Position sizing techniques to up your trading game

A good trader is also a good risk manager. And position sizing is the bedrock of good risk management

What is position sizing?

It refers to the technique of determining the size of your trade. The size of a trade could be in terms of

the amount of capital to be used in one trade or the quantity i.e. the number of shares to buy or sell in a trade.

As a trader, have you come across a situation where you have suffered a significant loss in one trade? Or, regretted trading in a small quantity in a high-performing trade? In both cases, position sizing could have helped by:

- Preventing big losses

- Optimising profit potential

Professional traders and investors globally use the Kelly Criterion, a formula, to determine what percentage of their total capital they should put in a single trade. This formula uses historical winning probability and win/loss ratio to determine the amount of capital to put in a trade.

While we will deep dive into how to use the Kelly Criterion (KC) for optimal position sizing in a separate blog, here is a quick overview of how it works. Let’s say, of your last 10 trades, 7 were profitable; then your winning probability is 0.7 (let’s call it W).

Now , to find the win/loss ratio, divide the average profit made in the 7 winning trades by the average loss made in the 3 losing trades. Let’s say that the ratio is 1:5 (we will call it R). The Kelly percentage (Kelly%) will be:

Kelly% = W – [(1-W)/R]

= 0.7

= 0.7

- [(1-0.7)/1.5]

= 0.5

That is 50%. So as per KC, you should ideally put 50% of the capital in the next trade.

Now, however good the past performance may be, parking half your capital in one trade would seem risky. Thus, many are critical of the KC. Nonetheless, the KC can be used with modification and can give good results. We will cover all of it in a separate blog.

Alternatively, there are other simpler ways to determine the position size. Here’s a step-by-step guide to implementing them.

**1. KYC

- Know your capital**

The math behind position sizing hinges on the amount of trading capital. So knowing how much capital you are willing to deploy is a critical first step.

You could decide that you want to trade with a capital of ₹5 lakh but may transfer only ₹2 lakh to your trading wallet, initially. You can then transfer the remaining amount as required. In such a case, consider a total corpus of ₹5 lakh for position sizing purposes.

Similarly, investors are often confused if they should add the unrealized profit of their open positions to the total capital. The conservative answer: Don’t. Till you book the profit, do not add it to the total capital.

2. Choose the position sizing method

Once the capital amount is well defined, you could choose a position sizing method from those listed below. While there is no ‘one size fits all’ solution, choose a method that suits your risk appetite and comfort. Do note, this is not an exhaustive list. There could be more position sizing methods.

For ease of understanding, we have divided the methods based on capital and risk. Here they are:

A. Capital-based

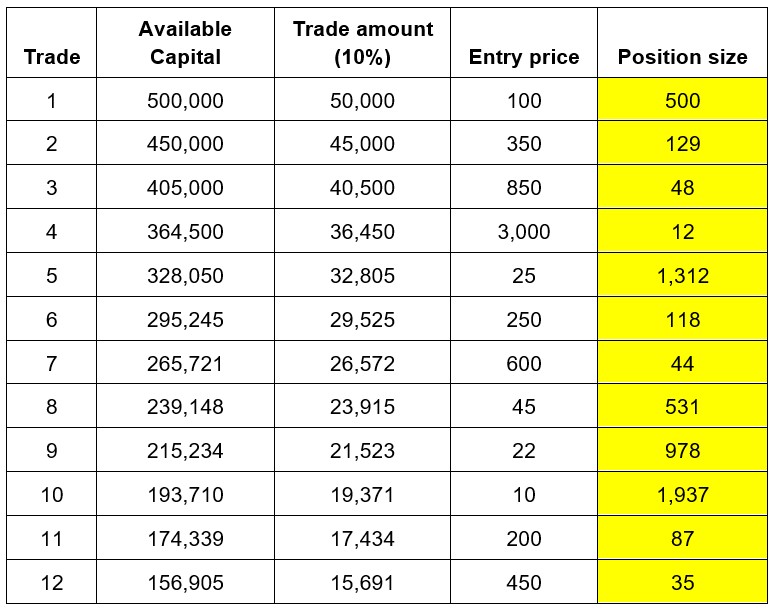

This is a very straightforward method where the capital is equally distributed in each trade. For example, if your capital is ₹5 lakh, you may want to allocate 10% (or ₹50,000) to each trade. It means you can execute 10 trades instead of putting the entire capital in one trade.

This is how it works:

Alternatively, a conservative trader could apply a fixed percentage (say 10%) to a reducing capital balance. Here is how:

This method is conservative because you could execute more than 10 trades (compared to the previous method) and thus distribute risk.

In the above examples, we have considered a 10% allocation to each trade. However, you could choose a number that strikes the right balance for you between diversification and risk tolerance.

