ITC Limited

ITC Limited

- Overview

From the author: Indian Tobacco Company Limited (“ITC” or the “** Company**”) was incorporated on 24 August 1910 under the name of Imperial Tobacco Company of India Limited and its name was changed to ITC Limited in 1974. Today, the Company is rated among world's most reputable companies by Forbes magazine and among India’s most valuable companies by Business Today. It ranks among India's '10 Most Valuable (Company) Brands', in a study conducted by Brand Finance and published by the Economic Times. For a financial report ITC including its balance sheet, shareholding pattern and dividend history visit – ITC Limited Financial Statements.

**Disclaimer:The stock analysis presented below should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis.

What's driving the stock

Cigarettes business: Dominant position in a growing industry with a strong distribution network

Indian Tobacco Company Limited (“ITC” or “** Company**”) is the market leader in cigarettes with 80% domestic market share. Put differently, it manufactures 4 out of 5 cigarettes consumed in India. This dominant position gives ITC a strong pricing power for its products. ITC cigarette brands include Insignia, India Kings, Lucky Strike, Classic, Gold Flake, Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk Cut and Duke & Royal.

The long term prospects of the industry is very encouraging with a significant portion of the country’s large population being below the age of 18 which is the minimum legal age to purchase or smoke cigarettes in India. Such a ‘young’ economy with growing disposable incomes and greater exposure to western lifestyles is favourable for an aspirational product such as cigarettes. As per Census India 2011 data, there will be roughly 100 million people attaining the age of 18 in the next 5 years. This should create a potentially huge market and considerable demand for cigarettes. As a company with the widest brand portfolio of cigarettes in India across various price points, ITC is well placed to capture such demand and gain from this opportunity. In terms of distribution network, the cigarette business of ITC is a logistical marvel. ITC made cigarettes have the deepest penetration and are available in the remotest areas of the country.

Growth of non-cigarette FMCG business

ITC has created some landmark brands. Over the last few years, the Company has been expanding rapidly in the Indian FMCG (non-cigarette), retailing and hotel sector. To put this in perspective, the company has launched a diverse range of products including confectionaries, biscuits, noodles, wafers and ready to eat meals. Some of its brands such as ‘Vivel’ in the soaps and shampoo category and ‘sunfeast’ in biscuits have quickly cornered a significant portion of the market in which they operate.

For August 2013, ITC cornered a 28 % market share in cream biscuits with its Sunfeast range, coming neck and neck with **Britannia **which has been a market leader in the segment. The Vivel brand of soaps and shampoos which was launched in 2008 has within 4 years cornered a sizeable share in the soap segment which has 40+ brands.

In retailing, ITC has established a nationwide presence through its Wills Lifestyle and John Players chain. 'Wills Lifestyle' stores currently stand at 90+ exclusive stores in 40 cities and more than 500+ 'shop-in-shops' in leading departmental stores.

