Max Pain

Introduction to Max Pain

In tug-of-war, by rule, only one team can win. The side that is stronger and plays as a ‘team’ wins!

In the options market too, there is a constant tussle between options buyers and sellers. This tug-of-war continues till the expiry date. Since options trading is a zero-sum game, one team rejoices and the other ends in pain.

It is generally believed that options sellers are more powerful. There are a couple of reasons behind that:

- Option selling (aka writing) requires bigger capital compared to options buying. Sellers have deep pockets.

- Institutions and high-net-worth individuals who prefer options selling have superior research capabilities. They are also called ‘smart money.’

A natural edge

Furthermore, option sellers also have the edge over buyers in certain situations. At expiry, if the option remains ‘out of the money’ or ‘at the money’, it expires worthless, i.e., sellers make money. Thus, in 2 out of the 3 scenarios (except ITM), sellers can make max gain.

What is Max Pain?

Max pain or Maximum Pain is a theory which states that on expiry day, the price of the underlying index/stock moves toward a point that results in maximum loss (pain) to the highest number of options buyers. Alternatively, it also means a minimum loss to option sellers.

The theory assumes that deep-pocketed sellers with their purchasing power work as a team (remember tug-of-war) to drive prices towards a more profitable point. However, this assumption is controversial. Further, this theory makes one believe that option sellers would always make money, which is also not true.

Calculating Max Pain

If you look at it from an option chain angle, max pain is basically one particular strike price out of all the available strike prices of an underlying. At that particular strike price, the option buyers will lose the maximum amount of money, or option sellers will lose the minimum.

How to find the max pain strike price:

- Pull the list of all the available strike prices and their OI for an underlying, say Nifty50 index.

- Based on the OI, calculate the loss the option sellers (call + put) would make at each strike price if the index were to close at that strike price.

- The max pain is at that particular strike price where the net loss is minimum to the options sellers.

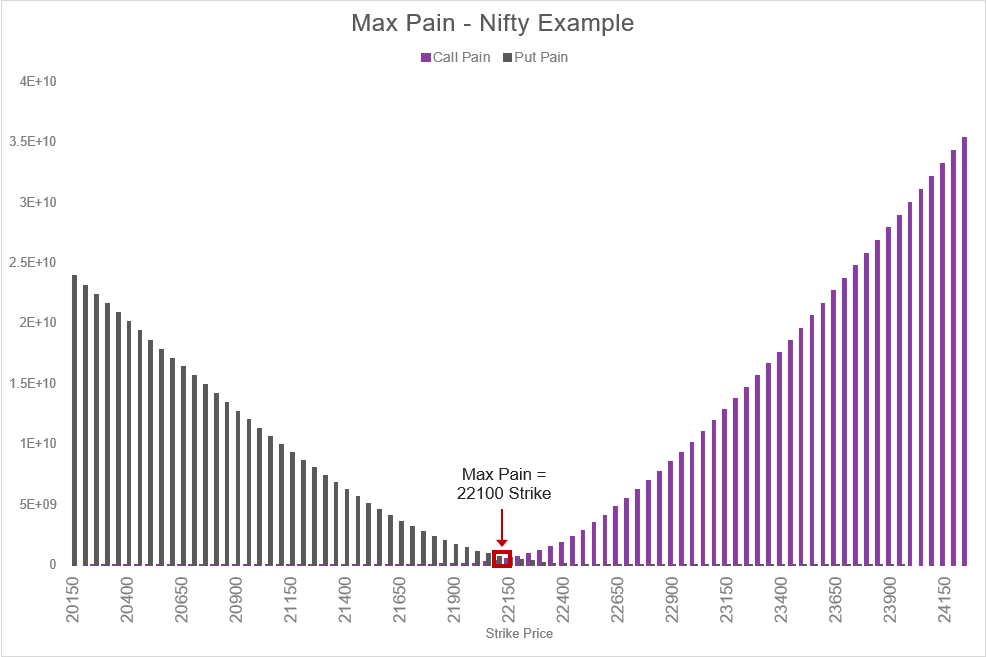

- If the above calculation were to be plotted on a bar chart, it would look like this. Here, put pain (PP) is the loss suffered by put sellers at different strike prices and call pain (PP) shows the loss suffered by call sellers at different strikes.

Illustration 1: Max Pain for the Nifty50

Source: Upstox

Source: UpstoxIt must be noted that the OI changes on a day-to-day basis, and so will the max pain.

Using Max Pain

Essentially, max pain helps to predict the expiry level. If you know where the market price will end on the expiry, an endless number of option strategies can be deployed. One example is presented here. Traders can sell a call and a put equidistant from the max pain price. Let’s say:

- Nifty50’s current price = 21997.70

- Max pain = 22100 (expected expiry point)

- Days to expiry = 1 day

Sample Trade

- Sell 22300 - Strike Call = ₹8.50

- Sell 21900 - Strike Put = ₹52.00

As per the max pain theory, since the options sellers would make a concentrated effort to drive Nifty toward 22,100 on expiry, the out of the money options would expire worthless. Therefore, the maximum profit in the trade will be ₹60.50 (8.50+52.00). This example uses real data and the Nifty did rise to 22,146.65 – slightly above the max pain point. If you had made this example trade, you would have attained the max profit because the Nifty closed below the short call and above the short put strike prices.

So this was a quick explainer on the Max Pain theory. While it looks pretty straightforward, use the max pain concept with a pinch of salt when making trading decisions.

Summary

- Max Pain is based on the theory that option sellers will drive the underlying price to a point where option buyers will be the least profitable.

- Option sellers are considered 'smart money' because selling options requires large amounts of capital that is available to institutions and high net worth individuals.

- Max Pain is a tool that can be used to help you select a strike price.

Is this chapter helpful?

- Home/

- Max Pain