch the index's price action around the 23,000–23,200 zone, a critical support level that aligns with the June 2024 lows, coinciding with the general election period. A close below this zone on the daily chart will signal further weakness. However, if the index protects this zone on a closing basis, it may extend the rebound up to the 23,800 zone.

For intraday range updates and revisions to these levels, visit our daily morning trade setup blog, published at 8 AM before the market opens.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story