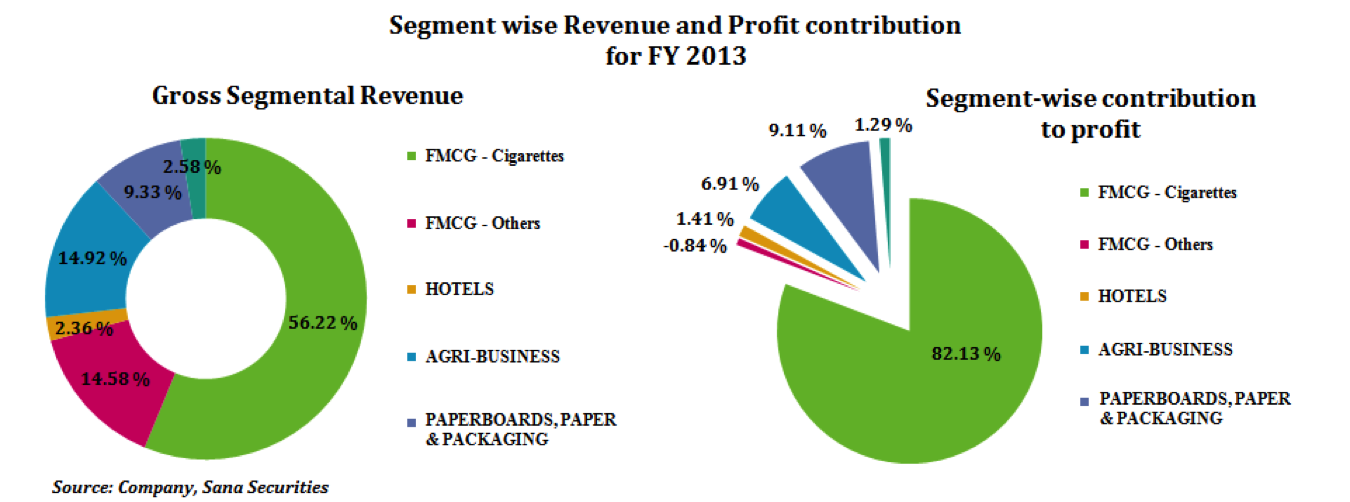

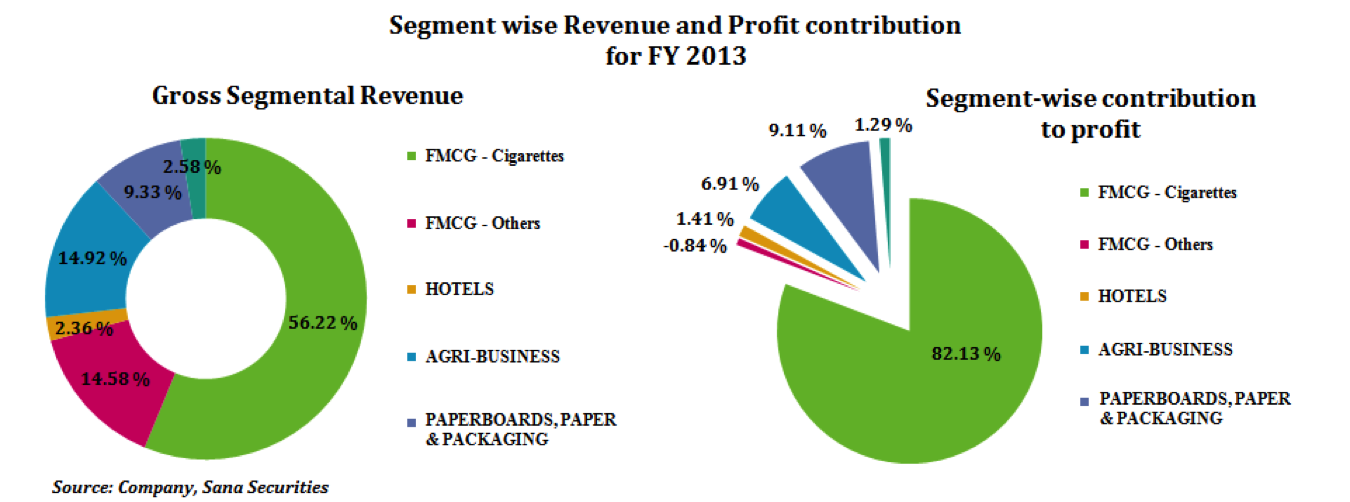

Caveat: While the company has achieved phenomenal growth in the non-cigarette FMCG sector on the back of aggressive marketing and celebrity endorsements, it still derives a majority of its gross revenue and net profit from its cigarette division. Competition in the Non-cigarette space is intense with well-established players such as Hindustan Unilever, Britannia, Nestle, Cadbury and many more. Over the years, the strong brand recognition of these companies has led to customer loyalty for their products. A new entrant like ITC is likely to face difficulty in winning and maintaining customer loyalty in the long term and may need to have huge advertising and marketing budgets on a continued basis to promote its line of products.

[caption id="attachment_2532" align="aligncenter" width="584"] ITC Revenue and Profit Contribution for FY 2013[/caption]

ITC Revenue and Profit Contribution for FY 2013[/caption]

ITC Revenue and Profit Contribution for FY 2013[/caption]

ITC Revenue and Profit Contribution for FY 2013[/caption]For FY 2013, non-cigarette FMCG sales were up 26.49 % to Rs. 7,037.71 Cr (previous year – Rs. 5,563.72 Cr) and non-cigarette FMCG loss declined by 58.67 % to Rs. 88.90 Cr (previous year – Rs. 215.08 Cr). For the same period the overall gross sales were up 18.53 % to Rs. 48,263.78 Cr (previous year – Rs. 40,716.79 Cr) and net profit was up by 21.69 % to Rs. 7,693.58 Cr (previous year

- Rs. 6,322.39 Cr).

The education and stationary business is consolidating its market leadership position with ITCs ‘Classmate’ and ‘Papercraft’ brands and the branded packaged foods business continues to grow rapidly driven by further premiumisation of the portfolio, higher volumes and improved profitability. ITC has upgraded and modernised its luxury hotels. In July 2011, it was awarded the highest rating of LEED Platinum making it the greenest luxury hotel chain in the world. Additionally, ITC has acquired a 14.98% stake in EIH Limited which operates the Oberoi Group of Hotels and holds a 12.88% stake in Hotel Leela Venture. We believe that as the economy starts improving; hotel business will become a larger revenue driver for ITC.

Strong financial position

ITC has a history of consistent growth and has one of the strongest financial positions amongst listed companies across all sectors in India. Total returns for ITC shareholders over the17 year period (i.e. 1995-96 to 2012-13) grew at an impressive CAGR of 25.7%.

The Company has reserves in excess of Rs. 18,500 Cr. and operates with negligible debt on its books. This strong financial position not only enables the company to have bigger marketing and advertising budgets as it forays further into the non-cigarette FMCG business; it also enables the company to take advantage of depressed valuations and acquire assets at cheap prices in a subdued economic environment.

What's dragging the stock

Systemic risk and high regulation and tax in cigarette business

Anti-smoking lobbies around the world have been working towards discouraging people from smoking and have gained particular momentum over the last few years. In 2004, the government imposed restrictions on advertising of cigarettes. In 2008, a ban was imposed on smoking in public places including restaurants and hotels. Further, the government attached graphic health warnings on cigarette packets from 2009 which have only become more deterring in recent times. In December 2012, a bill was introduced in the Indian Parliament to adopt plain packaging for cigarettes, which means that in addition to the graphic pictorial warnings, manufacturers will have to sell cigarettes in plain paper packing with no company or brand trademark and without any fancy logos or slogans. It is difficult to predict the stringency of anti-smoking laws and regulations which may be imposed in future and which may hamper the potential for growth of cigarette business.

Tobacco and in particular cigarettes are taxed heavily in India. There are about 30 different effective tax rates on cigarette sale across the country. ITC’s average VAT is at 20%. It is unlikely that the government will not increase further the rate of tax on cigarettes, let alone reducing such rate. Any such upward revision in taxes imposed on cigarette sales will make them more expensive reducing the volume of sales which will have a negative impact on the results of operations and financial performance of ITC.

Rajat Sharma is the CEO at Sana Securities, an independent equity research and financial advisory firm in India. Views expressed here are of the author and Upstox has not verified any facts stated above.