Going Short

What does going short mean?

Put simply:

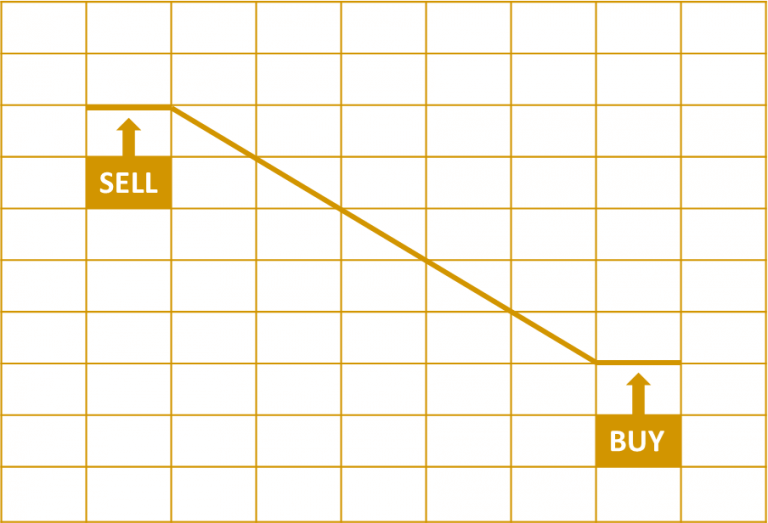

- When you go long – you buy first and sell later.

- When you go short – you sell first and buy later.

Illustration 1: Going short

Source: Upstox

Source: UpstoxHowever, shorting is different from selling a share or contract which you have already bought earlier. When you go short, you are selling an asset that you do not hold at that moment. While this may sound confusing, it is perfectly legit! Yes, you can go short in the Indian stock market.

The key reason behind going short is that you anticipate the price of the stock or underlying asset will fall from the current level (except in the case of put options, which we will learn in the upcoming chapters).

When you go short, you create a completely new sell position, or you can add to an existing short position.

Instruments you can short

In the Indian stock market, you can go short in the futures and options segment. You can even short equity shares but only on an intraday basis. Going short in the equity delivery segment is not permitted.

What is the reward on going short?

Once you are short at a certain price and the price falls from that level, you have an opportunity to buy and pocket a profit. How do you calculate the profit? The formula is simple and is the same whether you are going long or short:

Where your selling price must be higher than the cost price. If the selling price is lower, it will result in a loss.

The maximum profit one could make by going short is the selling price itself. For example, if you short Smartco Ltd., a hypothetical company, at ₹500 per share, that becomes your selling price. Now if the price falls by ₹50 to ₹450 and you buy it, your profit per share is ₹50. Since the value of a share cannot drop below zero, the lowest it can go is zero or say ₹0.05 where you can buy it and pocket the entire selling price of ₹500 as a profit.

However, it is rare for a stock price to fall to zero in a short period. In contrast, it is common for options premiums to turn zero, and as an options seller (also known as an options writer), you pocket the entire premium amount.

What are the risks to going short?

In a short position, the maximum risk is theoretically unlimited.

For example, let’s say you short Smartco Ltd. at ₹500. You will start making a loss if Smartco moves above ₹500. And since theoretically the price could keep on rising, the maximum risk could be unlimited.

Similarly, when you go short on options — particularly call options — the price could keep on rising based on the upward movement in the underlying asset. Thus, the maximum loss could be unlimited. In the case of a short put option, however, its value could continue to rise till the value of the underlying keeps on falling.

This is why it is said that the losses when going short are theoretically unlimited. However, in reality, this could mean losing one’s entire capital. Hence, it is advisable to tread with caution when short-selling options. Once you learn the ropes of options trading though, you will realize that option selling strategies can deliver consistent returns.

Short vs Short

The usage of the term short in derivatives should not be confused with the term used to refer to a duration for which an investment is held i.e., short term.

Now if you are ready to take the plunge, let’s move to the next chapter where we will show you how trading in Options can give you an edge.

Summary

- When you go short – you sell first and buy later.

- When you go short on a Call option, you believe the underlying price will fall.

- When you go short on a Put option, you believe the underlying price will rise.

- You can create a new position or add to an existing one when you go short.

- If you make a loss when shorting an option, you could stand to lose the entire capital.

Is this chapter helpful?

- Home/

- Going Short