Hedging of stocks using F&O

Financial markets are constantly evolving. Different financial instruments allow participants to address different aspects of their financial needs. While investors get an opportunity to grow their wealth by being part owners of businesses and benefit from the company's growth journey, traders can benefit from price fluctuations. However, trading in equities can also be risky. Financial instruments like Futures and Options help hedge portfolios and safeguard against big losses.

Futures and Options are leveraged derivative instruments and leverage is a double-edged sword. However, when deployed effectively, they can be a “knight in shining armour” for your positions in equities and protect your wealth against the volatile market. Here is a quick summary of what are Futures & Options:

What are Futures?

● Futures are standardised derivatives contracts traded on exchanges between two parties to buy or sell an asset at a predetermined price and quantity on a specified date in the future. The assets may be stocks, indices, commodities such as crude oil, gold, wheat, etc. on which the contract is based. However, in this article, our area of interest lies with stock futures and index futures.

● It is mandatory for both buyers and sellers to keep a margin to take a position in the futures market.

● Positions are either cash settled or physically settled.

● Futures are standardised derivatives contracts traded on exchanges between two parties to buy or sell an asset at a predetermined price and quantity on a specified date in the future. The assets may be stocks, indices, commodities such as crude oil, gold, wheat, etc. on which the contract is based. However, in this article, our area of interest lies with stock futures and index futures.

● It is mandatory for both buyers and sellers to keep a margin to take a position in the futures market.

● Positions are either cash settled or physically settled.

Note: Futures are not available for trading on all stocks registered on the exchange, but only on a select few.

What are options?

● Options are derivatives contracts traded on exchanges that enable the buyer of the contract, the right to buy or sell the underlying asset at a predetermined price and quantity on a specified date in the future. The assets may be stocks, indices, commodities, etc. on which the contract is based. However, for the purpose of this article, we will only discuss stock options and index options.

● The buyer of the option pays the premium and the seller receives it.

● The right to buy is a choice that the buyer of the option may choose to use, though it is not compulsory.

● The seller of the option, however, has to oblige and buy or sell the underlying, should the buyer exercise his or her right.

● All positions are either cash settled or physically settled.

● Options are derivatives contracts traded on exchanges that enable the buyer of the contract, the right to buy or sell the underlying asset at a predetermined price and quantity on a specified date in the future. The assets may be stocks, indices, commodities, etc. on which the contract is based. However, for the purpose of this article, we will only discuss stock options and index options.

● The buyer of the option pays the premium and the seller receives it.

● The right to buy is a choice that the buyer of the option may choose to use, though it is not compulsory.

● The seller of the option, however, has to oblige and buy or sell the underlying, should the buyer exercise his or her right.

● All positions are either cash settled or physically settled.

Here are some easy ways for you to hedge your equity positions using Futures and Options:

Protecting stocks using Futures

● Hedging the stocks of which Futures contracts can be traded.

Let's understand how this will work with the help of an example: Mr. Jha is an investor, he holds shares of Tata Steel in his portfolio. According to his analysis, it will be profitable for him in the long term. However, as per his analysis, there might be a fall in the price of the share in the short term.

He decides to protect his position using Tata Steel futures.

He takes a short position in the current month's Tata Steel futures contract by paying the margin. By doing so, he has protected himself from a sudden downward move.

Remember: Unlike in the Equities, in Futures short positions can be carried forward.

