Market News

These 6 IPOs raised over ₹10,000 crore each; here’s how they performed on the listing day

.png)

5 min read | Updated on February 16, 2026, 16:45 IST

SUMMARY

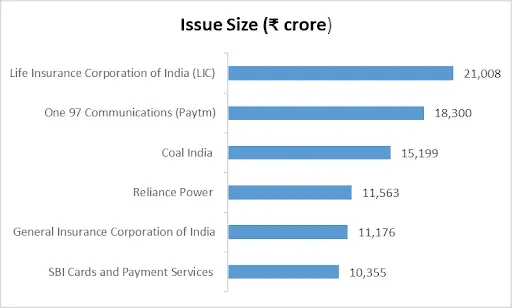

In this article, we dig deep into India’s largest IPOs, each raising over ₹10,000 crore. Leading the pack is LIC with the ₹21,000 crore IPO, the largest ever. With companies such as Hyundai planning to come up with the country’s largest issue size, here's a look at India’s 6 largest IPO performance.

Six largest IPOs of India: These IPOs raised fund over ₹10,000 crore each; here’s how they performed on the listing day

An Initial Public Offering (IPO) issue size indicates the scale of the IPO and the number of shares a company plans to offer to the public. While large IPOs typically attract retail investors, high liquidity can often result in subdued listing gains. Many previous large-sized IPOs have shown muted growth and failed to provide returns post-listing. Today, investors are increasingly focusing on companies with smaller market capitalisations, believing they offer greater potential for growth and higher returns.

Out of the 6 largest IPOs of India, except Coal India, all delivered a negative return on listing day.

A glance at India’s 6 largest IPOs which raised over ₹10,000 crore.

The below table represents the list of the 6 biggest IPOs in India based on their issue size.

| Issue Name | Issue Size (₹ crore) | Listing Day Gain / Loss (%) | YTD Return (%) | Return Since Listing (%) |

|---|---|---|---|---|

| Life Insurance Corporation of India (LIC) | 21,008 | (-)7.75% | 14.07% | 11.90% |

| One 97 Communications (Paytm) | 18,300 | (-)27.25% | 13.84% | (-)52.90% |

| Coal India | 15,199 | 39.73% | 32.60% | 47.87% |

| Reliance Power | 11,569 | (-)17.22% | 123.97% | (-)76.95%* |

| General Insurance Corporation of India | 11,176 | (-)4.56% | 24.03% | (-)11.10%* |

| SBI Cards and Payment Services | 10,355 | (-)9.51% | (-)1.43% | 10.57% |

(Source - Chittorgarh.com, * returns adjusted for bonus shares)

Life Insurance Corporation of India Ltd (LIC)

The company came up with an initial public offer of ₹21,008 crore in 2022, making it India’s largest issue to date, with an offer price of ₹904, The shares were listed on May 17, 2022, at a discount to the offer price at ₹ 875. IPO issued 2.95 times subscription, amounting to ₹62,006 crore.

One 97 Communications Ltd (Paytm)

The company launched its IPO worth ₹18,300 crore with an offer price of ₹2,150. The shares were listed on November 18, 2021, at a discount to the offer price of ₹1,564. The IPO received 1.89 times the subscription amounting to ₹34,568 crore.

Coal India Ltd

Coal India launched its IPO back in 2010 with issue size amounting to ₹15,199 crore. However, the IPO remained successful with over 15.28 times subscription. Further, its shares were listed on November 4, 2010, at ₹342 delivering a massive gain of 39.73% on listing against its issue price of ₹245.

Reliance Power Ltd

Reliance Power came up with its ₹ 11,563 crore IPO back in 2008 at an offer price of ₹450. The IPO received a massive response with 73.04 times subscription, but the shares were listed on February 2, 2008, at a discount to the issue price at ₹372.

General Insurance Corporation of India Ltd

The company went public with an IPO Issue of ₹11,175 crore, which is a decent 1.38 times subscription. The offer price of the issue was ₹912 and was listed at a discount of 11.10% at ₹870 on October 25, 2017.

SBI Cards & Payment Services Ltd

SBI Cards IPO with an issue size of ₹10,354 crore came in March 2020, receiving large interest with 26.54 times subscription. However, the Covid-19 pandemic ruined the momentum for IPO with shares getting listed at a discounted price of ₹ 683 against an issue price of ₹755 on March 16, 2020.

The IPO’s performance is not related to the company's issue size, subscription or industry, which is evident from LIC, the largest insurance company, having a modest listing gain. Reliance Power received 73 times subscriptions but it still got listed at a discount over the issue price.

Further market sentiment and economic conditions also play a significant role in successful IPO. The fear of economic disruption due to COVID-19 affected SBI Cards IPO, with share listing at a discount.

The larger issue size of IPO does create buzz around the market. However, companies with strong fundamentals and the ability to deliver value to shareholders over time create wealth for investors in the long run.

About The Author

Next Story