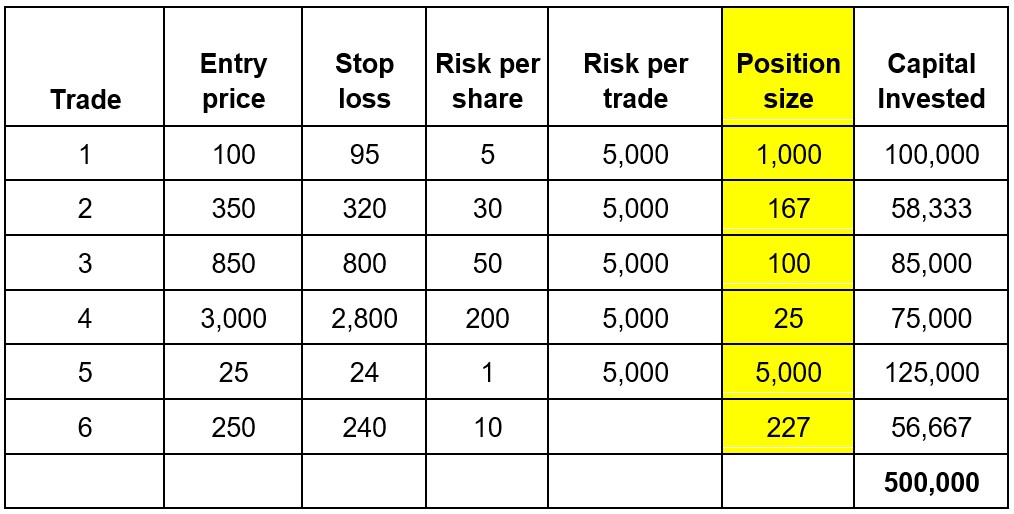

B. Risk-based

Here you risk a small percentage of your total capital on each trade and decide the position size based on the risk amount.

A simple way to calculate risk is entry price minus stop loss. In the below trade, the risk is calculated as:

Entry price: ₹100

Stop loss: ₹95

Risk = ₹5

Stop loss: ₹95

Risk = ₹5

Let’s say you decide to risk 1% per trade. So based on your capital of ₹5 lakh, 1% comes to ₹5,000. The position size will be calculated as:

Position size = Risk per trade / Risk per share

So the quantity for each trade would be as below:

You continue to follow the method till the last trade where the position size will be calculated based on the remaining capital.

The 1% risk rule helps to stay in the game for a long time, because only if you lose in 100 consecutive trades, will the entire capital be wiped off.

Even in a scenario where you are making profits and your trading capital increases -say to ₹10 lakh

- you can still continue with the 1% risk formula. However, now your risk per trade will rise to ₹10,000. This effectively means you will be able to take bigger positions and still risk no more than 1% of your capital per trade. That’s where the benefit of compounding kicks in.

In contrast, if you make losses and your trading capital reduces

- let's say it halves to ₹2.5 lakh

- your risk per trade will also reduce to ₹2,500. This would mean you are taking a smaller position per trade.

So, the position size will adjust based on your trading performance.

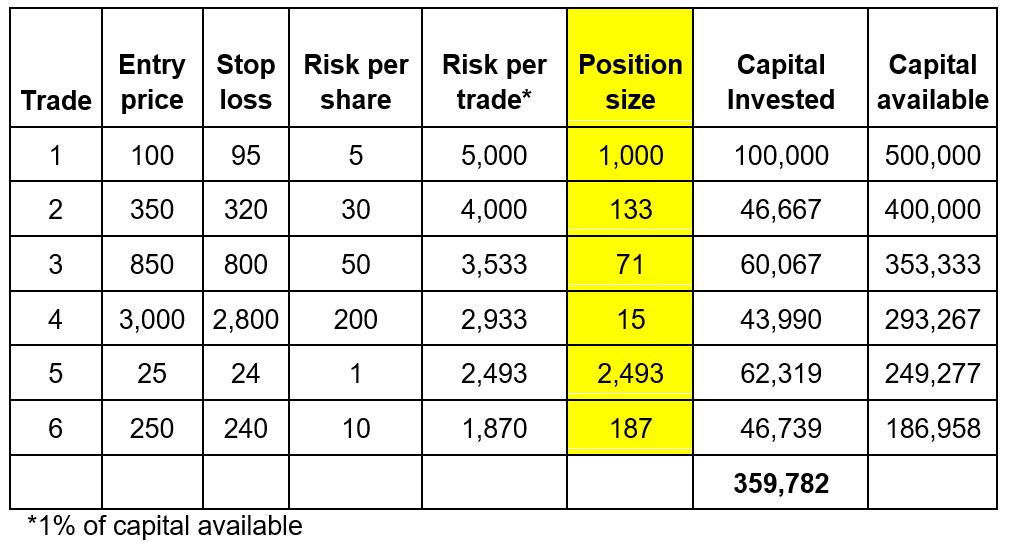

A conservative trader could also use the above risk-based method on reducing capital. Here is how:

In this scenario, the risk per trade reduces for every new trade. With this method, you will be able to execute more trades and it helps you stay in the game even longer.

You can change the 1% risk to 2% or whichever number you are comfortable with and which suits your risk appetite. However, choose a number that helps you stay put for a longer period of time. As trading experts say, “a trading career is a marathon, not a sprint”.