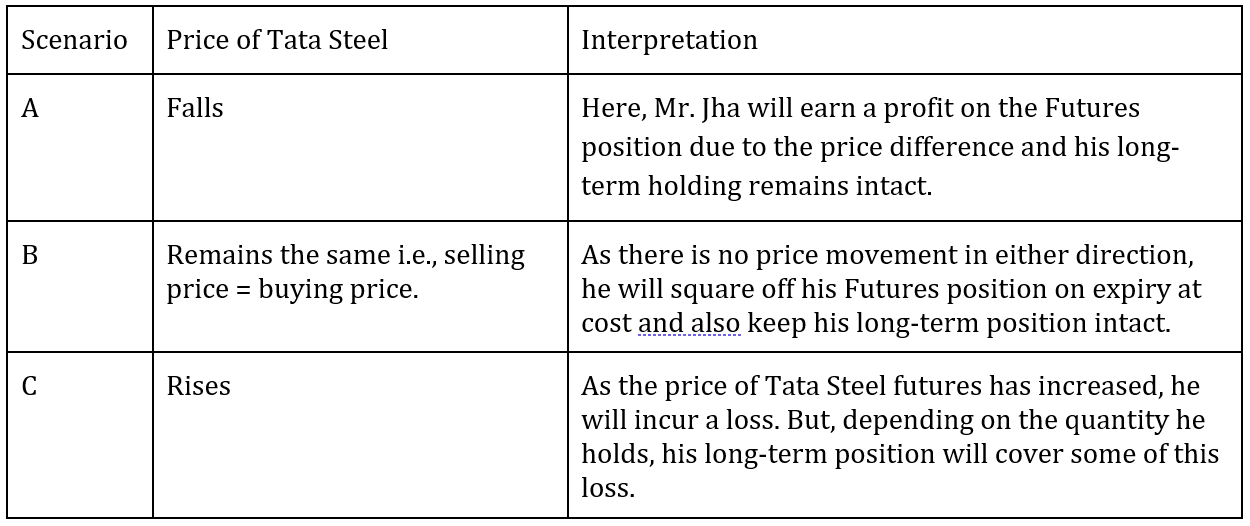

Now there are 3 possible scenarios:

If he holds the 5,500 shares in equity which is equal to the Futures lot size of Tata Steel, he will not have incurred any loss on this strategy. The loss incurred in futures is offset by the profit earned in equity holding.

Note: It is important to note that the profit in the holdings is notional while the loss in Futures position has to be paid in cash.

● Hedging the stocks of which Futures are not available.

Let's understand how this will work with the help of an example: Mr. Shah is a trader, he has a holding of ABC Ltd. According to his analysis, holding the shares of the company will in the long run be profitable for him. However, in the short term, there might be a decrease in the value according to his recent analysis.

Since there are no Futures contracts of ABC Ltd. available, the contract of Nifty50 Futures can be used to hedge this position.

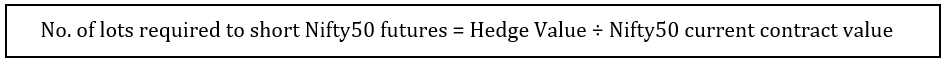

In order to use Nifty50 Futures, first the trader must find the Beta of ABC Ltd, after which he has to find the product of his investment and beta value to get the hedge value.

To get the number of lots required to short Nifty50 futures, he has to divide the hedge value by the Nifty50 current contract value.

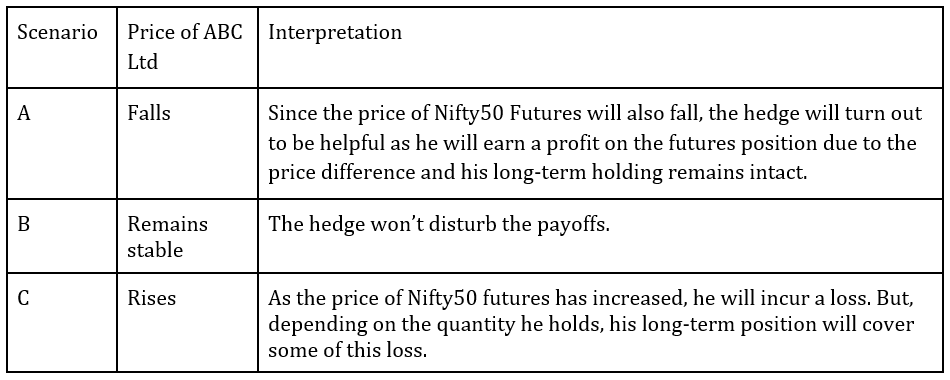

He takes a short position in the current month's Nifty50 futures contract by paying the margin. By doing so, he has protected the downside risk. Now there are 3 possible scenarios:

Note: This method is most effective when the hedge value is similar to the Nifty50 futures contract value or its multiples and the Beta value is closer to 1.

Let’s consider the case of Poonawalla Fincorp. The share price is ₹300 and its beta value is 1. This implies that for every 1% rise (or fall) in Nifty50, the share price is likely to go up (or down) by 1%.

This stock is not available in the Futures and Options segment. Assuming that an investor holds 3,000 shares of the stock, the current market value of this holding is ₹9,00,000. This is also the contract value of Nifty50 January Futures which is trading at 18,000 and has a lot size of 50.

When the trader wants to protect his equity holding against any fall in share price, they will sell 1 lot of Nifty50 Futures.

Since the contract value is equal to the holding value and the beta is 1, this is a perfect hedge.

Any fall in the price of the share will be offset by profit in the Nifty50 Futures position which will also slide lower.

Note: In an unlikely but possible event that the stock goes lower and Nifty50 moves higher, the trade could result into a double-whammy loss 0n both positions.

Hedging of stocks using Options

Options can also be used to hedge equity positions using the following strategies:

- Covered call strategy

The covered call strategy refers to selling a call option of a stock that the trader already holds in equities. This strategy is used when the trader has the view that a stock will trend downwards in the near term, but will move higher in the long run.

The break-even point for the call option sold is calculated using the following formula:

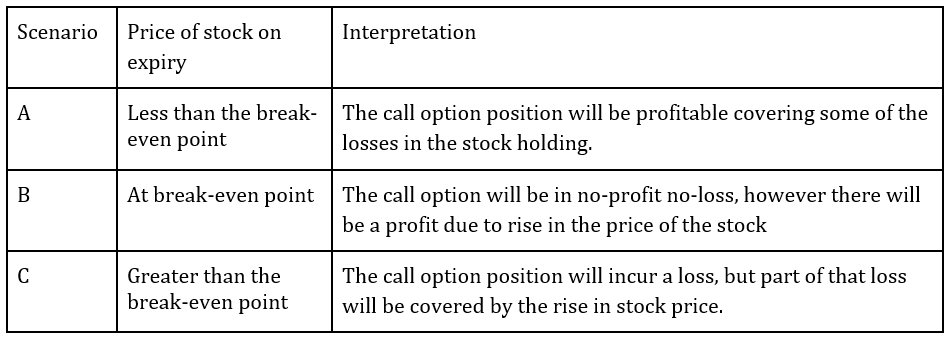

After deploying this strategy, there are 3 possible scenarios:

The profit potential here is limited to the premium received and the loss incurred can be set off against the notional profit earned on the holdings.

Similarly, even a covered put strategy can be used, this involves the selling of a put option, of a Futures contract that has been sold.

- Protective put strategy

A protective put strategy refers to buying a put option of a stock that the trader already has a holding of, in the cash market. This strategy is used when the trader has the view that a stock will trend downwards in the near term, but will be profitable in the long run so the trader uses this as a way to protect unrealized gains on shares from a previous purchase.

The break-even point for this put option position is calculated using the following formula:

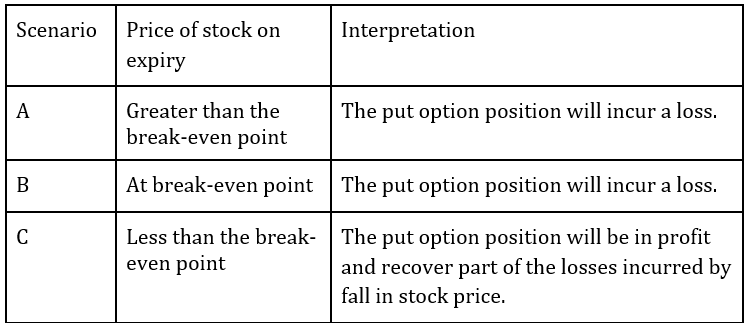

After deploying this strategy, there are 3 possible scenarios:

One big advantage that the Protective Put strategy has over the Covered Call strategy is that it restricts the downside side. If the stock price falls below the break-even point for the put option, any further loss in stock holding will be offset by the profit in put option by the same amount.

Similarly, there are many other strategies like Protective Call and Covered Put, that traders can deploy to protect their portfolio.